Moonshot Portfolio April 2021

April’s Crypto Moonshot Portfolio

Sign up below to receive regular updates from CryptoQuestion

The alt season is upon us and has been for some time, apart from a small blip here and there. Most alt coins are up a minimum of 200% since January, some 1,000%. Is this sustainable I hear you ask…

For some cryptocurrencies yes, because they started from a low base, but others are trading at unrealistic levels. In order to make money in this market, and keep it, it is important we take profits when we can and cash in our original investment, so when the bubble bursts, we are ahead of the game. And the bubble will burst. It always does. But that is no bad thing because it will make expensive quality projects more attractive again. However the memecoins of this world and the other crap will get hit hard. This may seem obvious but there are few people who emerge from a burst bubble ahead of their original position.

Finding value

It is becoming very difficult for the average cryptocurrency investor to find undervalued and undiscovered cryptocurrencies. We are not helped by the YouTube crypto influencers or the Reddit forums which continue to pump the same old stuff much of which has already experienced huge price hikes before we even get a look in. Examples include:

Plasma Finance up 1,700% in 3 months

MobieCoin up 3,800% in 3 months

Circuits of Value up 2,275% in 3 months

Phantasma up 1,000% in 3 months

We must be more inventive in order to find the cryptocurrencies that lurk under the radar and that is our key goal in forming this portfolio, to find undiscovered and undervalued cryptocurrencies. Not all of our selections will be totally unknown to the community but many of them haven’t experienced the same massive price increases that the rank and file coins have benefited from. Of course we are hoping that our selections will make their mark eventually — a few have already done exactly that such as BEPRO, Apollo and Katalyo.

State of play

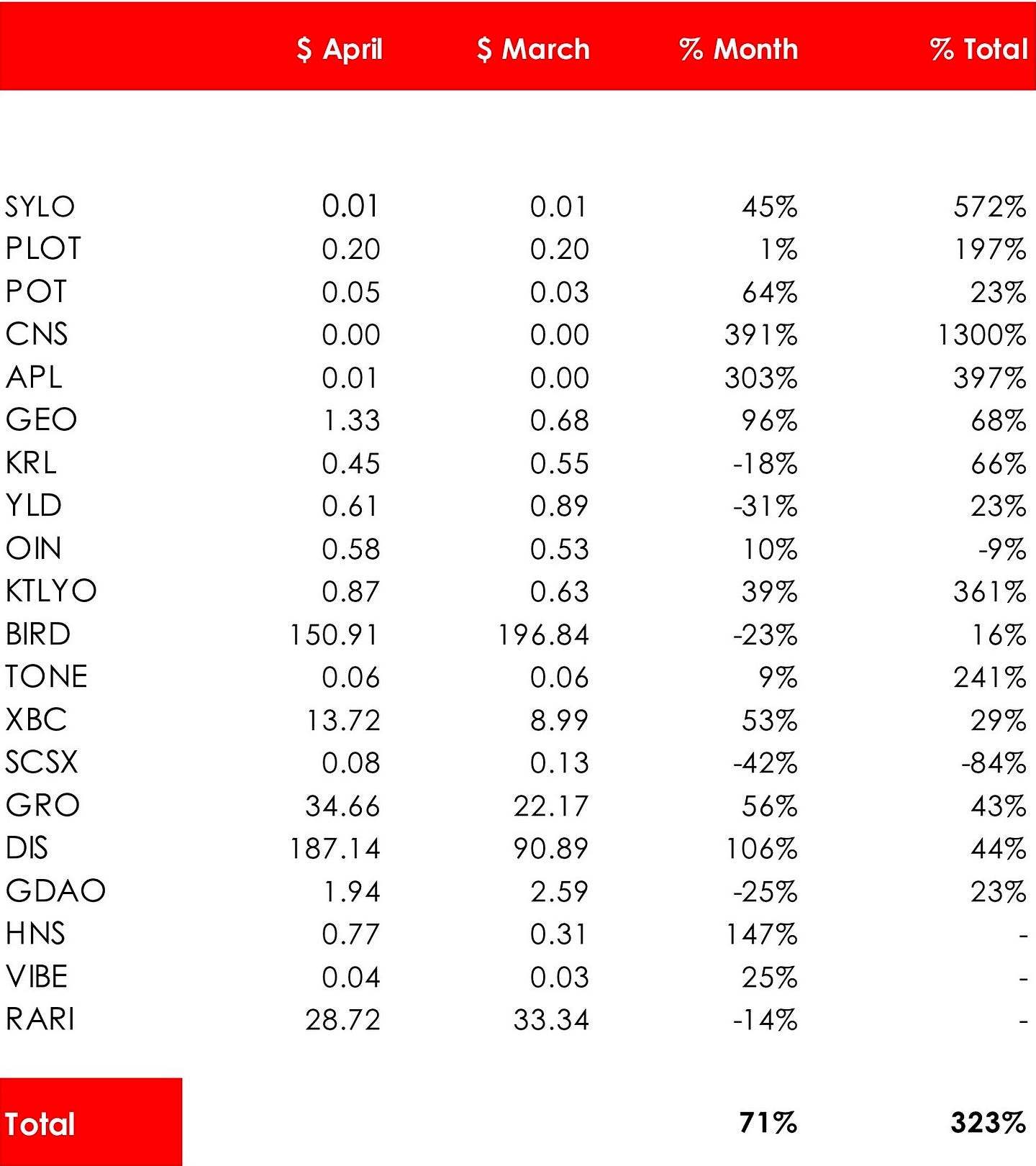

Let’s now focus on our current portfolio of twenty cryptocurrencies. The performers and the non performers, who are being culled and which new projects we have added.

Overall it was another great month. If you recall we were up 200% in March. We did warn you that this performance was unlikely to continue into April. Performance this month was still a very strong 70% taking our overall performance to 330% since February.

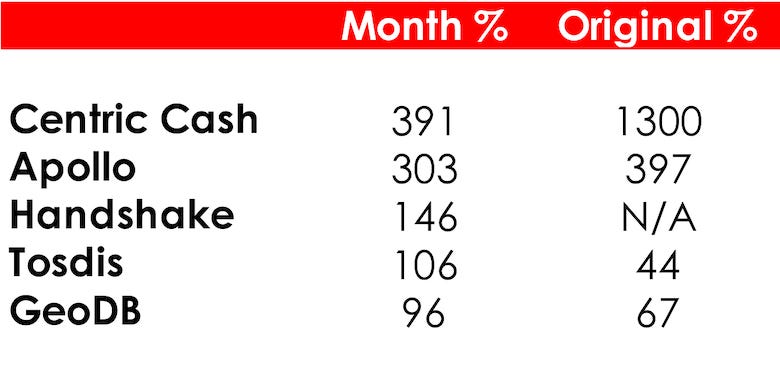

This month’s top 5 performers were:

