Report: Crypto Moonshots on Cosmos

Our search for undervalued and undiscovered cryptocurrencies continues…

In the last few weeks we have been systematically exploring various areas of the cryptocurrency ecosystem to find those rare gems. In this search we have examined many of the newly listed cryptocurrencies, the hundreds of projects on Binance Smart Chain and the projects within the Polkadot ecosystem. Probably the poorest crop were from the newly listed cryptocurrencies, many of which had no real world uses and were priced at absurd valuations. Greed has definitely set into the majority of the new projects coming to market with developers more concerned with making a few bucks than ensuring investors get a good deal.

This assessment may sound an over generalization however all it takes is a quick glance at the tokenomics of a sample of listings to verify our point. Investors are being asked to pay a price that already assumes that the project has succeeded. Of course most projects will fail, that is the hard reality of startups, crypto projects are no different. To value a project at $50 million when all it has is a website, a few thousand followers and a vision means that if a project does succeed the winners will be the founders with the investors receiving only the scraps.

Considering the investor is financing the developer’s dreams, valuations should be structured to reflect that. That is why one of the best sources of moonshots are older projects that have already demonstrated that they have a viable project. This is the best way to de-risk your investment.

You can read the reports we wrote on moonshots on Binance Smart Chain and Polkadot here.

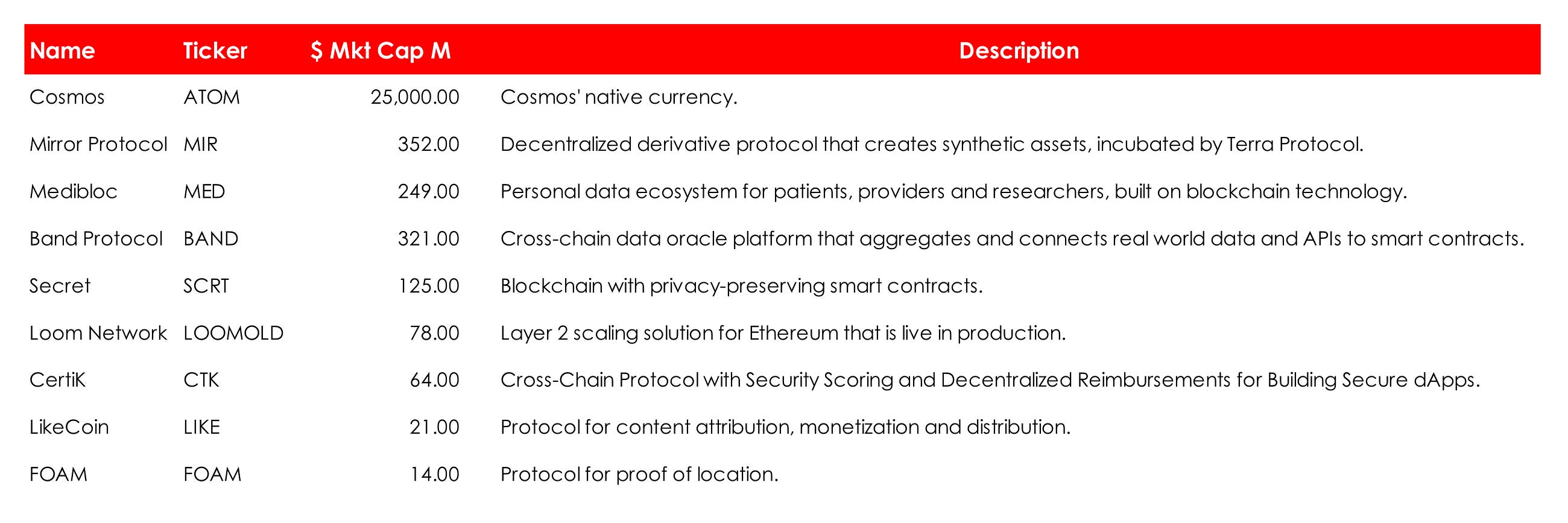

So with all that said we have decided to run our slide rule over projects in the Cosmos ecosystem.

A little about Cosmos

Cosmos is an ecosystem of parallel blockchains that are able to both scale and interoperate together. Cosmos based blockchains now incorporate the recently launched Inter-Blockchain Communication (IBC) protocol. This is an industry standard that enables inter-blockchain communication.

Cosmos is based on what are called Tendermint blockchains. These are considered to be some of the most secure and scalable in cryptocurrency with the ability to be able to handle up to 10,000 transactions per second. Tendermint makes it possible to create customizable, secure, and scalable blockchains from the ground up in weeks instead of years.

There are over 30 Tendermint based cryptocurrency blockchains.This interoperability is possible thanks to Cosmos’s Inter-Blockchain Communication protocol or IBC, which went live at the end of March this year.

The recent release of the IBC is believed to be one of the most significant milestones for the cryptocurrency space. According to Tendermint’s CEO Peng Zhong, any proof of stake cryptocurrency blockchain can theoretically connect to the IBC. The IBC already supports all substrate-based blockchains, which include the likes of Polkadot (DOT) and Kusama (KSM).

