Report: Crypto Exchanges — The Good, The Bad, and The Ugly

A comprehensive guide to choosing a crypto exchange based on feedback from the crypto community

This article is for everyone either in cryptocurrency or contemplating entering the crypto arena. Selecting a crypto exchange is not as straightforward as it may first appear. There are a host of considerations all of which will be critical to your success in the crypto space. Your choice will be guided by your level of expertise and appetite for risk. This article is going to point out the minefields awaiting the unsuspecting crypto traveler including customer service or lack thereof, sharp practices, fees, regulation, and exchanges to be wary of.

The first step on the crypto ladder is always to find a reliable cryptocurrency exchange. But it isn’t all about reliability. A good crypto exchange possesses the following characteristics:

- Great customer service

- Good liquidity

- Low fees

- Ease of use

- Wide selection of cryptocurrencies

- Insurance

- Regulation

A good place to start in your selection is www.coinmarketcap.com which lists over 300 exchanges. It is estimated there are more than 500 cryptocurrency exchanges operating today. However the traditional way of ranking exchanges by trading volume does not provide the investor a complete picture. Qualities such as customer service, ease of use and regulation are not factors that are usually taken into account when selecting a crypto exchange. The most important consideration that is always neglected is our old friend regulation. In compiling this article we have collected data from the cryptocurrency community taking into account their many experiences, good and bad.

VIEW OUR MICRO CAP WATCH LIST FOR INVESTMENT IDEAS ON SMALLER CRYPTOCURRENCIES WITH POTENTIAL

Great customer service

Great customer service and cryptocurrency exchanges is something you rarely hear in the same sentence. And it kind of makes sense. According to Coinbase’s recent regulatory filing for its upcoming IPO it has over 40 million customers and 2.8 monthly transactions. That explains why it takes them weeks to process new account opening requests and why there are regular complaints about outages. Binance is no better. Many people complain that they never receive a response from customer support, some wait months. Read this real life example of appalling customer service. This client of Binance.US has been painstakingly chasing for the return of his money for nearly six months. This is sure to make your blood boil…

Read his story on Reddit here

In the cold light of day this poor customer service can be expected. With millions of people transacting online every day these companies expect and demand the technology to handle everything. They neglect the human interface. But they neglect this at their peril as it is the few who create the biggest noise and can affect a brands reputation. Of the largest exchanges Gemini (ranked #13 by volume) scores highly on customer service. Some of the smaller exchanges have the worst customer service record. With many failing to carry out trades, failing to send cryptocurrency or fiat back to customers when requested and not responding to customer queries.

Liquidity

There is an advantage in choosing a crypto exchange based on trading volumes. An exchange with significant trading volumes indicates a few factors. Firstly that the exchange is financially stable, although this is not a given. Secondly that the exchange offers competitive fees and pricing (again not a given) and finally, that the exchange benefits from high liquidity. Liquidity is essential when dealing with any exchange. The better the liquidity the easier it is for you to buy and sell and the lower the spread between the bid-ask price (or the lower the market price in the case of most exchanges who markup the market price rather than charge a spread). Liquidity is definitely one of the top considerations when choosing an exchange.

Top ten exchanges by trading volume are:

- Binance

- Huobi Global

- Bithumb

- Coinbase Pro

- Kraken

- Bitfinex

- Bitstamp

- KuCoin

- Binance.US

- Bittrex

This ranking is based on current trading volume which may vary considerably.

