Report: Is there money to be made in the metaverse?

Exploring the metaverse, buying virtual land and identifying crypto moonshots

Mark Twain once said ‘Buy land, they’re not making it anymore’. Those words of wisdom have stood the test of time until the metaverse came along.

When Facebook announced they were changing their name to Meta it shone a light on a space which the mainstream hadn’t fully appreciated.

However as usual the crypto community was way ahead of the curve. Blockchain entrepreneurs have been busily developing metaverse applications for a few years now, Facebook just gave it mainstream recognition. Before that announcement the average person hadn’t even heard of the metaverse and if they had they didn’t have a clue what it meant.

Here is a brief definition for those in the metaverse beginner camp:

A shared, realistic, and immersive computer simulation of the real world or other possible worlds, in which people participate as digital avatars.

Investors have been piling into cryptocurrencies with even a faint connection to the metaverse well before the Facebook announcement. A recent report by the crypto fund manager Grayscale estimated the potential value of the market at $1 trillion. However mainstream adoption is probably some five to ten years away. Microsoft and Apple are other big players who have recognized the potential with Apple looking to enter the augmented reality market with the imminent launch of a range of smart glasses.

This article aims to look at some of the main operators in the crypto metaverse space and identify where investors should be investing their money to take advantage of this massive potential market.

The significance of the metaverse

The first question we have to ask ourselves before getting involved in financial matters is, why is the metaverse so significant?

Currently most applications in the metaverse relate to games. These include play-to-earn games which have proved popular in the crypto world such as Axie Infinity and The Sandbox. There is also the likes of Roblox, Fortnite and Minecraft which you can play within their own metaverses. Facebook intends to build yet another metaverse or as some have called it ‘a walled metaverse’. However the metaverse is much more than just games.

Imagine putting on your VR glasses and doing your shopping in your favorite store whilst sitting on your sofa. Imagine going to a Vegas casino and standing at a virtual roulette table and soaking up the atmosphere surrounded by other excitable players and no doubt a few dancing girls. Imagine having a drink with friends in a virtual pub.

That is why the metaverse is in fact bigger than a trillion dollar market.

However all this potential presents a problem for the investor…

Join us on Telegram here for lively debate and quality investment ideas. With an absence of shilling and spam this is the Telegram channel of choice for many crypto enthusiasts.

Top five metaverse crypto projects

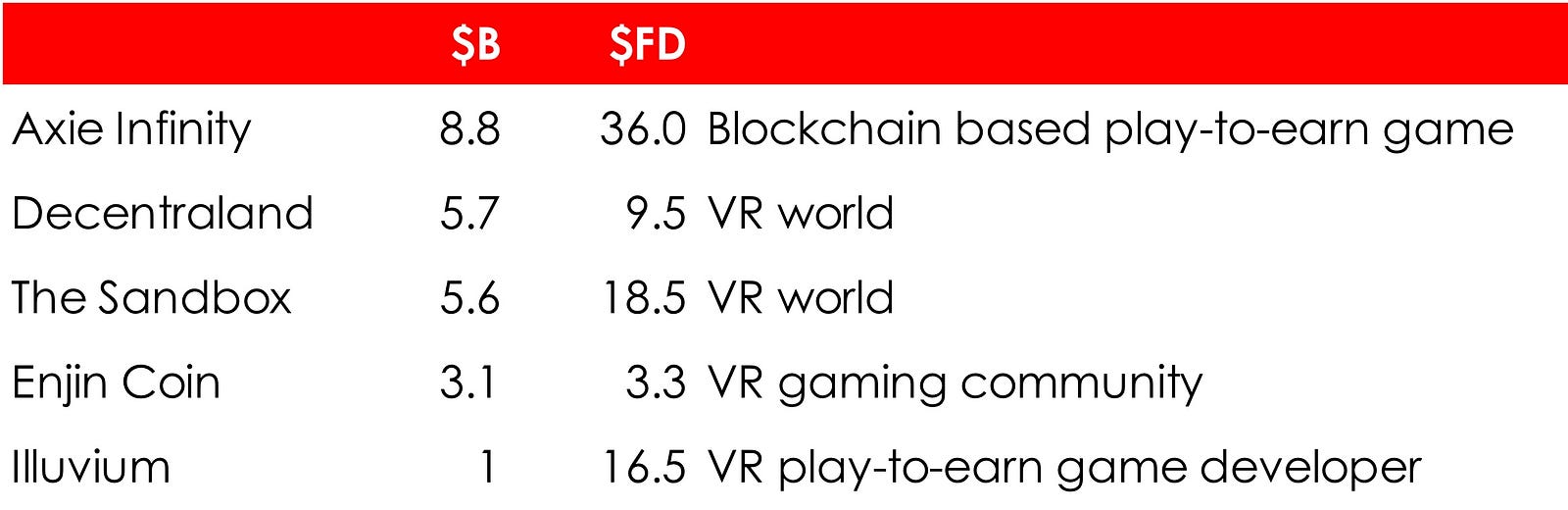

Before we examine this ‘problem’ let’s first look at the top 5 cryptos in the metaverse:

It doesn’t take a crypto analyst like our very own Moonshot to quickly work out that much of the future potential of the metaverse has already been factored into the valuations of most crypto projects in the space. Take for example Axie Infinity, a fully diluted market cap of $36 billion assumes that Axie will command 3.6% of the total future $1 trillion market. That appears totally unrealistic to a sober observer.