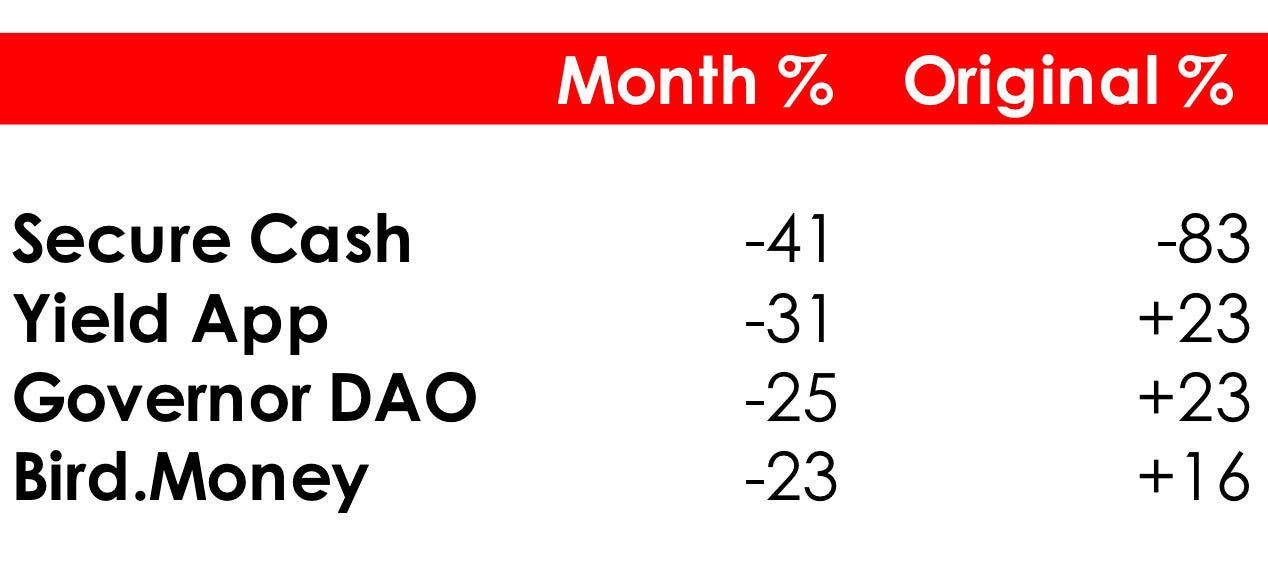

This months worst performers were:

Overall performance

Now let’s look at the overall performance of our portfolio:

We publish the Micro Cap Watch List every Friday. This is a list of small to micro cap cryptocurrencies which we believe are undervalued. It is a great source of investment ideas. Click here to view our latest list.

This months developments

SYLO

The price of SYLO is up 45% this month and 571% since we first added it to our portfolio. The crypto community continues to be increasingly supportive of SYLO which has helped the price continue its steady climb. We still consider SYLO a cryptocurrency worth buying considering its modest market cap.

This month SYLO announced a partnership with Moonstake where Sylo Smart Wallet users will soon have access to the largest staking pool network in Asia. They also announced the imminent support of NFTs on their platform.

PLOT

The price of PLOT is up only 1% this month and 196% since we first added it to our portfolio.

PLOT launched its public test net for version 2 of its platform which is expected to be both cheaper and faster. This is a team dedicated to their platform who have focused more on the tech than the marketing. However that will change and we believe this project remains undervalued compared to its competitors such as Augur.

Potcoin

The price of POT is up 64% this month and 23% since we first added it to our portfolio.

With a market cap of $11 million POT in our opinion is undervalued. POT is one of the last men standing in a once crowded market and although it is likely that marijuana is legalized on a federal basis in the coming years we believe there will still be demand for an alternative payment method and a general app for the marijuana buying consumer.

Whilst most of the community has forgotten about POT it has continued to work on its platform, This month it announced migration to Nexus (NXS) which will allow them to scale and deal with future transaction quantity. There are other exciting announcements in the pipeline. POT is a cryptocurrency worth accumulating.

Centric Cash

The price of CNS is up 390% this month and 1,300% since we first added it to our portfolio.

CNS has had a great run since we tipped it back in February. Although there was a setback when the previous CEO had a falling out with the team and tried to sabotage the project the new team seems to have weathered the storm and continued to develop its community and its offering. With a market cap of $9 million the token still looks undervalued in our opinion. Centric Cash recently announced that its token is now listed on HitBTC. It also announced that it has created over 26,000 wallets. This is obviously a project on an upward trajectory.

Apollo

The price of APL is up 302% this month and 397% since we first added it to our portfolio.

APL price has rocketed since March and has now exceeded our price target of $0.007. Although the price of APL has no doubt further to go we would suggest cashing in at least some of your profit in this one.

We have now removed APL from our portfolio.

GeoDB

The price of GeoDB is up 96% this month and 67% since we first added it to our portfolio.

GeoDB is having an incredible run since we tipped it back in March. The project has made a number of positive announcements including a 3rd party reward system and a buyback program. It also announced that its app GeoCash has over 250,000 users. With a market cap of $29 million and one of the leaders in the DAO space it is a cryptocurrency worth holding.

Kryll

The price of KRL is down 18% this month and up 66% since we first added it to our portfolio.

The project made two important announcements this month. Firstly it announced the listing of its token on Kucoin and secondly it announced that its platform had surpassed $1 billion in volume. Kryll in our opinion continues to be undervalued by the market considering it has already established a lucrative niche. Although the price is up a massive 9,500% in the last 12 months, albeit from a low base, over the last 3 months it is up only a modest 80%. We would recommend holding this one until the market recognizes its full potential.

Yield App

The price of YLD is down 31% this month and up 23% since we first added it to our portfolio.

YLD is one of the best DeFi projects out there. The first quarter saw massive growth including $46M AUM and $5.5M in App swaps. This is a project that isn’t sitting on its laurels and continues to grow its product base. We would suggest continuing to hold this cryptocurrency.

Listen to our podcast Inside Track where the founder of Yield App talks about his project and the cryptocurrency market in general and some of his favorite projects.

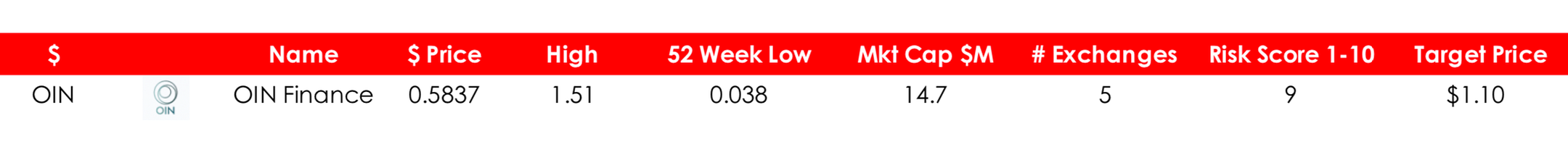

OIN Finance

The price of OIN is up 10% this month and down 9% since we first added it to our portfolio.

