Report: The complete guide for US crypto investors

Options available for investing in small and micro cap cryptocurrencies

US law enforcement is a foreign crypto firm’s worst nightmare and if it isn’t, it should be. The multiple agencies that oversee crypto regulation will come down hard on anyone targeting US investors if they are infringing the law in any way. It doesn’t matter if that company is in the US or in some far flung backwater of Africa. The long arm of US justice is all pervading.

That opening paragraph would or at least should send shivers down the spine of that crypto entrepreneur drinking his cappuccino in Lagos, Nigeria who thought it was fair game to target US investors to invest in his new NFT based memecoin. This article however isn’t about our friend in Nigeria. But it is relevant, loosely.

This relentless law enforcement and the US’s willingness to go anywhere to enforce its laws has made most sensible overseas crypto exchanges and projects very wary about allowing US investors to participate on their platforms. And that unwillingness has significantly reduced the options available to US investors when he or she wishes to invest through certain exchanges or buy certain tokens.

Let’s look at a quick example before we get stuck into the meat of the subject. FTX, one of the leading cryptocurrency exchanges, is unregulated, based in Hong Kong and does not allow US customers to use its services. It offers a market in over 270 cryptocurrencies however this wide selection is no use to US investors. If they wish to buy through FTX they will have to use FTX’s US arm. The problem here is the selection of tokens is much smaller, with only 20 cryptocurrencies offered on their US platform.

The bottom line is US investors who wish to invest in cryptocurrencies outside the top 100 by market cap are out of luck unless they wish to skirt the law.

Most common question from US investors

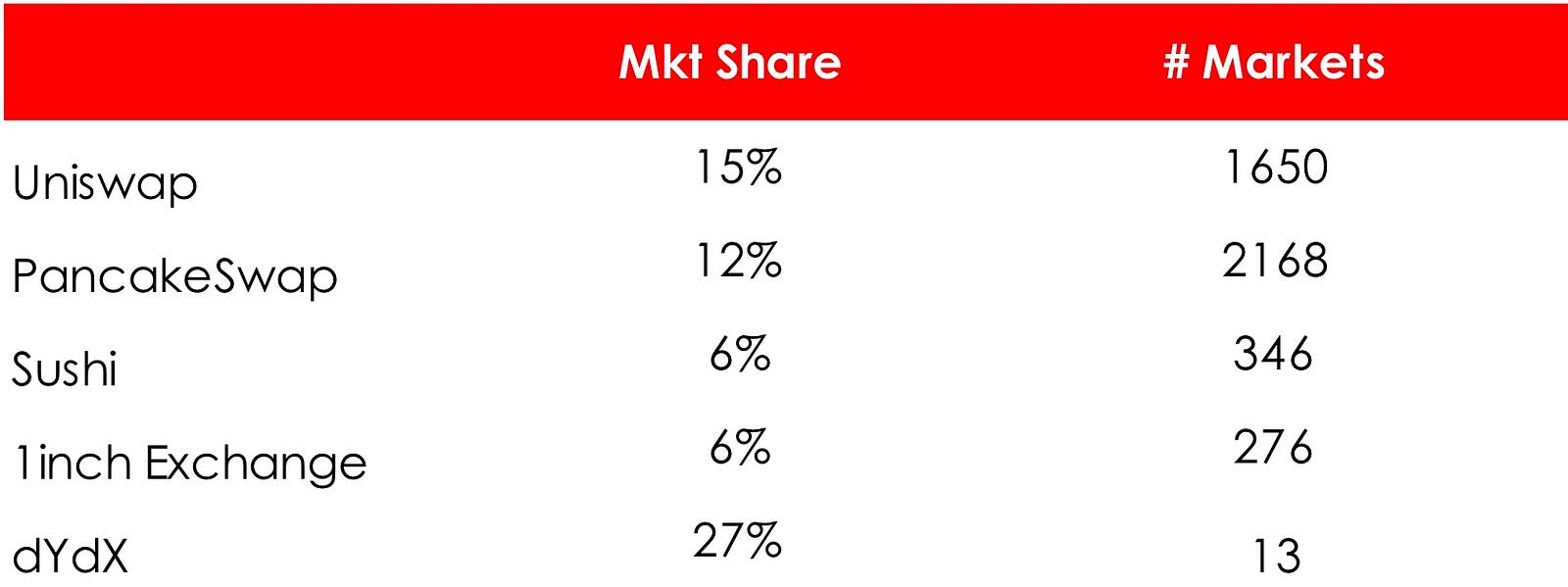

One of the most common questions we hear from US investors is, I am American, how can I buy this token? The US investor who wishes to gain access to the wild wild west of small and micro cap cryptocurrencies is at a disadvantage to his foreign counterpart. Many centralized exchanges that offer a market in smaller crypto projects do not allow access to US investors. The only option is for them to dip their toe into the daunting waters of the decentralized exchange with names such as Uniswap, Pancakeswap, 1Inch and Sushi.