There is no arguing this sector is going to explode. The question is, where should you invest your money where you will enjoy at least some of the coming upside as opposed to buying into projects where most of the upside has already gone?

Selection #1

From the top 5 list we like the look of Decentraland. Let’s be real, Decentraland is no moonshot. With a fully diluted market cap of $9.5 billion it is far from undervalued however what we like about Decentraland is it is more than just games. They are looking to build a virtual world that encompasses some of the things we talked about earlier, fashion, entertainment, in fact anything you would find in the real world.

Decentraland is a lightbulb moment for anyone interested in investigating the investment potential of the metaverse.

Decentraland has two investment plays. The first is investing in its cryptocurrency. The second is buying land. We have already looked briefly at the valuation of Decentraland’s token. Now let’s look at its virtual land.

Virtual land is like real estate. It is in finite supply with location playing an important factor in its value. Canny investors are buying up virtual land plots within Decentraland’s metaverse with the expectation of either developing it, renting it or flipping it. In the last 7 days alone there was $100 million in land transactions nearly 20% of which related to Decentraland ($80 Million related to The Sandbox).

However the average investor has been priced out of this market already with land changing hands recently at an average of $22,000 per 33ft x 33ft plot (an investor paid $2.43 million for 116 plots).

If we had money to burn we would consider purchasing our own plot of land on Decenraland and buying a few tokens in its native token MANA when the price shows signs of weakness.

Selection #2

The next question is, what projects outside the top five represent good value?

A good place to start your search for undervalued metaverse crypto projects is CoinGecko.

A project that grabbed our attention was Somnium Space CUBE’s (CUBE).

With a market cap of $238 million and a fully diluted value of $1.9 billion it is not cheap by any means!

Launched in 2018 by a team based in the UK, Somnium Space has built a VR world with a blockchain based economy. Selling NFTs and ERC20 in game currency and providing immersive VR experiences from entertainment to education. This is their blurb not ours.

What they fail to mention is that they are also selling ‘parcels’ of landin their virtual world. Compared to Decentraland’s land plots these are far more affordable for the average investor and are worth a closer look.

Again as a moonshot Sominum fails to make the grade however as a bet on the metaverse sector as a whole it is a decent pick. Similar to Decentraland, investors should look for price weakness before buying.

It has been described as one of the most invaluable resources in the world of altcoin investing. We couldn’t agree more. Download your free Micro Cap Watch List from our website here and receive it in your inbox every Friday.

Now the moonshot

Regular followers of CryptoQuestion will be familiar with our third selection. Rentible (RNB).

Rentible is a solution bringing decentralized Proptech to the masses enabling tenants and landlords to conveniently send and receive rental payments in various cryptocurrencies.

Rentible has sought to position itself as a first-mover in this niche. Its platform is in development and is expected to be deployed in beta form in December this year.

As a platform targeted at landlords and tenants this is an attractive proposition as crypto moves into the mainstream and landlords look at offering alternative forms of payment and of course additional ways of earning money. By offering a complete package Rentible could gain traction and become a go to solution for landlords. This alone is a massive market. However it is the recent news that Rentible is entering the metaverse gold rush which powered Rentible into our metaverse selections. Rentible announced that it will be the first digital marketplace for leasing virtual properties across the metaverse.

Rentible’s fully diluted token valuation of only $9 million doesn’t take into account its new position in the metaverse.

It won’t be long before owners of virtual land will be renting it as a way of generating an income. This has the potential to be a massive market in the not too distant future with investors in land already looking for ways to generate income. Rentible has a real possibility of taking a big chunk of this infant market.

It is rare to come across reasonably priced projects with real use cases that have also identified a realistic way of making money from the metaverse. Rentible is a true gem.

Conclusion

The metaverse is an area crypto investors should investigate. It is set to be an integral part of our future. However it has to be said, the vast majority of metaverse projects are what we call priced to perfection. Investors should look for price weaknesses to buy into their favorite projects and keep their eyes open for that killer project which decides to tread its own path to success. Rentible could be one such project, however there will be others. Patience is important when the crowd is in a frenzy. The metaverse crypto market is likely to undergo a major correction at some point, the question you have to ask yourself is, do you get into some of the larger projects now or wait?

A few words of warning to end with. Avoid rushing out to buy the next shiny metaverse cryptocurrency. 99.9% of new projects coming to market will fail. Also remember, buying virtual land comes with risk. Like buying land in the real world, if you purchase a plot within a metaverse where there are few visitors your land will have as much value as buying land in the middle of the Sahara.

Photo created by freepik — www.freepik.com

Join our Telegram channel here.

No Financial Advice

This report does not constitute financial advice or a recommendation to buy in any way. Always do your own research and never invest more than you can afford to lose. Investing in cryptocurrencies is a high risk, and you could lose 100% of your investment.

Recent Comments