Moonshot Portfolio June 2021

June’s Crypto Moonshot Portfolio

We analyze and rate twenty undervalued cryptocurrencies with moonshot potential

A lot can happen in a month in crypto. Since May 2020 when the bull run commenced, although some say the bull run started some 12 years ago, asset prices have been driven to unrealistically high levels by the insatiable demand for everything crypto. Growing numbers of participants have been chasing after the latest IDO or memecoin with little regard to the quality of these ‘assets’.

Projects have been coming to the market in record numbers mainly driven by Binance Smart Chain’s low gas fees making it cheap to establish a cryptocurrency many of which have identical structures. In reality it was never sustainable for the market to continue to value startup projects with no users or revenues at those astronomical prices. Some level of correction was inevitable. And in our opinion there is still some way to go before projects with zero fundamentals and ultra aggressive tokenomics are brought back down to earth.

That is why it is crucial that investors should focus on projects with a functioning platform, a growing user base and a clear niche. These projects are not however immune from the unforgiving, indiscriminate market but in the medium term they stand a better chance of shining. These are the types of projects that we have been trying to select as part of our portfolio.

Assessing value

A good way of assessing an asset’s growth potential is the discount to its all time high (ATH). Let’s look at some of the projects within our portfolio and see which offer the best value based on this one metric.

State of play

Let’s now focus on our current portfolio of twenty cryptocurrencies. The performers and the non performers, who are being culled and which new projects we have added.

As expected it was a bad month. The performance was down 23% taking into account the notional cash from previous exits and 45% on a like for like basis. However the portfolio is up 227% since its launch in February.

Every one of our selections, apart from one, saw a negative performance in the month. We hardest hit by Pancake Bunny which was hacked and lost 93% of its value compounded by a disastrous response to the attack. That one standout performer was Candela Coin, our long shot pick from last month, which saw an increase of 133%.

We removed four projects from our portfolio including Potcoin, Tidal Finance, Pancake Bunny and Growth DeFi.

We added four projects including CertiK, Haven, Uno Re and Mysterium.

Don’t expect July to be any better. We believe the volatility is here to stay for some time, but this is a great opportunity to fine tune our portfolio so it is prepped for when optimism returns to the market, which it will.

Overall performance

Now let’s look at the overall performance of our portfolio for the month:

This months developments

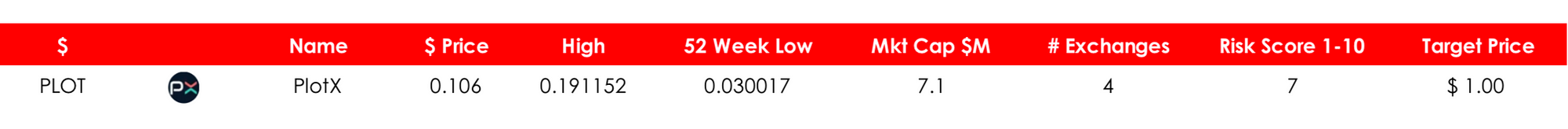

PLOT

PLOT announced the launch of its new platform on Polygon which in its first 10 days facilitated over 10,000 bets. Whilst this is a promising start there is now much work to do to market this new platform which is the focus of the next stage of its development. PLOTX recently launched a new product, prediction markets in pre-IDOs, which has proved to be popular. This is a project worthy of closer attention considering its strong team including the ex CTO of Nexus Mutual.

Listen to our podcast Inside Track here where the co-founder of PLOTX talks about the prediction market, the cryptocurrency market in general, including his favorite projects.

Potcoin

Potcoin has been promising, ‘Lots of great things’ for months with very little materializing. We believe that there’s a place for a legal marijuana based cryptocurrency but we have lost faith in Potcoin to perform. There are a few other similar coins in the marketplace offering the same optimism as POT including MotaCoin, but again these are worth avoiding for now until further solid evidence of progress is displayed. We removed Potcoin from our portfolio.

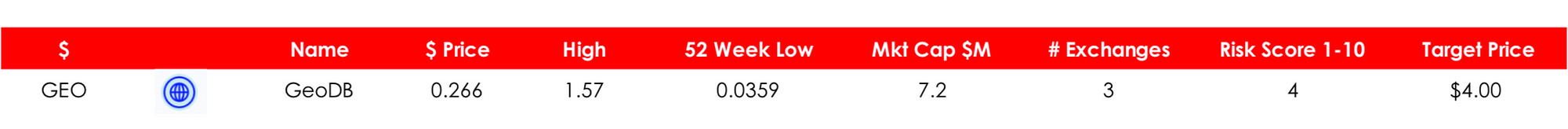

GeoDB

This project has been busily raising funds for its project through a number of crowdfunding campaigns. Check out their pitch here. Operating in the field of big data GeoDB provides a more efficient solution than legacy company’s. The downside to this project is its aggressive tokenomics, with a maximum token supply of nearly 13 the number of its current token circulation. This overhang is definitely a factor weighing on its token price. We have decided to maintain GeoDB in the portfolio for now but keep it under review.