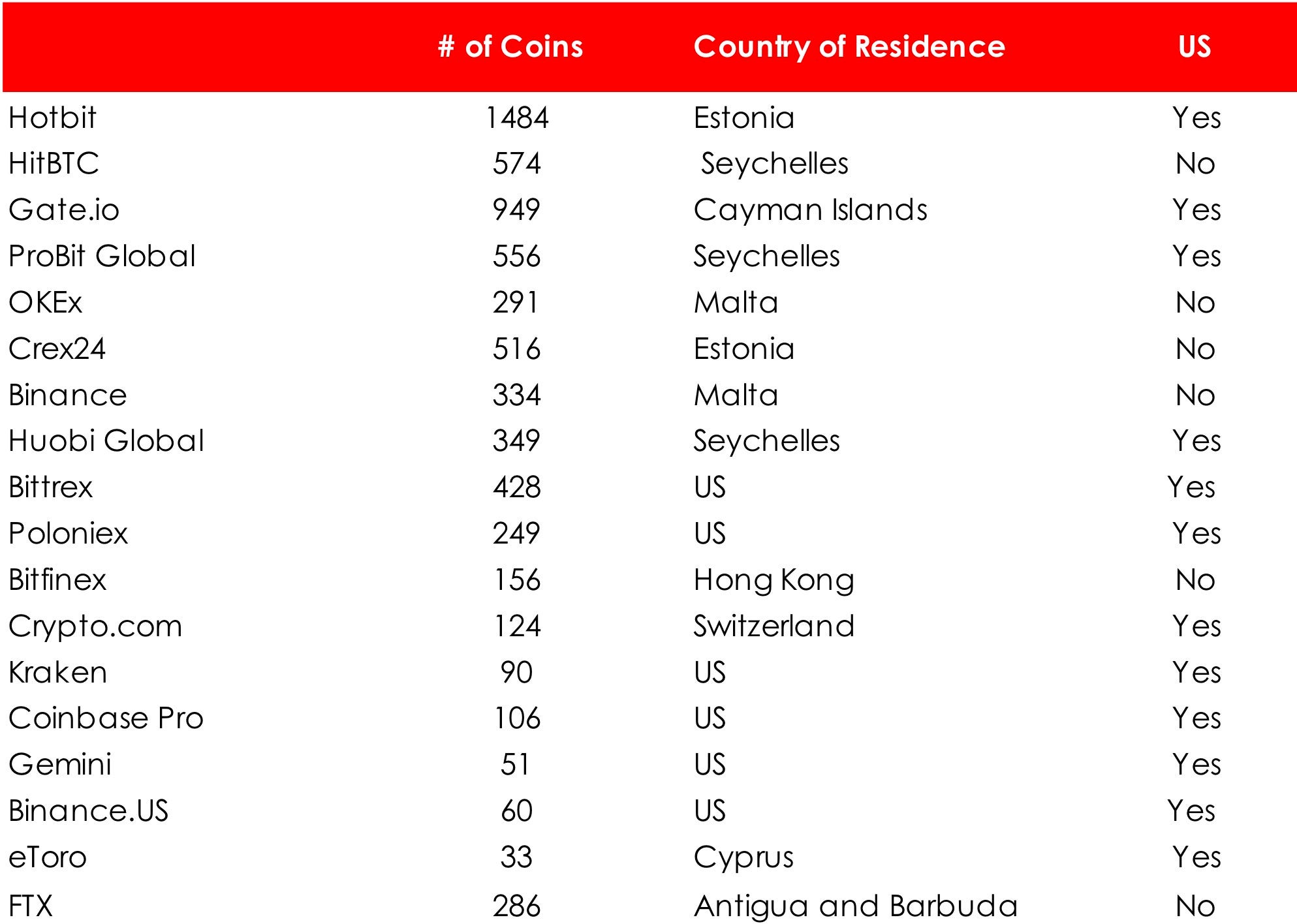

It is the case that the more regulated the exchange the smaller their selection of cryptocurrencies. That is particularly the situation with US based crypto exchanges. Here is a list of exchanges ranked by the number of cryptocurrencies along with whether exchanges permit US citizens to trade with them.

Regulation

Regulation is a complicated area in the cryptocurrency space. In the US there is no general consensus on any one authority regulating crypto exchanges. Regulation for crypto varies by state although there are no formal rules to govern exchanges. Several federal regulators claim jurisdiction over them, including the Securities Exchange Commission, the Commodity Futures Trading Commission and the Financial Crimes Enforcement Network.

Usually any firm that helps transfer funds (even virtually) requires a money transmitters licence. Basically that means that crypto exchanges targeting US citizens must have a transmitters licence as a bare minimum. In certain states such as New York they also require separate registration. Therefore exchanges targeting US citizens without the appropriate authorizations are treading on treacherous ground. As far as investors investing through such exchanges they risk losing everything if these exchanges are shut down by regulators.

