News Bulletin – August 2021

Latest News in the Cryptocurrency and Investment World

Market Overview

Last week confidence finally returned to the market. The Fear and Greed index went from extreme fear last month to a few days of greed. it sits at neutral now, a far cry from the doom and gloom pervading the market only a a short while ago. Bitcoin breached $40,000 and reached levels not seen since the rot set in back in May. Although there have been many potentially troublesome stories doing the rounds such as further clampdowns by China, potential US Government regulation and problems at Binance and Tether the market has finally looked the other way and has started to see the blue sky again.

Whether it continues is anyone’s guess but as we keep on saying, the goal has to be to find projects which have been neglected by the market and hold these for the long term. Lack of confidence in the market should always be looked on as an opportunity to buy into your favorite projects at lower prices assuming those favorite projects aren’t memecoins and or some other over hyped crap!

Trending

More trouble at Binance

Last month we wrote about the trial and tribulations at Binance. This month we are reporting on further signs of major problems at the largest central exchange in the world. There are reports of a US Government investigation into past infractions. They have also been forbidden to operate in Malaysia and Italy. In the UK a number of banks including Barclays and HSBS have blocked card payments after the UK regulator banned Binance from targeting UK investors. Further, the Government of India announced they are investigating their practices. Whilst Binance’s CEO and founder CZ pretends that he welcomes regulation the reality is he has missed the boat. He decided to take the fast route to success rather than the slower, more pondering path that Coinbase opted for, embracing regulation from day one. It is very hard to go back in time and right your wrongs. As we advised a few months ago investors should ensure they hold their assets in their own wallet just in case armageddon arrives at CZ’s palatial door.

Tether in the firing line

Tether has been the subject of much market rumor and speculation for years. However it seems as though people are starting to tackle these rumors seriously. June and July saw a stagnation in the growth of Tether whilst its smaller competitor USDC continued its aggressive growth. That halt in growth was also accompanied by a report that the US’s DOJ is investigating Tether over potential bank fraud. It is very rare that a DOJ investigation comes to naught. Despite Tether brushing it off as old news they are secretly shitting themselves because when the DOJ gets involved indictments will follow. Investors should be looking to use another alternative to Tether such as Paxos or USDC.

Circle and Robinhood

Circle, the firm behind USDC, is going public in a deal valuing it at $4.5 billion whilst Robinhood listed at a valuation of $31.8 billion. Although the stock didn’t fare well with the stock falling by 8% on its first day of trading.

Crypto credit cards

Visa crypto cards saw over a billion dollars in spending in the first half of 2021. More than 50 crypto firms have launched cards with Visa so far.

Number of crypto users

The number of people using cryptocurrencies around the world has doubled in six months. It is estimated that the global crypto population now stands at 221 million.

Staking and Yield Farming

Each week we provide the latest APRs from leading staking and yield farming platforms together with news from the industry.

Staking and yield farming has been a major driver in the huge growth in the DeFi sector. Investors are being enticed by the massive APRs on offer. Totally new projects tempting investors with returns of 10,000+ % are able to attract a deluge of money from investors who don’t seem concerned with the high risks involved. Our weekly review looks at the best platforms out there and the ones to avoid. We attempt to weed out the platforms that we think won’t stand the test of time.

Liquidity mining is here to stay. Our challenge is picking the winners from the losers. However a credible platform does not protect against the risk of a cyber attack or market risk. Cyber attacks or poor code are common in this space with Safe Dollar, Iron Finance and Pancake Bunny all being recent victims. No platform is totally safe. However as the market evolves investors will be able to insure themselves against these kinds of risks but that is something for the future, we are stuck with each other for now.

You can read our in depth report on staking and yield farming here.

You can also watch our new YouTube video which takes a deep dive into the world of staking and yield farming and attempts to explain the most complex issues and asks the question, is it all too good to be true?

Latest Inside Track Podcast

We have been busy finding you great content presented by leaders in their field. Our Inside Track library now numbers well over 20 podcasts from crypto influencers talking about subjects as diverse as memecoins to taxation including DeFi, decentralized exchanges and IDOs. You name it, we cover it. Take a look at our current library here.