Low fees

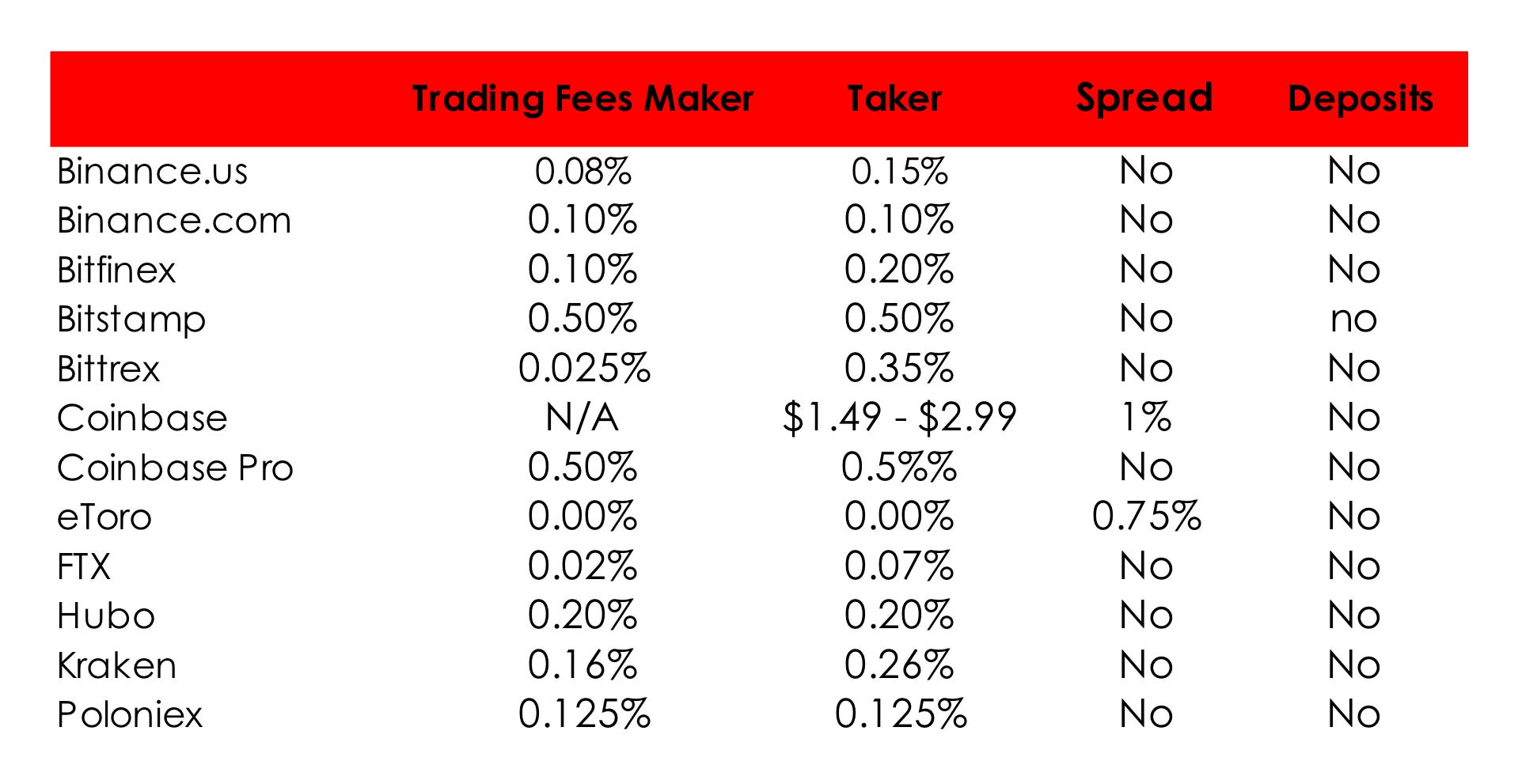

Trading fees are the primary source of revenue for exchanges. In Coinbase’s S-1 they disclosed that trading fees and spreads make up 90% of revenue. Some exchanges charge fees for deposits and withdrawals. Deposit fees are less common than withdrawal fees.

Here is a sample of fees from some of the well known exchanges:

A note on spreads

Although most crypto exchanges say they do not charge a spread on the purchase or sale of cryptocurrency this is not entirely correct. Many mark up the market price. This is the case with Robinhood, Square and PayPal for instance. It is hard to work out if the above exchanges follow this practice but we think it can be assumed that they do, but choose to hide it from the consumer. The wide price differences between crypto exchanges is a dead giveaway to this practice.

Ease of use

There are few complaints about the ease of use from customers using the bigger exchanges, most of the complaints come from dealings with some of the smaller and unregulated exchanges.

Wide selection of cryptocurrencies

It seems to be the case that the more regulated the exchange the smaller their selection of cryptocurrencies. That is particularly the case with US based crypto exchanges. Here is a list of exchanges ranked by the number of cryptocurrencies each offer along with whether exchanges permit US citizens to trade with them.

VIEW OUR MICRO CAP WATCH LIST FOR INVESTMENT IDEAS ON SMALLER CRYPTOCURRENCIES WITH POTENTIAL

Insurance

A few of the top exchanges insure against hacks but the exact nature of the insurance isn’t always totally clear. Let us take a look at some of the exchanges that insure.

Binance — They have their own insurance policy which is funded from trading fees. It is apparently held in cold storage but there is no indication how large this fund is.