Despite some exciting announcements the token price hasn’t seen much action in the last 30 days. OIN announced its partnership with DASH NEXT to launch an optimized Stablecoin. It also announced that its integration with Binance Smart Chain was now complete and fully operational.

The major risk with OIN is its large maximum token circulation compared to its current circulation implying a market cap of $60 million compared to $10 million now. We still believe that OIN is a solid coin to tuck away.

Listen to our podcast Inside Track where the founder of OIN Finance talks about the project, the DeFi market and his favorite projects.

Katalyo

The price of OIN is up 40% this month and 361% since we first added it to our portfolio.

The token price has exceeded our initial target of $0.85 and although we are still big fans of the concept we are also advocates of disciplined investing so we are afraid we will be virtually cashing out of this one.

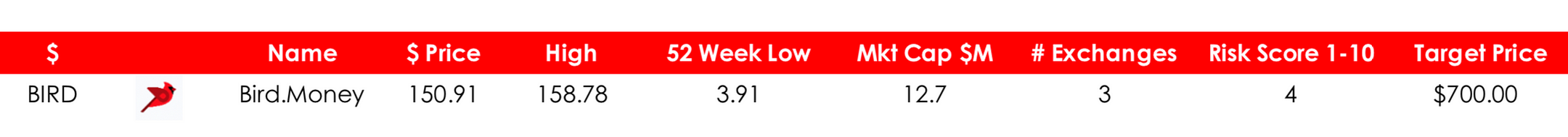

Bird.Money

The price of BIRD is down 23% this month and up 130% since we first added it to our portfolio.

We continue to believe this project is undervalued compared to its competitors. With a market cap of $13 million and a relevantly low maximum circulation BIRD represents a strong hold.

TE-Food

The price of TONE is up 9% this month and 240% since we first added it to our portfolio.

TE-FOOD is the world’s largest farm-to-table food traceability program. TONE is the basis of the tokenomics and, according to the team, is required for every transaction on the TrustChain. Considering the project’s leading position in this market we believe TONE is a core holding in our portfolio.

Bitcoin Plus

The price of XBC is up 52% this month and 29% since we first added it to our portfolio.

Although we had a good run with this coin we can’t see it going too much higher. There are better opportunities available so we have decided to drop this coin from our portfolio.

Secure Cash

The price of SCSX is down 41% this month a further 83% since we first added it to our portfolio.

Although the anonymous CEO of this project promises there are new developments on the way his lack of communication and total disrespect for his community makes this one worth selling and moving on.

Growth DeFi

The price of GRO is up 56% this month and 43% since we first added it to our portfolio.

This is one project that continues to grow its platform under the glare of the crypto lights. In seven months the price of the token is up only 200% from a low base despite continuing to burn its GRO tokens. With a market cap of $12 million this project looks grossly undervalued.

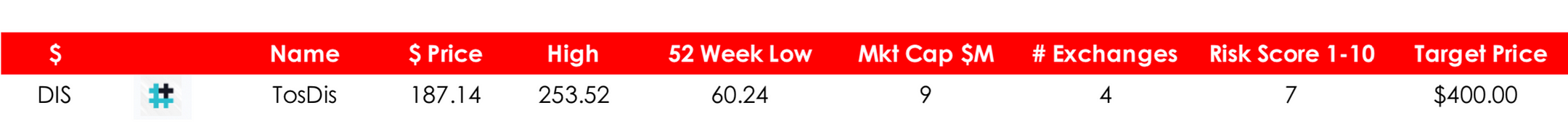

Tosdis

The price of DIS is up 106% this month and 44% since we first added it to our portfolio.

There is lots happening at DIS. The token has recently been listed on PancakeSwap with $400k of liquidity whilst it continues to introduce new staking and farming pools. With a market value of $9 million this is another project that continues to be neglected by the community despite its recent strong price run.

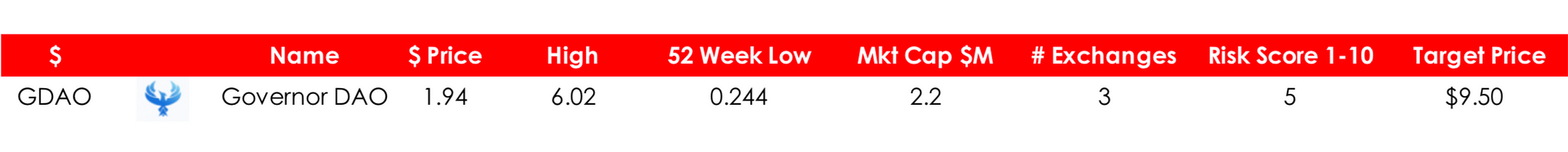

Governor DAO

The price of GDAO is up 25% this month and 23% since we first added it to our portfolio.

GDAO is a cryptocurrency we believe is substantially undervalued. We are fans of the Governance as a Service space and can see GDAO carving a lucrative niche. We are still holders of this cryptocurrency.

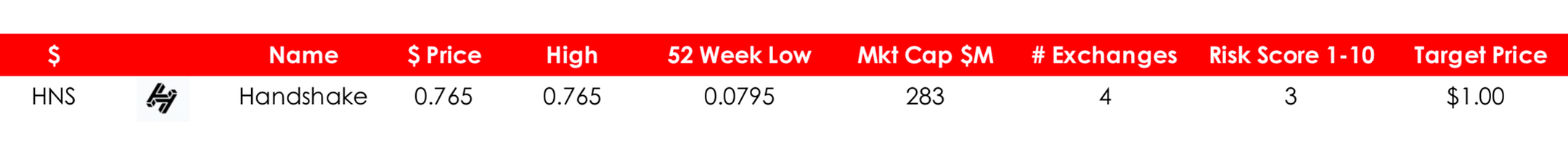

Handshake

The price of HNS is up 146% since we first added it to our portfolio last month.

The market has started to realize HNS potential as the team continues to develop its project. We believe that with a fully diluted market cap of $1.5 billion this is a cryptocurrency that is close to being fully valued. We have revised our price target from $1.50 to $1.00 to take into account the fully diluted market cap.

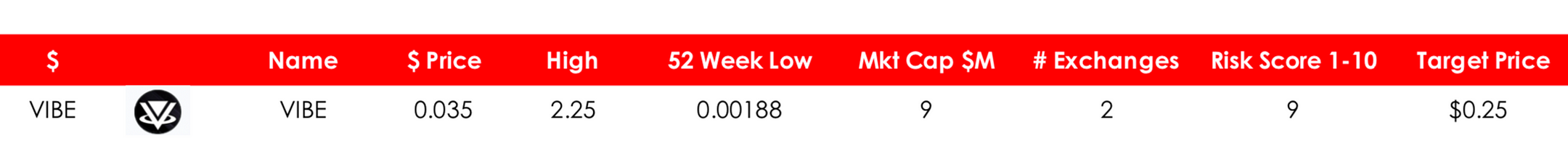

VIBE

The price of VIBE is up 25% since we first added it to our portfolio last month.

