Report: What is the next big thing in crypto?

Exploring what we believe is going to be the next hot space in crypto

When the crypto market recognizes a game-changing application, it moves fast. Look at what happened with NFTs (non-fungible tokens). Although the concept has been around since at least 2012, its acknowledgment by the wider crypto community and, more importantly, the world outside crypto only happened in 2020. Not only did everyone recognize the potential of NFTs and their many uses, from art to financial applications, but many of the NFT based cryptocurrencies were also quickly revalued. That revaluation resulted in an increase in market capitalization of 140% in 2020 (including new cryptocurrencies).

Of course, we all want to be there at the beginning of a situation like this. As an investor, however, the chances of us investing in the next Bitcoin, Ethereum, or Cardano are slim. Our best chance of making money is to recognize the next big thing before the crowd does.

So the billion-dollar question is, what is the next big thing?

Insurance

Insurance is ideally suited to the blockchain. It is an old industry with a bad reputation of insurance companies happily collecting premiums and doing all they can to avoid payouts. Blockchain can change all that. Claims can be paid instantaneously based on predefined criteria made possible by smart contracts.

The insurance industry is quietly working away on blockchain applications whilst pioneering startups have been eagerly setting up shop in the insurance blockchain space. The good news is the crypto community hasn’t yet realized the full potential of insurance as an investment opportunity.

These eager startups are not the traditional insurance companies you may expect to see advertising on television i.e., insuring your home, car, or person. This new breed of insurance startup is insuring against a bug in a smart contract, the inability to withdraw funds from an exchange, or the loss in value of a stable coin. As you can imagine, these types of services are much in demand in the crypto space particularly when you realize that the sector is generally unregulated and losses to hacks and other attacks were over $300 million last year alone. Insurance provides much-needed confidence in the fast-growing DeFi space.

Introducing the Inside Track podcast on Apple Podcasts iTunes — Views and opinions from movers and shakers in the cryptocurrency market. Learn from the best in the industry. Download the latest episodes in the series here.

A few examples of DeFi insurance in action

Below are three examples of coverage available:

Platform: Uniswap V1

Cost — 33.2%

Cover — Bugs in the solidity code that lead to a material loss of your funds

Platform: Yearn Finance

Cost — 2.6%

Cover — Bugs in the solidity code that lead to a material loss of your funds

Platform: Binance

Cost — 2.6%

You’re covered for the following events:

The custodian gets hacked and you lose more than 10% of your funds

Withdrawals from the custodian are halted for more than 90 days.

Claims require a proof of the incurred loss.

How insurance works in practice

Let’s explain how insurance works on the blockchain. There are two sides of the equation that are relevant to us as an investor.

The insured

Let’s say Ms. Smith wants to insure her holdings of stablecoins. She holds $1,000 of USDT, but she is worried the price of Tether may fall below the pegged value of $1. So she insures against this unpleasant possibility by paying a premium to cover this risk. If the price of USDT falls, she will receive an immediate payout depending on the terms of the insurance.

The crypto investor

Insurance on the blockchain allows crypto investors to participate to provide the necessary capital in order to cover the risk. The structure works a little like the insurance market Lloyds of London. The investor stakes cryptocurrency on the insurance platform and receives a proportion of the premiums payable. This makes insurance-based cryptocurrencies an effective way of capturing value. The capital contributed by investors is usually pooled, which means that their risk is spread among a number of risk situations.

Join our Telegram channel here. Here you can contribute to the lively debate with your own ideas, feedback and warnings.

Now let’s look at the most notable cryptocurrencies operating in this market and identify the ones which we believe offer the greatest potential.

Projects/Cryptocurrencies in the insurance space

Nexus Mutual

Overview

Nexus Mutual is a discretionary mutual offering an alternative to insurance for Ethereum users.

Description

Nexus is a community-driven project which has been mined into existence since September 2014 with no ICO or pre-mine. NXM is the governance token for the Nexus Mutual protocol. It is used to buy cover, vote on governance decisions, and participate in risk and claims. It is also used to encourage capital provision and represents ownership to the mutual’s capital. As the mutual’s capital pool increases, the value of NXM will increase as well.