And it isn’t all theoretical. THORCchain the multi billion dollar project released its THORSwap DEX the first-ever multi-chain decentralized exchange. It’s now possible to trade Bitcoin, Ethereum, Litecoin (LTC), Bitcoin Cash (BCH), SUSHI, BTCB, and BNB without a centralized exchange

View our Monthly Moonshot Portfolio here. Twenty researched and rated cryptocurrencies that are both undervalued and undiscovered.

Is Cosmos a moonshot?

Cosmos’ native currency is ATOM. ATOM’s market value is around $3.5 billion which compares to Polkadot’s $25 billion. Although the value of projects within Polkadot’s ecosystem are double that of Cosmos it is valued at nearly 7 times more than Cosmos. That would suggest that maybe ATOM should be one of our moonshots. However all is not what it appears…

Firstly ATOM has an annual inflation rate of anywhere between 7 and 20% although about 65% of ATOM’s supply is currently being staked. In addition, the ATOM token isn’t a crucial part of its ecosystem as ETH is with Ethereum or DOT with Polkadot. You don’t need to purchase the ATOM token to create a Tendermint blockchain, nor are you required to connect that blockchain into the Cosmos Hub. Until now, ATOM’s only utility was for staking on the Cosmos blockchain which powers the Cosmos hub and governs the Cosmos Network.

However there are plans afoot to change this by introducing features where ATOM is integral. Gravity DEX is just one of many upcoming features that the Tendermint team hopes will add value to Cosmos and increase utility and demand for ATOM.

So whilst we think Cosmos is one of the blockchains that is likely to be still around in a few years time we believe there is not too much upside to its token. Although saying that, a $3.5 billion valuation does look relatively inexpensive especially when you recognize that the ATH was $31.70 compared to the current price of $14.70. However we are not here to discuss Cosmos as an investment, there are better opportunities available.

Listen to our weekly podcast Moonshot Monday where we discuss three new cryptocurrencies that we believe offer significant upside potential.

Some common themes

There were two common themes we noticed when looking at the 50 odd projects in the Cosmos ecosystem. The first was that many of the projects we reviewed had only a small proportion of their total supply of tokens in circulation. Let’s look at Mirror Protocol as an example to demonstrate our point. Mirror has a current token supply of 68 million with a maximum supply of 370 million. Whilst on the face of it a valuation of $350 million may sound reasonable, when you look at its fully diluted valuation of $1.9 billion you may conclude there is better value elsewhere.

The second theme was that many projects had lofty ambitions but had made little progress in their path towards the stars. Now we are not by any means saying that ambition is not good, without ambition and good execution there is no progress, but the higher the ambition the more risky the investment opportunity. FOAM is an excellent case in point. Their business model requires them to sign up billions of nodes around the globe to provide a more reliable alternative to GPS.

On the face of it the project has merit. But you have to ask yourself; what are the chances of a small team working out of a Brooklyn naval yard achieving this ambitious goal? Highly unlikely would be our answer. This should act as a warning to conduct our own reasonableness test. How reasonable is it that project XYZ is likely to achieve its goal? How are they going to fund their lofty targets and do they have the experience and credible backers to execute their plan?

Join our Telegram Channel here and engage in the discussion on various investment ideas. It has been described as ‘…an oasis in the shilling noise that is every other forum’.

Projects worth a closer look

Before we get to the moonshots we have included a list of projects that are worth closer consideration. We did include FOAM on this list as we are not ruling out the reality of their ambitions completely. Many of these projects could be described as exciting and whilst FOAM may be high risk now if they show significant signs of progress it could be one for later.

Loom Network (LOOMOLD)

Overview

Described at the Next-Generation Blockchain Application Platform for Ethereum.

Loom Network’s sidechains allow for scalable blockchain games and DApps with the security of the Ethereum mainnet.

Loom Network has been live in production since March 2018 and continues to be one of the most cutting edge, multi chain scaling solutions.

Today most of the popular DeFi protocols run either on Ethereum or Binance Smart Chain, but they each have to bootstrap their own liquidity pools that are siloed on each chain. Loom makes it simpler to spin up new dedicated Loom chains for DeFi protocols allowing developers to build a new generation of DeFi protocols that utilize liquidity pools funded by assets across multiple chains, in a manner similar to THORChain.

Our Opinion

Price: $0.09

Fully Diluted Market Cap: $93 million

Risk Score:9

Target Price:$0.50

Loom is without doubt one of those projects with lofty ambitions. However we believe there is a mismatch between the fully diluted market cap of $93 million and the huge potential of the project. A valuation of $500 million would be a more accurate valuation based on its potential still leaving plenty of upside if the team succeeds in their goals. We have set a target price of $0.50 which is substantially below its ATH of $0.77. However whilst we believe the upside is substantial the risk is also high. There have been rumors that the project had died however these proved unfounded after recently completing another funding round. It is a reality though that Polygon, a similar platform, has left Loom standing. However if Loom achieves only a fraction of Polygon’s success that would make it an attractive investment — there is a reason why we call these moonshots after all!