Despite the NFT market softening VIBE’s price has held up and at a market cap of $7 million is still modest. We still believe that VIBE offers good value for investors.

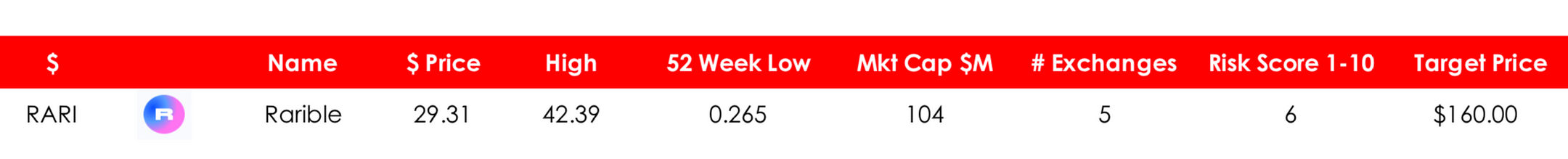

Rarible

The price of RARI is down 13% since we first added it to our portfolio last month.

RARI was the first governance token in the NFT space. Despite the price softening a little RARI is a quality project in a crowded space and we are still strong believers in this project. Our only concern is the massive maximum token circulation which is something that will surely weigh on the market cap of the token.

Listen to this weeks Moonshot Monday podcast on iTunes where you will hear three undervalued and undiscovered moonshots in a sector which we believe is going to be the next big thing.

Cryptocurrencies being added:

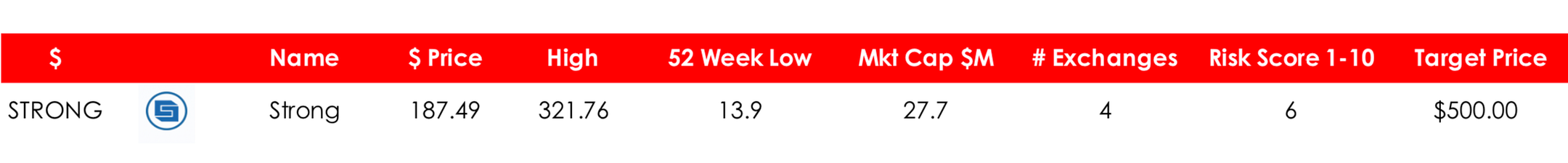

Strong

Overview

StrongBlock is the first and only blockchain-agnostic protocol to reward nodes for supporting the infrastructure of their blockchain.

Description

STRONG believes it is important to incentivize nodes because with limited resources and no financial incentive many nodes run out-of-date software, maintain incomplete blockchain histories and are intermittently off-line. To solve this, StrongBlock has made it possible for anyone to create a node in seconds and receive STRONG token rewards every day.

They call this “Nodes as a Service”. This allows anyone to create a Full Ethereum node in a few seconds with no technical expertise.

Since the launch of the StrongBlock DeFi node protocol, over 350 nodes have been registered. The total number of nodes number nearly 15,000. STRONG recently announced a tie up with leading DeFi platform Maker DAO, a major endorsement of STRONG’s business model.

According to STRONG each Node earns $20 per day, some people have multiple nodes. That makes this an attractive way of making passive income for anyone with a PC and some IT knowledge which is a definite formula for massive growth.

White Paper

There is no formal white paper. Read more here about the project.

Team

The project is led by an accomplished and experienced team. You can view the team here.

Our opinion

Target Price: $500

Risk Score: 6

Max circulation: 528,886

STRONG has a market cap of $28 million, with a price of $187. That compares to a high of $321. The token has a maximum supply of 535,000. The price has increased over 1,200% since January which under normal circumstances would be a complete turn off but we believe that the news of the partnership with DAO Maker, its modest market cap and limited supply makes this an exceptional opportunity. which justified a risk rating of 6 with a price target of $500. A projected market cap of $70 million still represents good value in our opinion.

Hybrix

Overview

Hybrix provides a solution for moving value between ledgers. The Hybrix protocol enables one token to exist on all ledgers.

Description

Hybrix’s solution is technically borderless, not being restricted to any single distributed blockchain or other digital ledger. No more having to constantly swap your tokens to operate on different blockchains, DEXs and ledgers.

Let’s say you want to use Tomodex, Pancakeswap or Uniswap without having to juggle your tokens, by simply loading your wallet up with Hybrix, connect the wallet to Uniswap, Tomodex or your choice of supported DEX and Hybrix will be available to swap.

It’s a cross-blockchain and cross-ledger token. It does not need its own blockchain, since it uses other blockchains to operate.

Hybrix currently supports 30 blockchains and 397 tokens. Swaps can be made between ETH and TOMO with more coming soon including WAVES and BSC.

The product is currently in beta testing.

Team

The team started working on this protocol back in 2014. They are an experienced, large team who’ve been developing a product for many years. View team here.

Click here to view Hybrix’s White Paper:

Our opinion

Target Price: $21

Risk Score: 8

Max circulation: 7,000,000

This is a coin which has so far been overlooked by the market with a market cap of only $11 million. Although the company is only in beta testing the potential of their product is massive. The risk however is if people are going to use their platform. Their loyal followers obviously believe they are onto something as do we. Adoption is the main risk and is why we have rated the token an 8 for risk. The potential upside is significant as we believe this is a $50–100 million market cap coin. We have set a price target of $21. All will become clear very soon as the project is close to launching its platform in the coming months.

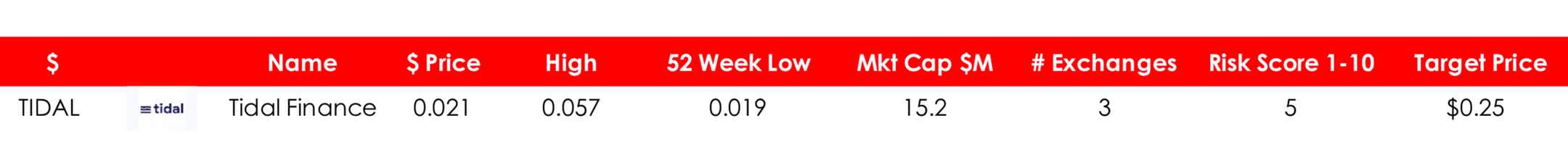

Tidal Finance

Overview

TIDAL is an insurance market built upon Polkadot that allows users to create custom insurance pools for one or more assets.

Description

Tidal will help users buy and sell insurance against decentralized finance protocols. The buying part is self-explanatory. As for sellers, they will have to provide liquidity for DeFi protocols they want to back and will receive Tidal tokens in return.

Tidal will charge a small percentage of transaction fees from cover sellers. Tidal combines different protocols into coverage pools to allow liquidity providers (LPs) to stake their capital to provide coverage on multiple protocols at the same time. These pools are assembled to offer LPs the ability to leverage their capital while mitigating the risks. Risks are reduced by combining protocols with low correlation and by limiting the duration of each coverage cycle. This approach provides LPs the ability to generate above-average returns while offering coverage seekers highly competitive pricing.