Let’s take Binance as an example. Initially it took a gun hoe approach and targeted the US without any regulation. Realizing it was taking a giant risk it set up Binance.US and only offered mainstream coins to US customers. Compare the number of coins it offers under its US operation to its Binance.com operation — 60 compared to 334. US citizens are restricted from buying through Binance.com.

There are still many exchanges that are either based and or regulated in jurisdictions that target overseas countries. In basic terms any US investor buying cryptocurrencies through an exchange regulated and or domiciled in Malta, Estonia, Cyprus and Seychelles for example are running a big risk that the US or even another country such as the UK will aim to shut that exchange down if they feel their citizens are being targeted and in the case of the UK and other countries they are breaking securities laws. There is a reason why exchanges are set up in countries with minimal regulation, but that doesn’t protect them from the long arm of the US.

As a general rule investors should only invest through exchanges that are regulated in their country of residence.

However American citizens have limited choice if they follow this general rule.

Why bother?

We all dream about finding the next big thing. Crypto investors are investing for the same reason. While the mainstream crypto investor is under the impression that he or she is investing in the next big thing by accumulating a few dollars worth of Bitcoin and Ether, the more adventurous amongst us realize that the true potential of amazing 100 times returns sits outside the mainstream. These are the investors looking for the next Bitcoin or Solana. This is why US investors feel like they are missing out by being restricted to investing in only the largest cryptocurrencies. And that is why there is always a work around…

Options available

Obviously there are ways of buying into a small cap cryptocurrency. Where there is a will there’s a way, the old saying goes. But be aware, with the will comes added risk. Let us check out what options you have.

Small centralized exchanges

Many of the small or micro cap cryptocurrencies are only available for purchase on smaller overseas unregulated exchanges.

Here are a few exchanges that list a disproportionate number of smaller cryptos:

Only a third of this list restricts US investors from using their site and as you can see all of them are based in some very questionable jurisdictions. However if you are looking to buy a cryptocurrency through one of these exchanges and then transfer to your own wallet your risk is far lower than holding your tokens with the exchange (subject to you not losing your private key of course).

It has to be said that the customer service and the ease of use on most of these platforms are significantly worse than the likes of Gemini and Bittrex (the customer service at Coinbase and Binance is abysmal but at least you know you will get a satisfactory response eventually).

We have to accept however that the world of small cap cryptos is high risk. As long as we have only allocated a small percentage of our crypto portfolio to small caps and we have diversified both the number of coins we have invested in and the exchanges we buy/hold through then you can minimize your risk substantially.

Decentralized Exchanges (DEXs)

What is a decentralized exchange?

A decentralized exchange (DEX) is a peer-to-peer (P2P) marketplace that connects cryptocurrency buyers and sellers. In contrast to centralized exchanges (CEXs), decentralized platforms are non-custodial, meaning a user remains in control of their private keys when transacting on a DEX platform. In the absence of a central authority, DEXs employ smart contracts that self-execute under set conditions and record each transaction to the blockchain.

Decentralized exchanges have seen a massive increase in volume over the last year. Many of the smaller cryptos are traded on decentralized exchanges. In order to participate you have to be tech savvy and somewhat patient. Your own wallet is the starting point which currently rules out the mainstream investor. But that will change with time as DEXs become easier to understand and navigate. Currently most of the complaints are about poor liquidity and heavy fees particularly with Ethereum based cryptocurrencies. However DEXs are the future. We would suggest that anyone interested in crypto give them a go.

There is one caveat, they aren’t regulated and there is no requirement for identification. This could be something US authorities come down hard on at some point, probably soon.

Top Six DEXs

Other — VPNs

It was estimated recently that a large proportion of US crypto investors avoid the fire walls built by overseas exchanges and invest anyway regulation be damned. That is a problem. It makes the exchange ultimately liable even though they have tried their level best to comply with regulation. However, employing a VPN so that the hosting platform thinks you are from any country outside the US is one solution. It does leave a bad taste in the mouth.

Conclusion

A US investor who wishes to gain some exposure to the cryptocurrency market by buying a portfolio of large market cap cryptocurrencies currently has limited restrictions. All the US based regulated exchanges offer a good selection of such coins.

Our only words of wisdom here is to buy your coins through onshore regulated exchanges.

However an investor who wishes to invest a small amount of his risk capital in an attempt to find the next Bitcoin or Ethereum will be looking to venture into the world of small and micro cap cryptocurrencies. The problem here is that the ground is treacherous. Investors are probably best mastering DEXs and buying through off market transactions as long as they are extra vigilant and are aware that scammers lurk in abundance in this market. But for the intrepid investor there are attractive rewards to be found and of course money to be lost.

Follow us on Twitter @cryptoimpartialand Instagram @cryptoimpartialand register for our newsletter here www.cryptoquestion.tech

Join our Telegram channel here.

No Financial Advice

This report does not constitute financial advice or a recommendation to buy in any way. Always do your own research and never invest more than you can afford to lose. Investing in cryptocurrencies is a high risk, and you could lose 100% of your investment.

Recent Comments