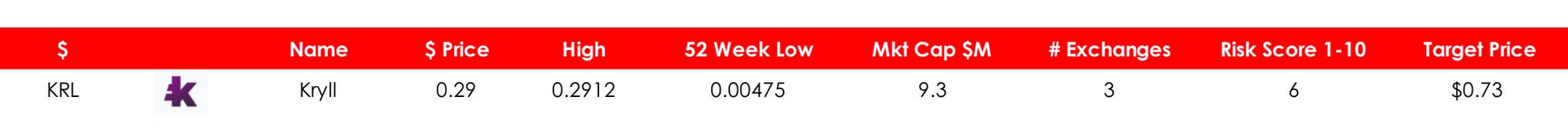

Kyrill

Kryll.io is a platform for cryptocurrency traders looking to use the most advanced trading tools and strategies. It announced another milestone announcing that it had traded $400 million in strategies in 30 days which was an increase of over 60% compared to the previous month. Its cryptocurrency will be particularly sensitive to the market sentiment but it is one worth holding onto.

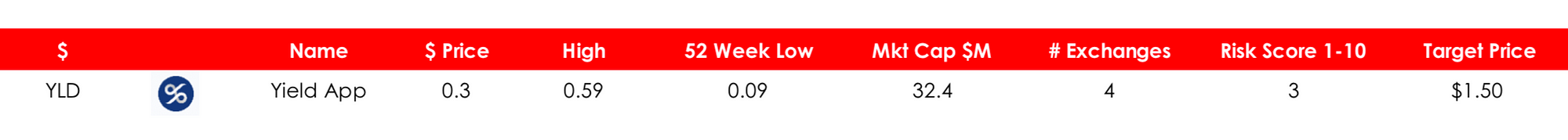

Yield App

Whilst the cryptocurrency market was in meltdown Yield continued to develop new products and build its assets under management which now stands at over $200 million, an increase of 40% in a month. This is a competitive space but there are few regulated platforms. Yield App is a quality project that we continue to be optimistic about.

Listen to our podcast Inside Track here where the founder of Yield App talks about his project, the cryptocurrency market in general and some of his favorite projects.

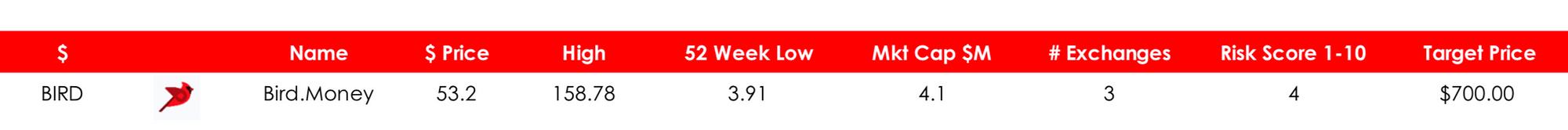

Bird.Money

The BIRD Score is the first DeFi credit score based on the statistical prediction of loan default, created using advanced machine learning methods and made available to lending protocols on DeFi. With the growth of DeFi this is an exciting area with much promise. Although Bird is at an early stage of its development its low valuation makes this one worth keeping on your radar.

Growth DeFi

This project operates in a competitive area which new operators seem to be joining every day. With only $1 million of TVL this project doesn’t seem to be making much progress and we have therefore decided to drop this from our portfolio.

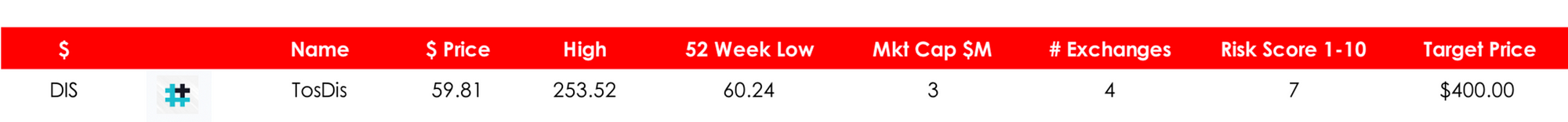

TosDis

Offering staking as a service to ERC-20 and BSC projects this is a potentially lucrative niche allowing projects to set up their own staking without the risk and infrastructure. Although TosDis is at an early stage it is one worth holding. The recent market slide means the tokens are looking exceptional value.