Tidal has said it has partnered with over 20 DeFi protocols to bring coverage for its users. Some of these protocols include bZx, Reef Finance, Equilibrium, StakeDAO, and others.

Tidal also plans to launch an insurance product for different proof-of-stake protocols, including Ethereum 2.0.

Tidal Finance recently raised $1.95 million in a private token sale round backed by Hypersphere Ventures, the venture firm co-founded by Polkadot co-founder Robert Habermeier, as well as Spartan Capital, Kenetic Capital, and QCP Capital.

Tidal is looking to launch its protocol in mid-April.

Team

The Tidal project team is both accomplished and experienced. As you will see from their LinkedIn profiles this is the perfect team to be leading a project of this quality.

LinkedIn — Chad Liu

LinkedIn — Dan Raykhman

Click here to view Tidal’s White Paper.

Our opinion

Target Price: $0.25

Risk Score: 5

Max circulation: 19,838,000,000

Tidal was our top pick from all the players currently operating in the cryptocurrency insurance space. Despite not having a live platform, it is treading a path already followed by the relative giant Nexus Mutual — market cap $607 million. Its management team is top tier, and the project is backed by leading VCs. That reduces the risk somewhat and justifies a risk score of 5. The potential, however, is in the price of its token. With a market value of $15 million and a price of $0.02, it is clear the market has overlooked this project’s potential, although it is a newcomer to the market, having only just completed an IDO. We have set a price target of $0.25. With the launch of its mainnet imminent, now would be a good time to start your own due diligence on this one. The biggest risk overhanging this project is its huge maximum token circulation.

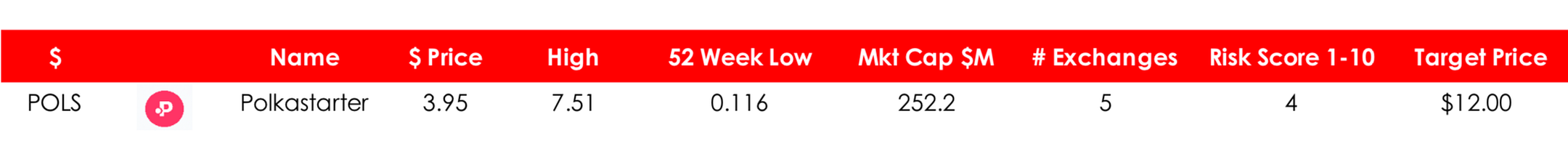

Polkastarter (POLS)

Overview

Polkastarter is a blockchain platform designed to provide an easy to use launchpad for cross-chain token pools and auctions. It is most commonly used by early-stage blockchain projects that want to raise capital and easily distribute their tokens at the same time.

Description

Through Polkastarter, blockchain projects can easily create their own cross-chain swap pools, which allow them to securely raise funds, while users can invest without risks, since swaps are automatically executed by smart contracts.

POLS is the native utility token of the Polkastarter platform and plays a number of roles in its ecosystem, being used for liquidity mining, governance, paying transaction fees, and gaining eligibility to participate in POLS-holder only pools.

Polkastarter’s main offering is its fixed swap smart contract, which allows projects to easily launch liquidity pools that execute orders at a fixed price — rather than using the AMM model made popular by Uniswap.

The platform is designed to handle a range of auction types, including sealed-bid and dutch auctions, as well as both fixed and dynamic ratio swaps. This makes it suitable for cryptocurrency projects looking to raise funds, as well as a variety of other use-cases, including private trades, OTC deals, and discounted sales.

Beyond this, other key features of the platform include permissionless listings, anti-scam capabilities, full KYC integration and liquidity mining.

The platform first went live in December 2020, and has quickly grown to become one of the most commonly used platforms for initial DEX offerings (IDOs).

Team

Polkastarter features an executive team with over three decades of combined experience in tech firms. It was co-founded by Daniel Stockhaus and Tiago Martins, who currently hold the roles of CEO and CTO at Polkastarter respectively.

Daniel Stockhaus is a serial entrepreneur credited with co-founding a highly successful e-commerce firm known as LiGo, as well as the digital growth agency Oliphant Ltd. Prior to this, he worked as a digital media designer for Fitch, and graduated with a bachelor’s degree in communication and media studies.

Tiago Martins, on the other hand, is a former professor of computer science and an experienced developer with expertise in online education and product development. He is also the co-founder of Codeplace, an online platform that teaches the fundamentals of web development.

Click here to view Polkastarter’s White Paper.

Our opinion

Target Price: $12

Risk Score: 4

Max circulation:100,000,000

Having already established a strong user base, Polkastarter is one of the leading lights in the decentralized launchpad space. It is looking to use its credibility and large investor base to diversify into other areas — the first one being DeFi insurance. Polkastarter’s token has a valuation of $255 million and a fully diluted valuation of $400 million. This is probably a billion dollar plus platform when you compare it to its rivals in the space such as PancakeSwap and Uniswap. We have set a risk score of 4 and a price target of $12.

Portfolio Selection — April 2021

Sylo

Overview

Decentralized data exchange. Operator of the SYLO smart wallet, which has over 250,000 users.

Description

The Sylo Protocol provides confidential communication as a utility to the Sylo Confidential Communication App. The protocol acts as the confidential networking layer for the Sylo App, creating P2P connections and providing a way for users to interact and exchange data confidentially.

The Sylo Protocol is being developed to provide fully decentralized confidential communication as a utility to all connected-apps within the Sylo ecosystem. Powered by blockchain and combined with other decentralized technologies, this Protocol will act as the networking layer for the Sylo DApp and 3rd-party connected-apps, while providing charging options for specific communications and services over the network.

The fully decentralized Sylo DApp will be the 1st application built on the blockchain-based Sylo Protocol, using technology already commercialized in the Sylo App that’s currently used by thousands globally, available on Apple Store and Google Play Store.

Sylo is a decentralized communication and data exchange network powered by a layer 2 micro payments infrastructure and the SYLO token. User-run Service Peers provide infrastructure to the network which allows developers and businesses to run privacy-first, unstoppable apps without deploying any infrastructure of their own. A staking architecture and unique probabilistic ticketing solution ensure minimal transaction fees and limitless scalability. This scalability is already on show within the project’s flagship app, the Sylo Smart Wallet; a decentralized, private messenger and crypto wallet with over a quarter-million users.

Click here to view Sylo White Paper

Team

Unlike many of the small and micro-cap cryptocurrencies, Sylo names each of its key members of its management team. The team appears to combine a broad range of talents, skills, and experience which should provide any investor with confidence in this project. This is Sylo’s description of their core team: ‘…combines a deep background in computer science, development, and user experience with the real-world business experience of entrepreneurs, designers, and world-leading technologists. Both in experience and attitude, the strength of Sylo is in its people.’