Nexus Mutual is exactly that, a mutual. That means members have full discretion over whether to accept a claim or not. Community discussions primarily take place on the claims discussions channel on their Discord server, where members share expertise and opinions. Any member can become a Claims Assessor by staking any amount of NXM. Assessing claims in line with the consensus outcome earns Claims Assessors NXM rewards, while voting against the consensus outcome results in the assessors’ tokens being locked up for a longer period than the initial stake to vote.

When assessing claims, Claims Assessors must determine whether the claimer has provided evidence that they materially lost funds in the hack. To do this, members could consult the list of impacted addresses to ensure the address sent as proof had been impacted.

Team

The team consists of insurance professionals and actuaries with 15 years of experience in a broad range of insurance and reinsurance roles, including CFO of UK Life operations for a global reinsurer. View the resumes here.

Our opinion

Nexus is referred to as the pioneer in the DeFi insurance space, insuring a wide range of smart contracts, lending platforms, and exchanges. With over $350 million in value locked, it is a clear leader in this sector. That dominance accounts for its market cap of $560 million, which is up 88% in the last three months. We do believe this is a billion-plus dollar protocol which is sure to benefit from any revaluation of the sector. We have set a price target of $290. NXM is one of those rare cryptocurrency projects that is performing, and it is only going to grow as the sector expands. For that fact and the project’s quality management, we have rated NXM a 5 for risk.

Don’t forget to look at our monthly Moonshot Portfolio Service where we select 20 cryptocurrencies which we research and rate. You can view our latest portfolio here.

Bridge Mutual

Overview

Bridge Mutual is a decentralized, discretionary p2p/p2b insurance platform that provides coverage for stablecoins, centralized exchanges, and smart contracts. Its platform allows users to provide insurance coverage, decide on insurance payouts, and get compensated for taking part in the ecosystem.

Description

While Bridge Mutual is relatively young, its offerings are game-changing as it seeks to bring the profits of mainstream insurance businesses to the lovers of blockchain and decentralized finance innovations.

Bridge Mutual’s digital assets coverage product was born out of the aim to shield cryptocurrency investors and users alike from smart contract bugs, exchange hacks, losses brought about by the dip in the price of stablecoins, and many more. The BMI Tokens are aimed at facilitating transactions on the platform with additional perks to the holders to join in the governance of the system in a more decentralized manner.

Any user can acquire or provide cover for smart contracts, stablecoins, or exchanges. Users who intend to provide coverage for any asset will select the coin, exchange, or project they are interested in and deposit stablecoins in the project’s pool. These deposited funds will earn the user some profits (stablecoins and BMI Tokens) through investments made by Bridge Mutual into yield generating schemes.

Team

The project benefits from an experienced and well-rounded team. You can view the team lineup here.

Our opinion

BMI was the subject of a very successful IDO which saw a 17X increase in investor’s money. However, since listing, the price is up a modest 100% since January. We believe the platform is one of the better ones in the space, which despite the massive price hike compared to its IDO is significantly undervalued compared to its main competitor Nexus Mutual. We have set a price target of $5 and a risk factor of 7.

We publish the Micro Cap Watch List every Friday. This is a list of small to micro cap cryptocurrencies which we believe are undervalued. It is a great source of investment ideas. View our latest list here.

Cover Protocol

Overview

Cover Protocol is a peer-to-peer insurance coverage marketplace that utilizes ERC-20 fungible tokens to allow permissionless and non-KYC coverage.

Description

Cover Protocol is a peer-to-peer insurance market, which operates in a similar fashion to a prediction market. Unlike other insurance protocols, the governance token is not used for underwriting risk.

The model depends fully on the market determining coverage premiums. Users who want to stay hedged against exploit risk should buy CLAIM tokens, while those who believe the underlying protocol is secure should buy NOCLAIM tokens. Cover Protocol enables users to essentially bet on the safety and security of the underlying protocol. Their model allows users to stake collateral to mint CLAIM tokens (redeemable if an exploit occurs) and NOCLAIM tokens (redeemable if no exploit occurs).

For example, if 100 DAI is used to provide coverage for Compound protocol until an expiry date, it will yield 100 CLAIM and 100 NOCLAIM tokens. On the expiry date, if there is a valid claim event, every CLAIM token will receive 1 DAI while NOCLAIM token will expire worthless. The converse is true if there is no valid claim event. In this case, every NOCLAIM token will receive 1 DAI, while a CLAIM token will expire worthless.