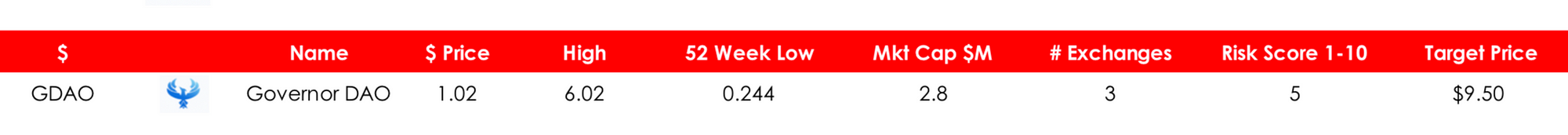

Governor DAO

GDAO is in the business of DAO as a service. That service is going to be crucial to many DeFi projects when regulation becomes a reality and projects look to ensure that their last remnants of central control are dropped in favor of a community led project. This is where GDAO comes in. But don’t expect any rapid progress. This is a slow burn project which is reasonably valued considering its potential.

VIBE

You need to be a brave investor to be holding NFT based cryptocurrencies right now. But VIBE, the augmented and virtual reality marketplace, continues to perform announcing that its ecosystem has surpassed 1 million transactions. Whilst the market value continues to decline we are doggedly holding onto this one.

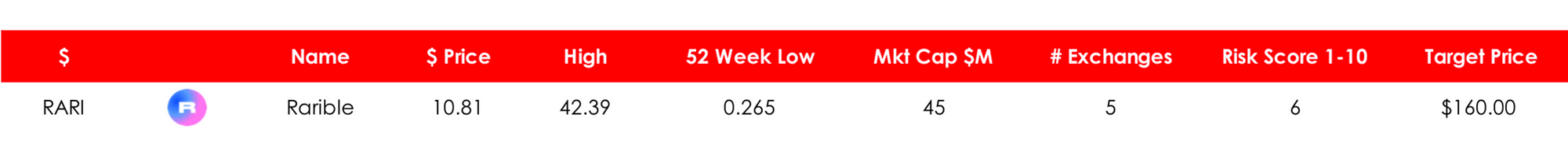

Rarible

RARI has performed terribly for months, but like VIBE it is one of the quality projects in a crowded space. Its tokenomics don’t help with a maximum token circulation 6 times higher than its current circulation. We continue to be holders of this project because of its strong position in the NFT space.

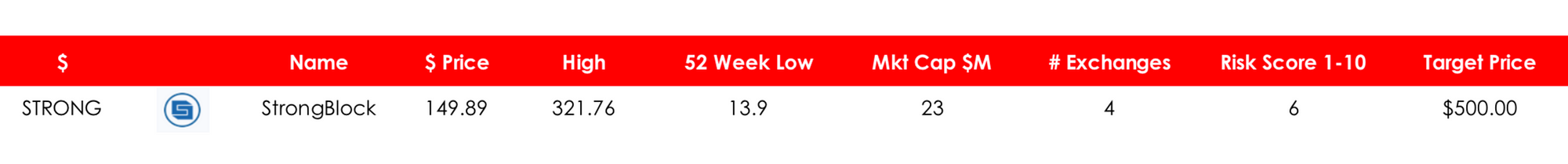

StrongBlock

Although there is competition emerging, STRONG is a leading player in the nodes as a service space. In only one month STRONG has increased the number of nodes from 25,000 to 37,000. Although we are not fans of its tokenomics the project is proving its model and is on a definite growth splurge. With the market weakness STRONG is a project worth buying into.

Tidal Finance

Tidal has been hit hard in the market slide. There are two factors at play here, firstly its overly aggressive tokenomics and secondly the competitive market it has found itself in. We have decided to exit Tidal as we believe there are better opportunities available.

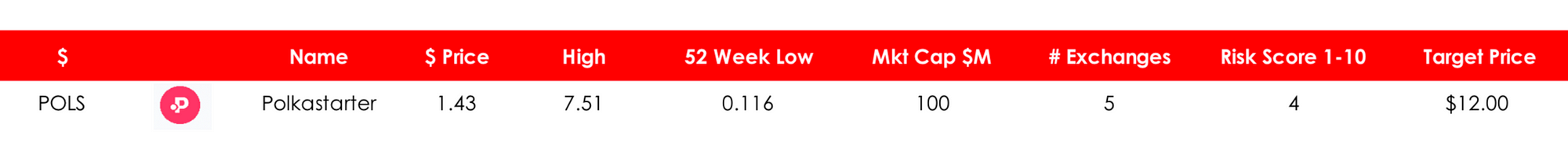

Polkastarter

When we first tipped POLS it was one of only a few in the newly created IDO launchpad space. Now that space is crowded with every man and his dog either entering this market or branching out into it. POLS is still one of the leaders and with its massive user base looks significantly undervalued when compared to other successful DeFi platforms.