Our opinion

Risk Score: 5

Target Price: $0.01

Maximum Supply: 10B

With a market cap of $19 million SYLO is close to the price target we set of $0.01. The team has already demonstrated it is a force to be reckoned having developed and launched its smart wallet which has over a quarter-million users. It also has a decent-sized community following it. We have ranked the coin a 5 in terms of risk as the team has already achieved a level of success however the potential has not been fully recognized in the price.

PlotX

Overview

Prediction market platform.

Description

PlotX is a non-custodial prediction protocol that enables users to earn rewards on high-yield prediction markets.

Dubbed as the Uniswap of Prediction Markets, PlotX uses an Automated Market Making algorithm to create, settle markets and distribute rewards on the Ethereum Blockchain without any counterparty risk. Markets are focused on crypto-pairs like BTC, ETH, YFI, etc, and are automatically created in intervals of 4 hours, 1 day, and 1 week. PlotX also uses on-chain governance powered by GovBlocks.

Click here to view PlotX White Paper

Team

Check out the team in this video on PLOT’s website

A well rounded team who have launched an impressive platform. They appear to have a close eye on regulation having restricted access to high risk countries such as the US. That is a comforting sign for the future.

Our opinion

Risk Score: 7

Target Price: $1.00

Maximum Supply: 200M

PLOT is a prediction market platform similar to Augur. Augur is one of the biggest players in this market, but that really isn’t saying a lot. With only $3.3 million of value locked (i.e. money currently committed to positions on its platform), Augur’s valuation of $300 million is obviously based on its potential. PLOT’s value is under 3% of Augur’s. That discount looks excessive to us. There are four exchanges that offer a market in PLOT. It has an all-time high of $0.19, so clearly, now is a good time to buy. We believe a price close to $1 is reasonable for the potential it offers. We have scored PLOT a 7 in terms of risk because it has not proved it can deliver on its model.

Potcoin

Overview

Payment facilitator in the legal cannabis market.

Description

PotCoin is a digital cryptocurrency aimed to empower, secure, and facilitate the Cannabis community, medicinal and recreational alike.

The tagline for PotCoin goes as the following:

“On every level of the Cannabis, Hemp and financial industries, our users and supporters can entrust PotCoin to extend credibility, stability, and security to this exponentially growing market and community.”

It is based on the Proof of Work Scrypt algorithm with a total maximum supply of 420 million coins. PotCoin supports wallet software on most major platforms, including Windows, Mac, Linux, and Android. It also has a web wallet.

Click here to view Potcoin White Paper.

Team

Potcoin was formed by three Canadian developers, however, they disbanded and the project was taken over by a group known as PotLabs, who was responsible for helping develop the coin in the first place. The fact that there is not a dedicated named team pushing this project is a concern.

Our opinion

Risk Score: 9

Target Price: $0.10

Maximum Supply: 420M

POT is, without doubt, a high-risk project. Although it was the first cryptocurrency in the legal cannabis market, adoption has been difficult. But saying that POT is one of the last men standing. Although there is not a dedicated team, there is a big community that supports its objective. POT does have huge potential, but it doesn’t come without significant risk, which is why we have rated it a 9. The price is 1% of its high, so it certainly has potential.

Centric Cash

Overview

Centric is a blockchain-based payment network composed of two distinct tokens which promote stability.

Description

Centric was conceived with the vision of one day replacing traditional fiat currencies. Blockchain technology will enable a more transparent world, and they believe their innovative approach to achieving widespread adoption long term is what sets Centric apart from other cryptocurrencies today.

They believe the largest obstacle to the mass adoption of cryptocurrencies is price volatility. The decentralized model to price discovery has made the majority of existing cryptocurrencies nothing more than stocks or commodities, valued on psychology, traded on unregulated stock markets, and susceptible to manipulation. The lack of price stability has prevented credit and debt markets from forming because volatility incurs a premium.

While the rest of the industry focuses on transaction throughput and smart contracts, Centric focuses on solving price stability to realize the economic capabilities that the blockchain enables.

Click here to view Centric White Paper

Team

Check out the Centric team here.

There is a new CEO who is far more communicative than the previous incumbent. It would be a good idea to sign up to their Telegram channel and view a few of his recent announcements.

Our opinion

Risk Score: 7

Target Price: $0.005

Maximum Supply: No max

We have scored CNS a 9 for risk. This is based on the fact that its team doesn’t possess a verifiable track record. This is by no means a major negative, particularly with such a low market cap. However, it does appear to have an interesting project which is operational and could see a revaluation considering its low market cap. Its price is less than 3% of its all-time high, so we believe there is potential in this cryptocurrency.

GeoDB

Overview

GeoDB is a decentralized peer-to-peer big data sharing ecosystem.

Description

GeoDB is a decentralized peer-to-peer big data sharing ecosystem, which returns value to its creators, the users. GeoDB’s mission is to democratize the 260 billion Big Data industry, building an open ecosystem in which to establish better and trusted relationships between market participants while giving back control and value to data generators, the users. GeoDB is using blockchain technology to eliminate intermediation in a huge industry and allow faster growth and adoption.

Click here to view GeoDB White Paper

Team

GEO boasts an experienced team of technology professionals that have demonstrated that they are credible by raising money through a crowdfunding round. See the full team here.

Our opinion

Risk Score: 4

Target Price: $4.00

Maximum Supply: 300M

The team behind GEO recently completed a capital raising through Seedrs, raising GBP2.5 million, surpassing their target of GBP2 million. The downside is there is a large maximum supply compared to the current circulation, but we believe that is outweighed by the potential of the project and the team behind it.

Kryll

Overview

Kryll is your first intuitive platform to define powerful crypto trading strategies.

Description

Kryll is your first intuitive platform to define powerful crypto trading strategies through a simple drag n drop editor. Create automated winning strategies, benchmark them, share with the community, enjoy user-generated content.

Kryll is the ultimate platform for cryptocurrency traders looking to use the most advanced trading tools and strategies, as well as benefit from the community’s hive-mind to get the best returns within cryptocurrency markets.

The platform provides intuitive ways to create your own trading strategies that can be set to execute automatically. Through a What You See Is What You Trade™ interface, you can design trading strategies making use of the industry’s most powerful tools and safely test them with backtesting and sandboxing.

Once your tools prove their worth, you can set them to live-trade on your behalf, taking the right positions at the right time, as if you were following the markets 24/7.

On Kryll you can also rent out your very own winning strategies to help fellow traders be more successful. You will be rewarded with passive income for sharing your strategies.

Click here to view Kryll White Paper

Team

An accomplished team with a proven track record of success in both tech and entrepreneurial flair. Check out the full team here.