Our latest addition to our library over the last month include the following topics:

Kirobo talks cryptocurrency transfers — the $160 million project discusses its various solutions for crypto users in the event they send their cryptocurrency to the wrong address.

L1ght L1st talks staking and yield farming — an explanation of the complex world of liquidity farming made simple for the novice investor.

Yield App talks DeFi — leading regulated DeFi Dapp discusses the future of DeFi and the potential of its own project.

Energy Ledger talks oil and the blockchain — how their solution would prevent another Colonial pipeline hack.

Moonshot Monday

Listen to this week’s Moonshot Monday podcast here where we discuss three of our favorite moonshots from previous podcasts and publications.

A Few Articles That You Don’t Want To Miss

Click below to read a few of the articles we published last month which you may like to catch up on:

Raising capital — a lesson from the school of hard knocks

How to launch a cryptocurrency

Finally…

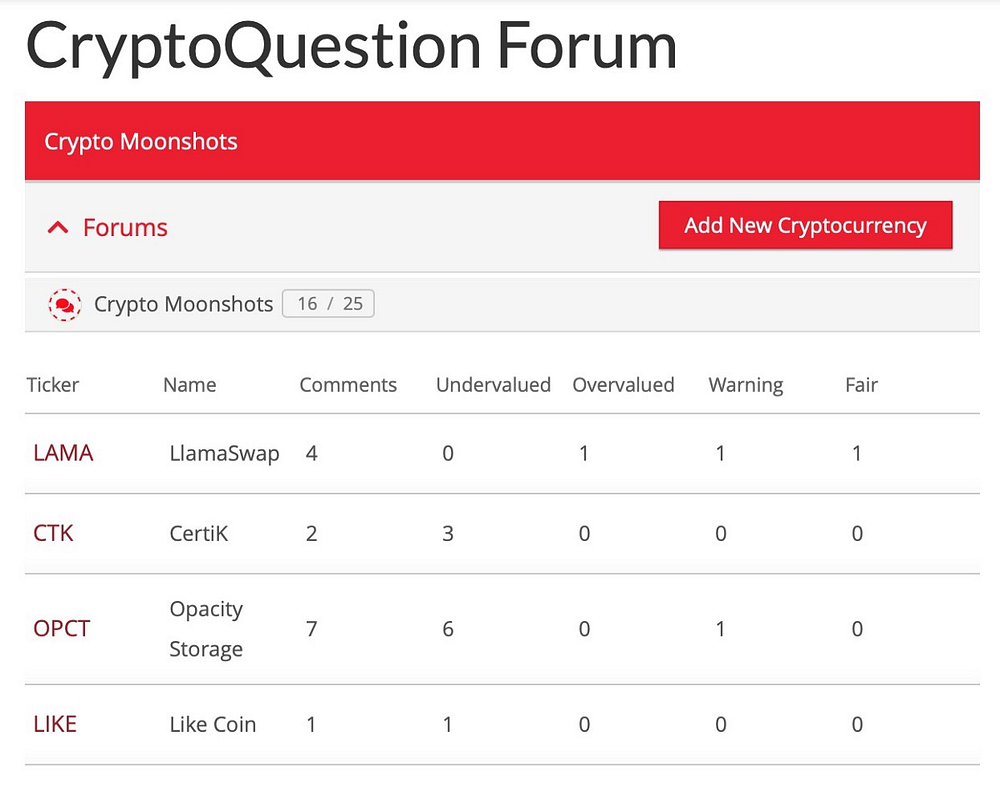

The Crypto Moonshot Forum

Remember to start using our new forum. We need more content before we can release this valuable resource to the world.

It’s a great source of ideas. If you are an avid user of Reddit this forum is going to be a breath of fresh air unless you like pages of spam of course.

Not Financial Advice

This article does not constitute financial advice or a recommendation to buy in any way. Always do your own research and never invest more than you can afford to lose. Investing in cryptocurrencies is high risk, and you could lose 100% of your investment. The article should be treated as supplementary information to add to your existing knowledge.

Recent Comments