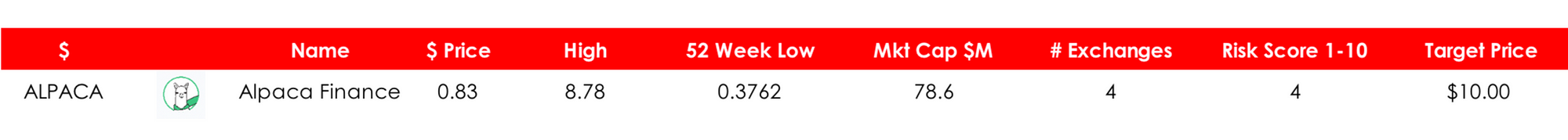

Alpaca Finance

Alpaca was a new inclusion in our portfolio last month which we were excited about. Since the market fallout the valuation has fallen a lot further than its TVL which is still a healthy $1.3 billion. Alpaca is a potential recovery play.

Pancake Bunny

BUNNY was subject to a massive hack which led to its token plummeting in value and a massive outflow of funds locked. To try to remedy the situation the team intervened and increased the supply of tokens from 1.5 million to 10 billion. That last action is why we have removed BUNNY from our selection. All DeFi projects are at risk of an attack, particularly, it seems, those on BSC. However it is down to how the project team handles the situation that counts. The handling in this case was poorly managed and as a result we have lost confidence in the project.

Candela Coin

Candela was one of our long shot projects in last month’s Portfolio Selection. In the previous month Candela has obtained additional listings for it’s coin on the exchange and has continued to develop its platform and infrastructure. It is the only coin whose price increased during the market dip and is promising more news very soon.

Listen to our podcast Inside Track here where the founder of Candela Coin talks about his project, blockchain and solar power and some of his favorite projects.

Cryptocurrencies being added

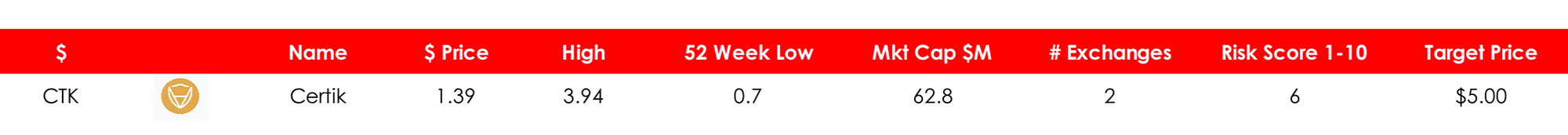

Certik (CTK)

Overview

A cross-chain Protocol with security scoring and decentralized reimbursements for building secure dApps.

Description

CertiK is a pioneering blockchain security firm that uses a cross-chain protocol with security scoring and decentralized reimbursements for building secure dApps.

Blockchain projects can receive security insights from its Security Oracle, which provides real-time guards of on-chain transactions and identifying and flagging a wide range of malicious vulnerabilities before they occur.

Depending on the level of the security score, audited blockchain projects of any protocol may be eligible for a CertiKShield membership, which is a flexible, decentralized reimbursement system for any crypto asset that is irretrievably lost or stolen due to security issues. CertiKShield memberships are open to all community members of these eligible blockchain projects, providing a safety net to holders of crypto assets in case anything unexpected happens.

Click here to view CertiK White Paper

Team

CertiK has the advantage of an exceptionally experienced team. You can view the team here

Our Opinion

Risk Score: 6

Target Price: $5.00

Maximum Supply: 100,183,153

CertiK has been at the forefront of crypto investor interest recently after auditing the memecoin SafeMoon. CertiK and Quantstamp are the two leaders in this field, although Quantstamp focuses more on non DeFi projects. With the exponential growth of DeFi on BSC and DeFi in general there is going to be a continued demand for projects to be audited and as importantly, insurance cover.

We analyzed the crypto insurance space in a previous report highlighting its massive potential and the key players. CertiK wasn’t part of that analysis but it should have been. CertiK is in a prime position to build a significant share of this market competing directly with the likes of Nexus Mutual, its largest player.