Our opinion

Risk Score: 6

Target Price: $0.73

Maximum Supply: 49M

We believe that Kryll has a unique business model which could easily gain traction. We especially like the novel touch, where traders can rent out their own strategies to help fellow traders be more successful. This allows traders to be rewarded with passive income for sharing their strategies on something that could scale quickly. Despite the large max supply compared to the coins in circulation, the price does not take into account the quality of the team and the potential of this platform to scale.

Yield App

Overview

YLD, a licensed and regulated FinTech company, offers a mobile app and web platform designed to provide the easiest way to invest in DeFi using crypto or traditional currencies.

Description

YLD’s intuitive app and web platform enable users around the world to earn high returns from DeFi products without having to go through a lengthy, complex, and often costly learning process. Operating under a banking license, YLD offers an insured investment fund managed by a team with years of experience in FinTech and cyber security. At the core of its strategy is the YLD token, which rewards community members and allows them to boost their APY.

Click here to view Yield App White Paper

Team

Both an experienced and accomplished project team benefiting from a team of quality advisors. See the full team here.

Our opinion

Risk Score: 3

Target Price: $1.50

Maximum Supply: 300M

YLD has a market value of $60 million which when you look at other similar platforms in the DeFi space, this cryptocurrency is grossly undervalued. YLD’s platform is regulated and is aimed at the unsophisticated user, which could make this an attractive bet on the eventual mass adoption of DeFi. With a limited maximum number of coins in circulation, this is a good choice for any portfolio.

OIN Finance

Overview

DeFi platform providing liquidity mining and loans.

Description

OIN is described as being the first DeFi platform to provide liquidity mining and loans on Ontology, and ultimately on other top platforms through cross-chain functionality. The platform will build the bridge technology to seamlessly integrate Ethereum into its ecosystem, opening up to all of the current DeFi space. Cross-chain technology is crucial in DeFi and its growth as a legitimate financial infrastructure, after all, traditional finance also integrates the whole world, its currencies, and its different financial systems.

Click here to view OIN White Paper

Team

OIN has what appears to be a large dedicated team, check the full team out here.

Our opinion

Risk Score: 9

Target Price: $1.10

Maximum Supply: 100M

This cryptocurrency suffers from the same problem as many others: lack of information on the team’s past achievements and a massive maximum supply of 100 million compared to only 6.75M million in circulation. That all probably goes some way to explaining OIN’s low market cap which we believe still doesn’t reflect its full potential, however, this is a high-risk high reward investment which should definitely be balanced with some lower-risk opportunities.

Bird.Money

Overview

Bird.Money is an ERC20 token which acts as a non-custodial digital asset lending and borrowing platform.

Description

BIRD is an off-chain API interface for third-party integration with other companies, developers, and DeFi apps. Some of the features available include ETH account analytics POST and GET endpoints. Other features include account blacklist, Oracle integration with google search, on-chain and off-chain equity measurement, on-chain and off-chain assets measurement will be released in the near future.

Initial features of the API would be free to organisations, developers, and the whole community. After the BIRD sales, only customers with BIRD tokens will have access to the premium services such as Smart Contract Analytics. Smart Contract analytics will allow the community to gain unrivaled intelligence about a token or farm just by simply pasting the smart contract address.

Click here to view BIRD White Paper

Team

This is how BIRD describes their team, ‘The Bird nest comprises a global group of professionals that hold a high level of standard, not only for their work but for the people around them and the community. Our team is fully committed to the Bird.Money vision, the concept and growth of decentralized finance, global inclusion and fairness throughout.’ They appear to have an experienced team who are more than capable of achieving their objectives. See the full team here.

Our opinion

Risk Score: 4

Target Price: $700.00

Maximum Supply: 140,000

Bird is one of our top picks. It has a number of things going for it. Firstly it is an oracle similar to the popular Chainlink. An oracle integrates information from outside the blockchain. BIRD is focusing on credit scores for the DeFi space, a potentially useful and lucrative area. Bearing in mind that Chainlink is valued at over $10 billion BIRD is, in our opinion, grossly undervalued. It also has a maximum supply of only 140,000, with already 80,000 in circulation.

TE-FOOD

Overview

Decentralized systems that manage the food supply chain allowing traceability of food stuff.

Description

TE-FOOD is a blockchain-based farm-to-table food traceability solution. Its mission is to provide transparency in the food industry.

TE-FOOD aims to enable customers to improve consumer trust and brand exposure, gain deeper supply chain insight to improve their operational efficiency, comply with export regulations, protect their brands against counterfeiting, and perform quicker product recalls. As an end-to-end solution, TE-FOOD offers many components for the complete supply chain to identify tracked items and batches, capture the data, store it on blockchain, process the data, and present it to the consumers.

Launched in 2016, TE-FOOD reportedly serves over 6,000 business customers and performs 400,000 business operations each day. The team claims food products tracked with TE-FOOD are available for more than 150 million consumers around the world.

TE-FOOD’s blockchain (the FoodChain) is a public permissioned blockchain that enables both supply chain participants and the consumer community to maintain masternodes to decentralize traceability information.

TFD is an ERC20 token and operates on the Ethereum platform, which represents a tokenized software licence, enabling users of TE-FOOD’s ecosystem to perform their activities. All individuals and organizations need to possess a certain number of TFD licence tokens to use TE-FOOD’s ecosystem.

Click here to view TE-FOOD White Paper Team

An accomplished experienced team who have already gained adoption beyond the majority of other blockchain projects. See team here.

Our opinion

Risk Score: 7

Target Price: $0.075

Maximum Supply: 1B

It has to be said there is a lot of talks and little action in the blockchain space. Huge potential, but very few projects deliver. TONE is one project that has bucked that trend. It has established a niche in the food market and has on boarded over 6,000 business customers. We believe this reduces the risk of investing in TONE substantially and is a solid investment in any diversified cryptocurrency portfolio.

GROWTH DeFi

Overview

DeFi ecosystem on the Ethereum blockchain built to maximize yields from the top DeFi protocols.

Description

GROWTH’s purpose is creating an ecosystem where both GRO holders and gToken holders can benefit from the positive effects of compounded interest, high liquidity, and a share of arbitrageurs profit without suffering from impermanent loss.

Click here to view GROWTH’s White Paper

Team

Check out the team in the link below. The two main people behind the projects are highly experienced and tech-savvy, one holding a Ph.D. in Computer Science from Yale.

Our opinion

Risk Score: 8

Target Price: $100.00

Maximum Supply: 984,374

This project is active, and according to their App, has over $7m in Total Value Locked. That is not a bad start for a new project which hasn’t been subject to all the hype that some projects in the DeFi space have attracted. In our opinion, the market cap of GROWTH does not represent its current or future potential. We have scored GRO an 8 for risk as this is a crowded space, however, the difference is these guys are doing it and succeeding hence why we think this is a great coin to tuck away. This article is a deep dive into the project which is worth a read to understand the full picture.

TosDis

Overview

The one-stop DeFi interoperable solution powered with Liquid Staking.