Bittrex — Client funds/assets are insured up to $300m, insuring against theft from hot/cold wallets. This is the most comprehensive and independent insurance plan in the industry.

Gemini — The Winklevoss twins established their own insurance company to insure only funds held in cold storage up to $200m.

Coinbase — Insures only money held in their hot wallet up to $255m. Whilst the insurance policy is with a Lloyds registered broker it only covers a small fraction of potential exposure as 98% of their crypto holdings are held in cold storage.

Apart from Bittrex all of these insurance arrangements are not as clear cut as they first appear. If insurance is important to you it is essential to establish what each exchange is insuring against in case of a major hack. Hacks are not rare, they are commonplace meaning insurance should be a major consideration when selecting an exchange.

A note on security

Let’s face it despite the protestations from many exchanges that they are invulnerable to cyber attacks, it is nonsense. Most exchanges have been hacked at some point or another including Binance despite their website proclaiming they are bullet proof. One of the few exchanges that has never been hacked is Coinbase. But never say never.

Regulation

Regulation is a complicated area in the cryptocurrency space. Take the US for example. There is no general consensus on any one authority regulating crypto exchanges. Regulation for crypto varies by state although there are no formal rules to govern exchanges. Several federal regulators claim jurisdiction over them, including the Securities Exchange Commission, the Commodity Futures Trading Commission and the Financial Crimes Enforcement Network.

Usually any firm that helps transfer funds (even virtually) requires a money transmitters licence. Basically that means that crypto exchanges targeting US citizens must have a transmitters licence as a bare minimum. In certain states such as New York they also require separate registration. Therefore exchanges targeting US citizens without the appropriate authorizations are treading on treacherous ground. As far as investors investing in such exchanges they risk losing everything if these exchanges are shut down by regulators.

Let’s take Binance as an example. Initially it took a gun hoe approach and targeted the US without any regulation. Realizing it was taking a giant risk it set up Binance.US and only offered mainstream coins to US customers. Compare the number of coins it offers under its US operation to its Binance.com operation — 30 compared to 337. US citizens are restricted from buying through Binance.com.

There are still many exchanges that are either based and or regulated in jurisdictions that target overseas countries. In basic terms any US investor buying cryptocurrencies through an exchange regulated and or domiciled in Malta, Estonia, Cyprus and Seychelles for example are running a big risk that the US or even another country such as the UK will aim to shut down that exchange if they feel their citizens are being targeted or more specifically are being allowed to invest. There is a reason why exchanges are set up in countries with minimal regulation, but that doesn’t protect them from the long arm of the US.

As a general rule investors should only invest through exchanges that are regulated in their country of residence.

A note to Americans

American citizens have limited choice if they follow the general rule above. If a US citizen wishes to buy a small cap coin for instance many are not available on US based exchanges. Also a number of cryptocurrency exchanges offering these smaller coins do not accept US citizens.

There are however many that do, and these are the smaller exchanges based in places like Argentina, the Seychelles and other off the beaten track jurisdictions. These exchanges generally have poor liquidity, their customer service is non existent and peace of mind is only induced through a few stiff drinks or a handful of narcotics!

That provides the American investor who wants to take on more risk than the average investor with a dilemma. Do they stick with the 60 odd coins offered by the likes of Binance.US and Coinbase or do they risk buying from the smaller exchanges to get in on the micro and small cap coin action? As long as they are only risking a small fraction of their crypto portfolio then this is probably a risk worth taking. However as we will explore shortly, another option worth considering is the decentralized exchange.

Exchanges for beginners

Let’s define a beginner. Here we are talking about the person who only wants to buy Bitcoin and possibly Ether. They are not really interested in trading in various cryptocurrencies, just yet anyway. Again there are many options but your safest bet is to buy Bitcoin through either Square or PayPal. It is simple, cheap and secure. If you plan to dabble in a few other coins other than Bitcoin, PayPal is still an option but you may want to consider opening an account with one of the large exchanges. Our recommendations would be Gemini or Bittrex. Coinbase are taking weeks to open an account (over 3 weeks in many cases). The risk of dealing with a non regulated firm is not something we would readily recommend for a beginner.

TAKE ONE OF OUR FREE ONLINE CRYPTO COURSES — CHOOSE FROM SEVEN MODULES HERE

Once bitten twice shy

Like in life, it is never wise to give a second chance to someone who has wronged you. That life lesson is particularly applicable in the world of crypto. If an exchange has not acted appropriately once it is likely to repeat the same behavior a second time. It is best not to take the risk of checking to see if they have changed their ways. Below are a handful of exchanges that have come a cropper at some point and are not worth the risk of trading with again.