We publish the Micro Cap Watch List every Friday. This is a list of small to micro cap cryptocurrencies which we believe are undervalued. It is a great source of investment ideas. View our latest list here.

LikeCoin (LIKE)

Overview

LikeCoin is a protocol for content attribution, monetization and distribution. LikeCoin chain is a Bonded Proof of Stake blockchain developed on top of Cosmos. As a permissionless protocol, 800+ media chose to adopt LikeCoin with her WordPress plugin. LikeCoin also provides an easy-to-use mobile app, Liker Land, for laymen to read content, reward creators, transfer LikeCoin and delegate to validators.

At its core, LikeCoin works as a repository for immutable digital content metadata recording that data and guaranteeing its integrity using LikeCoin’s digital registry protocol, the International Standard Content Number (ISCN). The ISCN functions like an International Standard Book Number (ISBN) for digital content; this unique, immutable content identifier contains metadata including author, title, language, publisher, and place/time of publication.

The ecosystem also offers a valuable means for rewarding the creators and curators who produce and share registry content. LikeCoin algorithmically quantifies the value and impact of ISCN-registered content shared and consumed within the ecosystem, and rewards its creators with LikeCoin tokens. Creators receive LikeCoin every time their content is liked or shared, and LikeCoin users (known as “Likers”) can additionally “tip” both creators and curators via the ecosystem’s “Super Like” feature. All this can be accessed in a variety of ways — either directly through the free Liker Land app and its related browser extension, or indirectly through a click of the LikeCoin button available for common blogging platforms.

Our Opinion

Price:$0.02

Fully Diluted Market Cap: $41 million

Risk Score:6

Target Price:$0.1

LikeCoin is the kind of project we like. A reasonable valuation, a viable product which is gaining traction and a clear use case for its native currency. So let’s look at the numbers. According to LikeCoin they have:

- 300K pieces of content on LikeCoin

- 80K Likers using the LikeCoin platform

- 11K creators sharing content on LikeCoin

LikeCoin hasn’t by any means gone mainstream but it is building a loyal community of users in a space it pretty much has to itself. With a market cap of $41 million we believe this undervalues LikeCoin’s potential. We have set a price target of $0.1 which translates to a market value of $200 million, not an unreasonable valuation for a project already performing. The risk is less than projects like Loom and Foam because it has a working platform that is generating traffic in increasing numbers.

Listen to our series of podcasts Inside Track. These are valuable resources allowing listeners to gain a better understanding of various sectors of cryptocurrency from NFTs to DeFi presented by experts hands-on in the market.

CertiK (CTK)

Overview

CettiK is a pioneering blockchain security firm that uses a cross-chain protocol with security scoring and decentralized reimbursements for building secure dApps.

Blockchain projects can receive security insights from its Security Oracle, which provides real-time guards of on-chain transactions and identifying and flagging a wide range of malicious vulnerabilities before they occur.

Depending on the level of the security score, audited blockchain projects of any protocol may be eligible for a CertiKShield membership, which is a flexible, decentralized reimbursement system for any crypto asset that is irretrievably lost or stolen due to security issues. CertiKShield memberships are open to all community members of these eligible blockchain projects, providing a safety net to holders of crypto assets in case anything unexpected happens.

Our Opinion

Price: $1.43

Fully Diluted Market Cap: $141 million

Risk Score: 6

Target Price:$5.00

CertiK has been at the forefront of crypto investor interest recently after auditing the memecoin SafeMoon. CertiK and Quantstamp are the two leaders in this field, although Quantstamp focuses more on non DeFi projects. With the exponential growth of DeFi on BSC and DeFi in general there is going to be a continued demand for projects to be audited and as importantly, insurance cover.

We analyzed the crypto insurance space in a previous report highlighting its massive potential and the key players. CertiK wasn’t part of that analysis but it should have been. CertiK is in a prime position to build a significant share of this market competing directly with the likes of Nexus Mutual which has a $740 million market cap.

The main risk is the unregulated nature of DeFi and the possibility governments will start coming down hard on projects which claim to be decentralized but still have an element of central control. On that basis we have scored Certik a 6 for risk. The beauty of CertiK is how its native currency is critical to its platform. That is a major tick in the box for the investor. With a fully diluted market value of $141 million we believe this substantially undervalues its dominance in their market and its potential to grow in the insurance space. We have set a price target of $5.00 which compares to an ATH of $3.94

Check out the report we wrote about the crypto insurance space: What is the next big thing in crypto?

Not Financial Advice

This article does not constitute financial advice or a recommendation to buy in any way. Always do your own research and never invest more than you can afford to lose. Investing in cryptocurrencies is high risk, and you could lose 100% of your investment. The article should be treated as supplementary information to add to your existing knowledge.

Recent Comments