The main risk is the unregulated nature of DeFi and the possibility governments will start coming down hard on projects which claim to be decentralized but still have an element of central control. On that basis we have scored Certik a 6 for risk. The beauty of CertiK is how its native currency is critical to its platform. That is a major tick in the box for the investor.

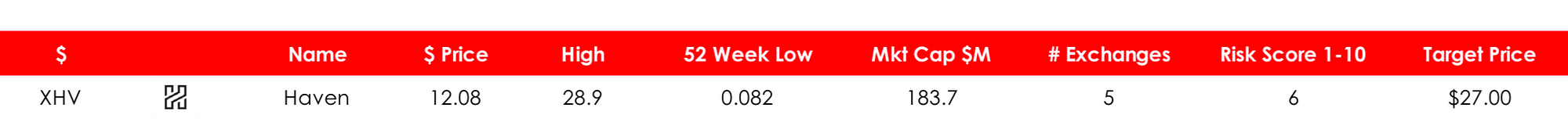

Haven (XHV)

Overview

Haven is an untraceable cryptocurrency with a mix of standard market pricing and stable fiat value storage.

Description

Haven has a built in on-chain smart contract that controls the minting and burning of coins to facilitate value for users that choose to send their coins to offshore storage contracts.

Sending Haven to offshore storage or burning records a reference on the blockchain to the current fiat value which can be restored later back into Haven by minting new coins to the tune of the current fiat value.

Haven uses ring signatures, ring confidential transactions and stealth addresses meaning payments cannot be tracked or linked back to any user. Wallet addresses and transaction amounts are completely obfuscated on the Haven blockchain making all activity invisible.

Click here to view Haven White Paper

Team

Some of the team have chosen to be anonymous, however their project lead is David Bantock and Neil Coggins is their technical lead.

Our Opinion

Risk Score: 6

Target Price: $27

Maximum Supply: 18,400,000

We believe Haven offers a novel solution to the user looking for privacy combined with stability.

Haven definitely has a unique solution to the privacy problem and is a hybrid of the typical privacy coin with its storage function. Haven’s market cap is at a significant discount to many of the larger privacy coins. We believe Haven is well worth closer attention. Their maximum token supply is dynamic meaning that the most that can be mined are 18.4 million but the mint and burn feature causes both inflation and deflation.

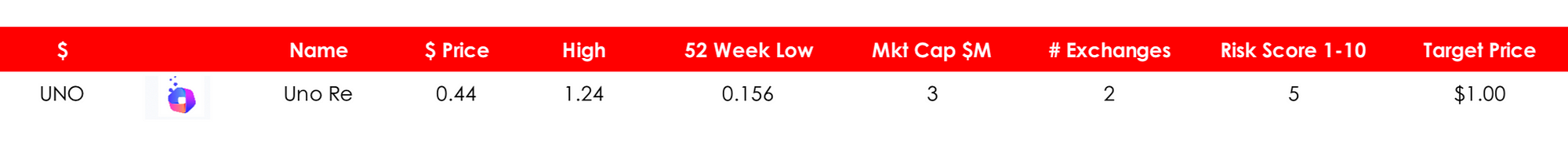

Uno Re (UNO)

Overview

The first Decentralized Reinsurance platform.

Description

Reinsurance is also known as insurance for insurance companies. Reinsurance is the practice whereby insurers transfer portions of their risk portfolios to other parties to reduce the likelihood of having to pay a large obligation resulting from an insurance claim.

The option to trade in this highly profitable market is currently controlled by a few large corporations — Uno Re is a first-of-its-kind platform, allowing the average user to reap the rewards of trading and investing in this risk.

Click here to view Uno Re White Paper

Team

An experienced and technically capable team. You can view the team here.

Our Opinion

Risk Score: 5

Target Price: $1.00

Maximum Supply: 384,649,206

UNO is the first decentralized reinsurance platform. We have been followers of the crypto insurance market for some time as most of you know. However, a few months ago we predicted it would be the next big thing in cryptocurrency. What we hadn’t anticipated was how many new insurance based projects would enter the market. The good thing about UNO is that many of these new entrants are using UNO to offset some of their risk putting them in a unique position in a competitive space. The DeFi insurance market is set to grow exponentially and projects like UNO are in a prime position to benefit.