OKEx — After the exchange claimed that one of its founders had been arrested and that he was in possession of the exchange’s private key they halted all withdrawals and threatened clients when they tried to withdraw their currency.

KuCoin — The exchange lost $150m to a hack, in response Kucoin suspended all deposits and withdrawals and ignored anxious customers questions.

Bitfinex — Is owned by the same holding company that owns the stable coin Tether. A scathing report from the New York’s District Attorney revealed a total disregard for both transparency and client funds.

BitMEX — The derivative exchange was hit by a complaint from the US authorities after lax know your client procedures and other lapses. The two co-founders are currently on the lamb.

Buying small micro cap cryptocurrencies

Many of the small or micro cap cryptocurrencies are only available for purchase on some of the smaller unregulated exchanges.

Here are a few exchanges that list a disproportionate number of smaller cryptos:

Only a third of this list restricts US investors from using their site and as you can see all of them are based in some very questionable jurisdictions. However if you are looking to buy a cryptocurrency through one of these exchanges and then transfer it to your own wallet your risk is far lower than holding your tokens with the exchange (subject to you not losing your private key of course).

It has to be said that the customer service and the ease of use at most of these sites are significantly worse than the likes of Gemini. We have to accept however that the world of small cap cryptos is high risk. As long as we have only allocated a small percentage of our crypto portfolio to small caps and we have diversified both the number of coins we have invested in and the exchanges we buy/hold through then you can minimize your risk substantially.

Before moving on from this subject it is worth touching on decentralized exchanges, which is our next topic of conversation. Many small and micro cap stocks are listed on Uniswap. It will be useful to familiarize yourself with this platform if you are interested in participating in the hunt for moonshots.

VIEW OUR MICRO CAP WATCH LIST FOR INVESTMENT IDEAS ON SMALLER CRYPTOCURRENCIES WITH POTENTIAL

Decentralized Exchanges

What is a decentralized exchange?

In the words of Gemini, ‘A decentralized exchange (DEX) is a peer-to-peer (P2P) marketplace that connects cryptocurrency buyers and sellers. In contrast to centralized exchanges (CEXs), decentralized platforms are non-custodial, meaning a user remains in control of their private keys when transacting on a DEX platform. In the absence of a central authority, DEXs employ smart contracts that self-execute under set conditions and record each transaction to the blockchain. These trustless, secure transactions represent an accelerating segment of the digital asset market, and are pioneering new financial products.’

Decentralized exchanges have seen a massive increase in volume over the last year, although they are some way from usurping the centralized exchanges. Many of the smaller cryptos are traded on decentralized exchanges. In order to participate you have to be tech savvy and somewhat patient. Your own wallet is the starting point which currently rules out the mainstream investor. But that will change with time as DEXs become easier to understand and navigate. Currently most of the complaints are about poor liquidity and heavy fees. However DEXs are the future. We would suggest that anyone interested in crypto give them a go.

There is one caveat as regards DEXs, they aren’t regulated and there is no requirement for identification. This could be something US authorities come down hard on at some point but again your risk mitigation steps should avoid any major losses.

Top Six DEXs

Conclusion

Unlike the highly regulated world of stocks the cryptocurrency market is the wild west in comparison. However, there are some exchanges that are trying to do things properly, Coinbase, Bittrex and Gemini for instance. Transparency, poor customer service and lack of regulation seem to be the biggest problem. Take insurance for example, with the exception of Bittrex, other exchanges claim to cover losses but on closer inspection there is usually some unpleasant catch, that is the case with Coinbase. Customer service in the entire industry is appalling. There are thousands of complaints of anxious customers not hearing back after weeks, it is taking Coinbase over 3 weeks to set up a new account. This is an area that must improve. However investors can vote with their wallets. If they are looking for good customer service and regulation then they can choose exchanges like Gemini, if they are looking to buy Bitcoin and simply hold it they have PayPal and Square and if the professional investor has taken the appropriate steps to mitigate his or her risk they have over 500 exchanges to choose from.

REMEMBER IF YOU HAVE ANY CRYPTOCURRENCY RELATED QUESTION USE OUR FREE Q&A SERVICE HERE

Not Financial Advice

This article does not constitute financial advice in any way. Always do your own research and never invest more than you can afford to lose. The article should be treated as supplementary information to add to your existing knowledge.

Recent Comments