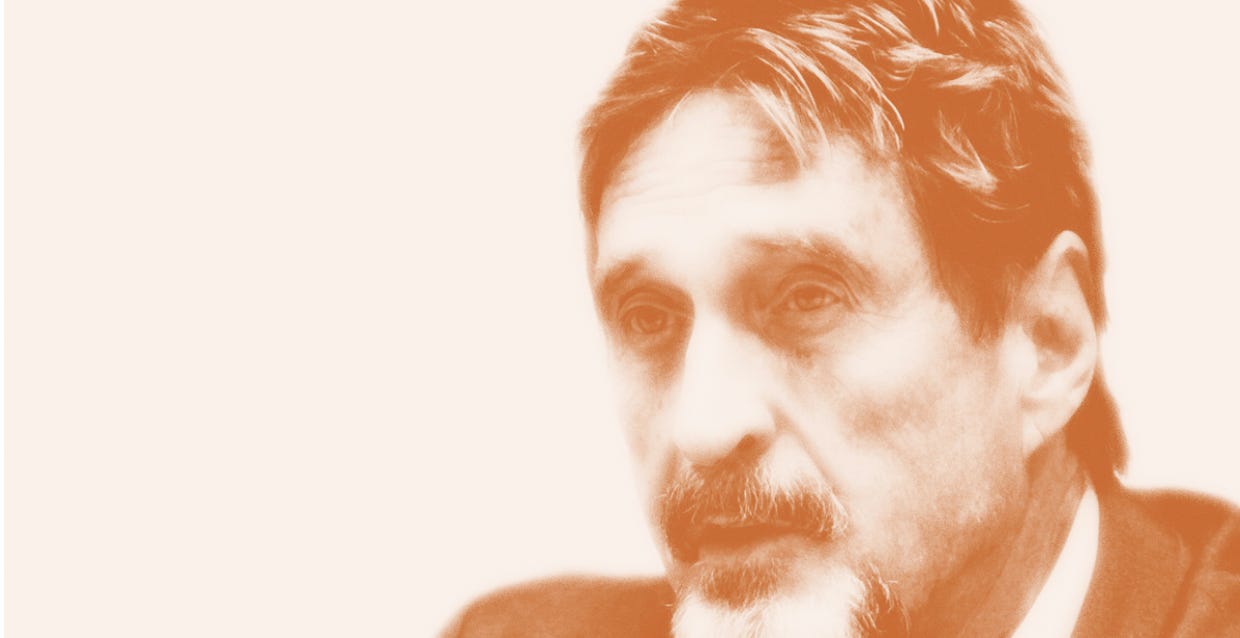

Report: Two valuable lessons the crypto industry can learn from McAfee’s demise

McAfee wasn’t the only one shilling cryptocurrencies and he won’t be the last

He has been described as a crypto expert, a bandit, an outlaw, a maverick and a master shiller. And those are only the tip of the iceberg.

In this article we are going to focus on two of his qualities, his crypto expertise and his prowess in the business of shilling, or in common lingo pump and dump.

Whilst it was tempting to write an article about some of his colorful exploits this has been done brilliantly already. I don’t need to tell you what a full life he led. Having dug deeply into McAfee’s shenanigans, what struck me was that we can learn a very valuable lesson from his most recent activities, that of a crypto promoter.

Pump and Dump

Between December 2017 and October 2018 McAfee started buying cryptocurrencies and promoting them through his Twitter account where he was followed by over 700,000 ‘fans’.

The first crypto he selected to give the McAfee treatment to was Verge. In fact, Verge is now a leading privacy coin, so maybe it wasn’t such a bad pick after all. But the Government wasn’t worried about the quality of his picks. They were pissed that he endorsed cryptocurrencies after acquiring a significant wedge of tokens for himself failing to disclose that fact. His promotions were also peppered with false and misleading statements, another no no. He went a stage further, which really put the icing on the cake. He lied to investors when asked outright on his Twitter feed and other media channels. ‘No I don’t own any, I don’t need the fucking money,’ he ranted.

Verge was his first toe in the crypto water. And it was a profitable one. He made a 400% return on investment in four days giving him a taste for more. He went on to shill another 11 cryptocurrencies in this way. Including a few popular ones such as Dogecoin, Stellar and Tron. According to the Government he made $2 million from his pump and dump activities.