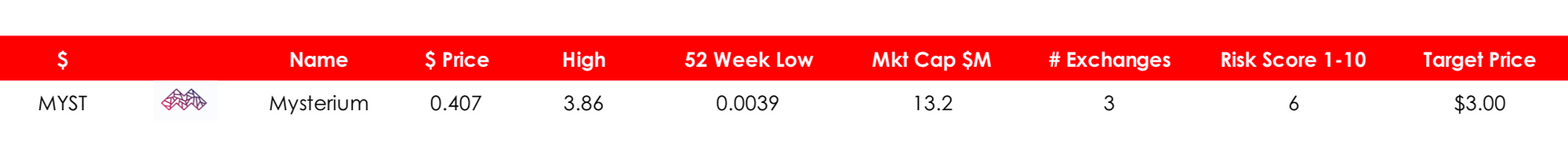

Mysterium (MYST)

Overview

Mysterium is building a decentralised P2P VPN and other tools that allow users to browse the internet freely, earn by sharing connections and build censorship-resistant applications.

Description

Mysterium Network is building the world’s largest P2P network to power Web 3 privacy applications. An open source, Swiss-based company founded in 2017, Mysterium is rewiring the internet so it’s secure, free and accessible for all. Mysterium held a token sale through which it raised $18 million USD.

The network is transparent and permission-less by default, made up of layered VPN protocols, blockchain and smart contracts. It lays the groundwork for all kinds of next-gen services to be built on top of it, including Mysterium’s flagship product, the decentralized VPN app.

This dVPN plugs into Mysterium’s global network of residential nodes, one of the fastest growing online communities decentralising the web. This open marketplace allows anyone to become a node and rent their unused bandwidth and IP address to those in need. Individual users can choose from providers located all around the world, allowing them to unblock content, and making them resistant to logging, surveillance and cybercrime. Users pay nodes for providing VPN services in MYST, the network’s native token and reserve currency.

Click here to view Mysterium White Paper

Team

Although there is limited information available on the team it does appear they are more than capable of achieving their goals having already raised significant funds and grown to 1,100 nodes in 409 countries in relatively short order. You can view the full line up here.

Our Opinion

Risk Score: 6

Target Price: $3.00

Maximum Supply: 32,433,365

Mystereum provides an alternative and arguably superior product to the popular VPN. It allows users to pay as they go, whilst node operators are paid to participate. It already boasts some 1100 nodes in 409 countries and it continues to grow its user base and node network. This is a perfect use case for blockchain technology, providing an alternative to VPNs which are centrally controlled, owned and operated.

Portfolio Selection — June 2021

Sylo

Overview

Decentralized data exchange. Operator of the SYLO smart wallet, which has over 250,000 users.

Description

The Sylo Protocol provides confidential communication as a utility to the Sylo Confidential Communication App. The protocol acts as the confidential networking layer for the Sylo App, creating P2P connections and providing a way for users to interact and exchange data confidentially.

The Sylo Protocol is being developed to provide fully decentralised confidential communication as a utility to all connected-apps within the Sylo ecosystem. Powered by blockchain and combined with other decentralised technologies, this Protocol will act as the networking layer for the Sylo DApp and 3rd-party connected-apps, while providing charging options for specific communications and services over the network.

The fully decentralised Sylo DApp will be the 1st application built on the blockchain-based Sylo Protocol, using technology already commercialised in the Sylo App that’s currently used by thousands globally, available on Apple Store and Google Play Store.

Sylo is a decentralised communication and data exchange network powered by a layer 2 micropayments infrastructure and the SYLO token. User-run Service Peers provide infrastructure to the network which allows developers and businesses to run privacy-first, unstoppable apps without deploying any infrastructure of their own. A staking architecture and unique probabilistic ticketing solution ensure minimal transaction fees and limitless scalability. This scalability is already on show within the project’s flagship app, the Sylo Smart Wallet; a decentralized, private messenger and crypto wallet with over a quarter-million users.

Click here to view Sylo White Paper

Team

The team appears to combine a broad range of talents, skills, and experience which should provide any investor with confidence in this project. This is Sylo’s description of their core team: ‘…combines a deep background in computer science, development, and user experience with the real-world business experience of entrepreneurs, designers, and world-leading technologists. Both in experience and attitude, the strength of Sylo is in its people.’

Our Opinion

Risk Score: 5

Target Price: $0.02

Maximum Supply: 10B

The team has already demonstrated it is a force to be reckoned having developed and launched its smart wallet which has over a quarter-million users. It also has a decent-sized community following it. We have ranked the coin a 5 in terms of risk as the team has already achieved a level of success however the potential has not been fully recognized in the price.

PlotX

Overview

Prediction market platform.

Description

PlotX is a non-custodial prediction protocol that enables users to earn rewards on high-yield prediction markets.