Their business model consists of charging a redemption fee upon redeeming Tokens. This way, the network is able to sustain itself and generate revenue, which COVER token holders can later vote on what to use these fees for (either buybacks, distributed to token holders, etc).

Their target market are those who are hesitant to deposit money into risky protocols without some form of protection against risks, as well as those who purely want to speculate on the safety of a protocol.

Team

There is limited information on the team. View it here.

Our opinion

The protocol has some $10 million of value locked, which compared to Nexus Mutual makes it seem like a pin prick on its radar. However, it is one of only a few blockchain insurance platforms that are fully functional. It has to be said that their solution to the insurance problem isn’t as user-friendly as its peers. This doesn’t mean that the tokens price will not benefit from any revaluation of the crypto-insurance sector as a whole. Its price is 74% off its all-time high, a price we predict will exceed $2,000. Cover has suffered from some major setbacks recently, including a hack and a falling out with yearn.finance which led to a parting of ways after a shotgun wedding. The risk factor we have allocated to this cryptocurrency is a 9 for these reasons, as well as its slow adoption.

Tune into our Moonshot Monday podcast on iTunes where we discuss three possible cryptocurrency moonshot each week. Listen here.

Nsure

Overview

Nsure Network is a decentralized insurance project that borrows the idea of Lloyd’s of London, a market place to trade insurance risks.

Description

Nsure Network is a decentralized insurance project that follows the business model of insurance underwriters Lloyd’s of London, a marketplace to trade insurance risks where premiums are determined by a Dynamic Pricing Model. In this model, capital supply and demand from the entire platform determines the price jointly, similar to the pricing mechanism in the free market, by having Nsure tokens backing the policies purchased.

NSURE is the governance token for the Nsure Network. Unlike Nexus Mutual that follows a mutual model, Nsure follows a shareholders model where the Nsure token is akin to holding the share of the network.

Stakers can stake up to 4 times their Nsure token, limited to a total of 10 projects, subject to the assumption that not more than 25% of token balance (100% of 400% total staking power) is allocated to each project.

For example, John has 100,000 tokens, the maximum staking power he has is 400,000. He could stake up to 100,000 on Compound and 50,000 each on other 6 projects. As a comparison, Nexus Mutual allows up to 10x leverage.

Each Staking epoch is 14 days, including 11 days’ Lock Period and 3 days’ Rebalance Period. Participants are free to rebalance their portfolio based on their strategy and new information (such as Total Sum Insured) or withdraw tokens during the Rebalance Period. Staked tokens are not withdrawable nor transferable during the Lock Period.

50% of the premium will be shared with Nsure stakers that stake on the protocol as a part of the underwriting programme.

40% of the premium collected will be accumulated in the surplus pool. When there is a valid claim, 50% of the payout will come from the staked Nsure tokens. The remaining 50% of the claim will come from the surplus pool. If the amount in the surplus pool is insufficient, then the remaining claim amount will be taken from the capital pool.

The protocol has recently announced that its mainnet launch is imminent.

Team

A young experienced team especially in the blockchain space. You can view the summary resumes here.

Our opinion

This is another insurance platform that has yet to launch, but unlike Cover, it is following the traditional business model that many of the other crypto-insurance players are taking. That should mean it picks up market share and becomes a significant player in the smart contract and DeFi insurance space. Its token has a modest market cap of only $16 million, which has seen a 140% increase in the last three months, but that still leaves it undervalued, in our opinion. We would expect to see a valuation of $60 million in the short to medium term. We have set a price target of $5 and attributed a risk factor of 7 because of its early stage.

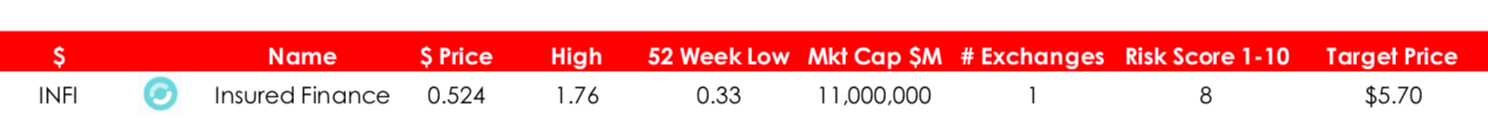

Insured Finance

Overview

Insured Finance is a crypto-insurance solution that will allow its users to secure comprehensive coverage on their digital asset holdings.