The Government points out that investors lost money on these endorsements as they led to short term price spikes falling back down to earth in the ‘long term’.

ICO Touting

At some point when McAfee was happily shilling away a bright young crypto founder contacted him to see if he was interested in promoting his upcoming ICO. This is where McAfee proved his metal, earning his place in history as a master shiller. He set out a number of stipulations before we would agree to get involved.

Firstly he wanted 30% of all the money raised. Secondly he wanted to be paid daily to ensure he was always in control of the arrangement not the other way round. And thirdly he wanted a bonus paid in tokens.

That first ICO earned McAfee $6 million. His biggest earner from the 7 ICOs he promoted. The Government said he earned $11 million from these activities. Although McAfee claims in an email to his sidekick that he held $20 million in coins which needed to be liquidated. That was on top of the $11 million in cash he made from the two schemes. The total haul was somewhere in the region of $33 million, assuming he sold all those tokens.

The Government was pissed because he failed to disclose how much he was being paid for his ‘work’ and continued publishing false and misleading statements.

That little lot was probably enough to earn him up to 10 years in Federal prison with a plea deal. Possibly 5 to 6 with cooperation and good behavior. Far far more if he was mad enough to go to trial. But let’s come back to that shortly.

Lessons to be Learnt

So with all that said, what are the valuable lessons we can learn from McAfee’s crypto activities?

If I was McAfee I would have felt a little hard done by. It is a bit like the kid at school who gets caught smoking crack behind the bike shed. ‘Everyone else is doing it!’ He exclaims. McAfee was definitely not the only one doing it. He just happened to be one of the highest profile offenders and as a result was easy to target and take down.

And that brings us up to date. Shilling never died. In fact it has got markedly worse. The most high profile shiller has to be our South African friend Elon. Although he isn’t out for a quick buck like McAfee was. But putting aside Elon, shilling is rife. Shilling memecoins, yield farming and staking platforms you name it, it is being shilled somewhere.

Thousands of posts blatantly promoting some ultra shit coin are littering our forums and Telegram inboxes.

Some posts are less obvious, although they still have the rockets pointed to the moon. They come in the guise of a detailed opinion post on Reddit about how the user stumbled across this great coin and why he or she thinks it is ‘going to the moon’. There is no mention of their holdings in said token or their involvement.

The most blatant of all are the ‘pump’ groups. These are a scam. They rarely produce the results they promise and the people behind them do not disclose their holdings before the pump.

The Feds will no doubt get their teeth into the pump groups before too long. They are the most blatant exploiters of investors right now.

However there are two lessons which I am going to leave you with.

The first lesson is for the investor

Never trust any ‘expert’ or anonymous opinion piece posted on any forum. Everyone has an ulterior motive. Doing your own research is imperative. That involves checking out the tokenomics, the team, the number of users or funds locked and the fully diluted valuation. Don’t skimp on this.

The second lesson is for the shillers themselves

Many of you will be connected to a particular project. And in general terms we don’t have a problem you shilling your own project, how else are you going to raise your project above all the other crap competing for a limited supply of eye balls and hard cash? But be careful. It doesn’t take much to add a one liner at the bottom of your post to say you own tokens in the project. Arguably it makes it a stronger proposition. And in reality if everyone starts doing it then no one is going to bat an eyelid. At some point regulators will target a few projects that have been relentlessly shilled and it won’t be hard for them to track down the culprits. So for your own sake and those of the investing public be more transparent.

And Finally…

I’ll end with something that has nothing to do with cryptocurrency. Did McAfee kill himself? Of course he did. When he found out he had lost his fight for extradition he was left in a dark place where the thought of facing years in a US prison would have felt overwhelming. ‘When is this ever going to end,’ would have been the thought going through his head. And someone like McAfee wants to be in control. He ended his life on his terms. Rest In Peace.

Not Financial Advice

This article does not constitute financial advice or a recommendation to buy in any way. Always do your own research and never invest more than you can afford to lose. Investing in cryptocurrencies is high risk, and you could lose 100% of your investment. The article should be treated as supplementary information to add to your existing knowledge.

Recent Comments