Description

TosDis is a new DeFi project which combines the power of staking as a service and liquid staking for POS coins. In this way, they are combining the best of both worlds — allowing crypto investors to stake their PoS digital assets via TosDis EasyStake. At the same time, they take care of the technical aspect of the staking process and the benefits of liquid staking. TosDis is bringing together Staking-as-a-Service and liquid staking to unlock more generous access to digital assets. It is a new word in the Proof-of-Stake algorithm’s improvement, allowing its users to use a platform-independent betting mechanism and increasing the liquidity of tokens.

Click here to view TosDis White Paper

Team

See here for more information

Our opinion

Risk Score: 7

Target Price: $400.00

Maximum Supply: 99,986

This cryptocurrency looks attractive. It has developed and continues to develop new innovative solutions in the fast-expanding DeFi space. That, coupled with the low market cap and low maximum circulation, makes this a good buying opportunity, in our opinion. Take a read of this article to see the various developments since launch.

Governor DAO

Overview

Governor is a DAO that seeks to offer Governance-as-a-Service to new DAOs.

Description

Governor is a DAO that seeks to offer Governance-as-a-Service to new DAOs in order to ensure active and fair governance on day zero. GDAO is the governance token that grants voting rights and represents ownership of the project treasury.

Click here to view Governor DAO White Paper

Team

This is a community run project.

Our opinion

Risk Score: 5

Target Price: $9.50

Maximum Supply: 3,000,000

The projects staking and mining solutions are live and slowly gaining traction. We have scored GDAO a 5 in terms of its risk because we believe the current price is far too low compared to where the project is now and its potential in the lucrative DAO space. Take a look at this link which gives you a better understanding of the project and why it is one to look at more closely:

Handshake

Overview

The Handshake project aims to create an alternative certificate authority and naming systems that are used for root Domain Name Server (DNS).

Description

Handshake is decentralized and permissionless, typically compared to The Internet Corporation for Assigned Names and Numbers (ICANN), which is centralized. As of now, names that are used in top-level domain names such as .com, .net, and social networking usernames are centrally managed by a central authority.

The Handshake Protocol consists of a node that anyone can participate permissionless to be part of a decentralized open naming platform. Handshake Coin (HNS) is the native currency in the protocol that allows the transfer, registration, and update of internet names. The aim of introducing a unit of currency is to counter spam where someone claims and registers all the possible names without any form of control.

Free and Open Source Software (FOSS) developers are allocated the majority of their initial coins. This is done by way of allocating HNS coins to Github users that meets the minimal requirement of open source activity.

Click here to view Handshakes White Paper

Team

An exceptionally talented and experienced team. Founded by Joseph Poon (co-creator of Bitcoin’s Lightning Network and Plasma payment channels), Andrew Lee (CEO of Bitcoin payments gateway Purse), Christopher Jeffery (CTO of Purse and creator of Bitcoin node software Bcoin), Boyma Fahnbulleh (Bcoin developer), and Andrew Lee (Founder of VPN provider Private Internet Access).

Our opinion

Risk Score: 3

Target Price: $1.00

Maximum Supply: 2.04B

This project is billed as an experiment by its team however, the founders have raised $10 million from various high-profile VCs including, a16z, Founders Fund, Polychain Capital, and Draper Associates. These investors combined to purchase 7.5% of the initial supply of HNS, valuing the Handshake network at $136 million. This combined with the exceptionally accomplished project team makes this a project worth serious consideration. If you believe that blockchain is the web of the future, then gaining exposure to a cryptocurrency that is set to benefit from the expected demand for customized domain extensions is a bet worth taking.

VIBE

Overview

VIBE operates marketplaces and hubs inside Augmented and Virtual Reality created on the Ethereum blockchain driven by the cryptocurrency VIBE.

Description

Creating next generation NFTs and developing new standards for gaming on the blockchain. Built for users and developers on the layer 2 solution VIBENet and powered by the VIBE token.

VIBE is a fully decentralized and immutable ERC-20 Token with a fixed token supply. VIBE is used for purchasing digital goods and services in the ecosystem. VIBE Ecosystem is powered by the VIBE token and the Layer-2 side chain solution VIBENet.

White Paper is not available — click here for news

Team

Founded by Alessio Mack and Matthew Myers. The development team consists of 12 core members who are seasoned developers and marketing experts. It also has a quality assurance member, Renee Isaac.

Our opinion

Risk Score: 9

Target Price: $0.250

Maximum Supply: 267M

VIBE is certainly in the right space — NFTs. However, although it is obvious from its constant flow of news and developments that this project is carving itself into a lucrative niche, it doesn’t come without risk. We have scored VIBE a 9 in terms of risk as it is in a highly competitive market, saying that with its low market cap and the strong community, this project, in our opinion, is a risk worth taking.

RARIBLE

Overview

Rarible is a creator-centric NFT marketplace and issuance platform. RARI is a governance token with a Marketplace Liquidity Mining program.

Description

Rarible brands itself as the world’s first “community-owned NFT marketplace.” Furthermore, Rarible leverages its RARI token — which, similarly, is the world’s first governance token in the NFT field — to power this community-run platform model. In giving users a token with governance powers, Rarible is borrowing a page from the DeFi playbook.

At its core, Rarible is an NFT (non-fungible token) platform for securing digital collectibles secured with blockchain technology. However, Rarible has a considerably more ambitious vision than merely becoming a platform for securing art and digital collectibles using blockchain.

Rarible represents a digital NTF platform with a particular focus on art assets. Specifically, Rarible includes a marketplace that allows users to trade various digital collectibles or NFTs, similar to OpenSea.

Users can also use Rarible to create — commonly known as “minting” NFTs, or non-fungible tokens. This is significant for various content creators. For example, an artist could sell their creations, such as books, music albums, or movies, as NFTs.

Rarible is placing significant emphasis on creating an entirely autonomous platform, run through a community governance model. Moreover, Rarible is now shifting heavily towards becoming an actual Decentralized Autonomous Organization (DAO).

The White Paper is not available — see this informative blog.

Team

Rarible is a company founded by Alex Salnikov and Alexei Falin and is based in Moscow. Salnikov has worked in cryptocurrency since 2013, while Falin previously co-founded a marketplace for digital stickers that can be used on chat platforms.

Our opinion

Risk Score: 6

Target Price: $160.00

Maximum Supply: 25M

Rarible is an easy-to-use platform that has received a great deal of praise for its relatively simple and intuitive user interface. Its connection to Yearn Finance’s yInsure initiative is another promising development as Yearn Finance is one of the hottest names in DeFi. Rarible is a standout project in the NFT space, and whilst the price of RARI has increased significantly in recent months, we believe in the long term it has further to go. Its biggest risk is the large mismatch between the maximum token circulation and the tokens currently in circulation.

View:

Moonshot Portfolio – March 2021

Moonshot Portfolio – February 2021

No Financial Advice

This article does not constitute financial advice in any way. Always do your own research and never invest more than you can afford to lose. The article should be treated as supplementary information to add to your existing knowledge.

Recent Comments