Description

Insured Finance is building the future of digital asset insurance. By enabling cryptocurrency users to insure one another, Insured Finance allows a broad array of cryptocurrency assets to be insured at extremely competitive rates. Market participants can easily request or provide coverage on a wide variety of cryptocurrency assets. Claims are fully collateralized and payouts are instant.

Not only can digital asset owners secure insurance for their holdings, but those that provide insurance can earn a return on their capital. The project is in Beta Testing at present with the mainnet due to launch ‘imminently‘ but with no set date.

Team

The team has a diversified experience base, covering finance, insurance and technology. You can view their resumes here.

Our opinion

Insured Finance benefits from a modest market cap of $11 million. At such a low valuation and with the realistic prospect of a market revaluation, the potential upside is significant. We have set a price target of $5.70. This project is not without risk. It is yet to launch its platform, but we believe the market is big enough for INFI to still carve a lucrative niche. The risk, however is commensurate to the potential high reward, and we have scored this project an 8 for risk.

Visit our website here to download free books, online courses and insightful articles.

Tidal Finance

Overview

TIDAL is an insurance market built upon Polkadot that allows users to create custom insurance pools for one or more assets.

Description

Tidal will help users buy and sell insurance against decentralized finance protocols. The buying part is self-explanatory. As for sellers, they will have to provide liquidity for DeFi protocols they want to back and will receive Tidal tokens in return.

Tidal will charge a small percentage of transaction fees from cover sellers. Tidal combines different protocols into coverage pools to allow liquidity providers (LPs) to stake their capital to provide coverage on multiple protocols at the same time. These pools are assembled to offer LPs the ability to leverage their capital while mitigating the risks. Risks are reduced by combining protocols with low correlation and by limiting the duration of each coverage cycle. This approach provides LPs the ability to generate above-average returns while offering coverage seekers highly competitive pricing.

Tidal said it has partnered with over 20 DeFi protocols to bring coverage for its users. Some of these protocols include bZx, Reef Finance, Equilibrium, StakeDAO, and others.

Tidal also plans to launch an insurance product for different proof-of-stake protocols, including Ethereum 2.0.

Tidal Finance recently raised $1.95 million in a private token sale round backed by Hypersphere Ventures, the venture firm co-founded by Polkadot co-founder Robert Habermeier, as well as Spartan Capital, Kenetic Capital, and QCP Capital.

Tidal is looking to launch its protocol in mid-April.

Team

The Tidal project team is both accomplished and experienced. As you will see from their LinkedIn profiles this is the perfect team to be leading a project of this quality.

LinkedIn Profile — Chad Liu

LinkedIn Profile — Dan Raykhman

Our opinion

Tidal is our top pick in this sector. Despite not having a live platform, it is treading a path already followed by the relative giant Nexus Mutual. Its management team is top tier, and it is backed by leading VCs. That reduces the risk somewhat and justifies a risk score of 5. The potential, however, is in the price of its token. With a market value of $20 million and a price of $0.03, it is clear the market has overlooked this project’s potential, although it is a newcomer to the market, having only just completed an IDO. We have set a price target of $0.25. With the launch of its mainnet imminent, now would be a good time to start your own due diligence on this one.

Summary of our findings

To the average person on the street, insuring smart contracts and stable coins is as foreign to them as bumping into someone from Eritrea but not to the educated crypto community. The insurance market has only really grown in significance in the last twelve months when total value locked went from under $1 billion to $50 billion, which is where it stands today. As DeFi grows, so will the insurance potential, and as the sophistication of insurance offerings expands, so will DeFi. Investing in insurance-related cryptocurrencies is an effective way to gain exposure to the continued explosive growth in the DeFi space.

From the above projects, our favored cryptocurrencies are:

It is a pretty safe bet that DeFi is going to continue to grow, your real bet, however, is on whether the crypto community will recognize insurance as the next big thing and if and when it does which cryptocurrencies are set to benefit. That final decision is down to you my friend…

Not Financial Advice

This article does not constitute financial advice or a recommendation to buy in any way. Always do your own research and never invest more than you can afford to lose. Investing in cryptocurrencies is high risk, and you could lose 100% of your investment. The article should be treated as supplementary information to add to your existing knowledge.

Recent Comments