Dubbed as the Uniswap of Prediction Markets, PlotX uses an Automated Market Making algorithm to create, settle markets and distribute rewards on the Ethereum Blockchain without any counterparty risk. Markets are focused on crypto-pairs like BTC, ETH, YFI, etc, and are automatically created in intervals of 4 hours, 1 day, and 1 week. PlotX also uses on-chain governance powered by GovBlocks.

Click here to view PlotX White Paper

Team

Check out the team in this video on PLOT’s website here.

A well rounded team who have launched an impressive platform. They appear to have a close eye on regulation having restricted access to high risk countries such as the US. That is a comforting sign for the future.

Our Opinion

Risk Score: 7

Target Price: $1.00

Maximum Supply: 200M

PLOT’s closest competitor is Augur which is one of the biggest players in this market, although PLOT’s focus is more on financial bets. It benefits from an experienced management team and a platform that is already proving popular with users. The main risk is potential regulation and adoption. However with a market cap significantly less than Augur, PLOTX represents a decent investment opportunity.

GeoDB

Overview

GeoDB is a decentralized peer-to-peer big data sharing ecosystem.

Description

GeoDB is a decentralized peer-to-peer big data sharing ecosystem, which returns value to its creators, the users. GeoDB’s mission is to democratize the 260bn Big Data industry, building an open ecosystem in which to establish better and trusted relationships between market participants while giving back control and value to data generators, the users. GeoDB is using blockchain technology to eliminate intermediation in a huge industry and allow faster growth and adoption.

Click here to view GeoDB White Paper

Team

GEO boasts an experienced team of technology professionals that have demonstrated that they are credible by raising money through a crowdfunding round. See the full team here.

Our Opinion

Risk Score: 4

Target Price: $4.00

Maximum Supply: 300M

The team behind GEO recently completed a capital raising through Seedrs, raising GBP2.5M, surpassing their target of GBP2M. The downside is there is a large maximum supply compared to the current circulation, but we believe that is outweighed by the potential of the project and the team behind it.

Kryll

Overview

Kryll is your first intuitive platform to define powerful crypto trading strategies.

Description

Kryll is your first intuitive platform to define powerful crypto trading strategies through a simple drag n drop editor. Create automated winning strategies, benchmark them, share with the community, enjoy user-generated content.

Kryll is the ultimate platform for cryptocurrency traders looking to use the most advanced trading tools and strategies, as well as benefit from the community’s hive-mind to get the best returns within cryptocurrency markets.

The platform provides intuitive ways to create your own trading strategies that can be set to execute automatically. Through a What You See Is What You Trade™ interface, you can design trading strategies making use of the industry’s most powerful tools and safely test them with backtesting and sandboxing.

Once your tools prove their worth, you can set them to live-trade on your behalf, taking the right positions at the right time, as if you were following the markets 24/7.

On Kryll you can also rent out your very own winning strategies to help fellow traders be more successful. You will be rewarded with passive income for sharing your strategies.

Click here to view Kryll White Paper

Team

An accomplished team with a proven track record of success in both tech and entrepreneurial flair. Check out the full team here.

Our Opinion

Risk Score: 6

Target Price: $0.73

Maximum Supply: 49M

We believe that Kryll has a unique business model which is gaining traction. We especially like the novel touch, where traders can rent out their own strategies to help fellow traders be more successful. This allows traders to be rewarded with passive income for sharing their strategies on something that could scale quickly. Despite the large max supply compared to tokens in circulation, the price does not take into account the quality of the team and its current growth/ The most significant risk in the near terms is its sensitivity to market volatility.

Yield App

Overview

YLD, a licensed and regulated FinTech company, offers a mobile app and web platform designed to provide the easiest way to invest in DeFi using crypto or traditional currencies.

Description

YLD’s intuitive app and web platform enable users around the world to earn high returns from DeFi products without having to go through a lengthy, complex, and often costly learning process. Operating under a banking license, YLD offers an insured investment fund managed by a team with years of experience in FinTech and cybersecurity. At the core of its strategy is the YLD token, which rewards community members and allows them to boost their APY.

Click here to view Yield App White Paper

Team

Both an experienced and accomplished project team benefiting from a team of quality advisors. See the full team here.

Our Opinion

Risk Score: 3

Target Price: $1.50

Maximum Supply: 300M

When you compare YLD to other similar platforms in the DeFi space it appears grossly undervalued. YLD’s platform is regulated and is aimed at the unsophisticated user, which could make this an attractive bet on the eventual mass adoption of DeFi. YLD is a good choice for any portfolio.

OIN Finance

Overview

DeFi platform providing liquidity mining and loans.

Description

OIN is described as being the first DeFi platform to provide liquidity mining and loans on Ontology, and ultimately on other top platforms through cross-chain functionality. The platform will build the bridge technology to seamlessly integrate Ethereum into its ecosystem, opening up to all of the current DeFi space. Cross-chain technology is crucial in DeFi and its growth as a legitimate financial infrastructure, after all, traditional finance also integrates the whole world, its currencies, and its different financial systems.

Click here to view OIN White Paper

Team

OIN has what appears to be a large dedicated team, check the full team out here.

Our Opinion

Risk Score: 9

Target Price: $1.10

Maximum Supply: 100M

This cryptocurrency suffers from the same problem as many others: a massive maximum token supply, with a total supply of 100M compared to only 6.75M in circulation. That all probably goes some way to explaining OIN’s low market cap which we believe doesn’t reflect its full potential, however, this is a high-risk high reward investment which should definitely be balanced with some lower-risk opportunities.

Bird.Money

Overview

Bird.Money is an ERC20 token which acts as a non-custodial digital asset lending and borrowing platform.

Description

BIRD is an off-chain API interface for third-party integration with other companies, developers, and DeFi apps. Some of the features available include ETH account analytics POST and GET endpoints. Other features include account blacklist, Oracle integration with google search, on-chain and off-chain equity measurement, on-chain and off-chain assets measurement will be released in the near future.

Initial features of the API would be free to organisations, developers, and the whole community. After the BIRD sales, only customers with BIRD tokens will have access to the premium services such as Smart Contract Analytics. Smart Contract analytics will allow the community to gain unrivaled intelligence about a token or farm just by simply pasting the smart contract address.

Click here to view BIRD White Paper

Team

This is how BIRD describes their team, ‘The Bird nest comprises a global group of professionals that hold a high level of standard, not only for their work but for the people around them and the community. Our team is fully committed to the Bird.Money vision, the concept and growth of decentralized finance, global inclusion and fairness throughout.’ They appear to have an experienced team who are more than capable of achieving their objectives. See the full team here.

Our Opinion

Risk Score: 7

Target Price: $700.00

Maximum Supply: 140,000

Bird is one of our top picks. It has a number of things going for it. Firstly it is an oracle with some similarities to the popular Chainlink. An oracle integrates information from outside the blockchain. BIRD is focusing on credit scores for the DeFi space, a potentially useful and lucrative area. Bearing in mind Chainlink’s multi billion dollar valuation BIRD is, in our opinion, grossly undervalued. It also has a maximum supply of only 140,000, with already 80,000 in circulation and has an aggressive burning program.

TosDis

Overview

The one-stop DeFi interoperable solution powered with Liquid Staking.

Description

TosDis is a new DeFi project which combines the power of staking as a service and liquid staking for POS coins. In this way, they are combining the best of both worlds — allowing crypto investors to stake their PoS digital assets via TosDis EasyStake. At the same time, they take care of the technical aspect of the staking process and the benefits of liquid staking. TosDis is bringing together Staking-as-a-Service and liquid staking to unlock more generous access to digital assets. It is a new word in the Proof-of-Stake algorithm’s improvement, allowing its users to use a platform-independent betting mechanism and increasing the liquidity of tokens.

Click here to view TosDis White Paper

Team

See here for more information

Our Opinion

Risk Score: 7

Target Price: $400.00

Maximum Supply: 99,986

DIS continues to develop new innovative solutions in the fast-expanding DeFi space. That, coupled with the low market cap and low maximum circulation, makes this a good buying opportunity. Take a read of the article here to see the various developments since launch.

Governor DAO

Overview

Governor is a DAO that seeks to offer Governance-as-a-Service to new DAOs.

Description

Governor is a DAO that seeks to offer Governance-as-a-Service to new DAOs in order to ensure active and fair governance on day zero. GDAO is the governance token that grants voting rights and represents ownership of the project treasury.

Click here to view Governor DAO White Paper

Team

This is a community run project.

Our opinion

Risk Score: 6

Target Price: $9.50

Maximum Supply: 3,000,000

The projects staking and mining solutions are live and slowly gaining traction. We have scored GDAO a 6 in terms of its risk because we believe the current price is far too low compared to where the project is now and its potential in the lucrative DAO space. Take a look at this YouTube link here which gives you a better understanding of the project and why it is one to look at more closely.

VIBE

Overview

VIBE operates marketplaces and hubs inside Augmented and Virtual Reality created on the Ethereum blockchain driven by the cryptocurrency VIBE.

Description

Creating next generation NFTs and developing new standards for gaming on the blockchain. Built for users and developers on the layer 2 solution VIBENet and powered by the VIBE token.

VIBE is a fully decentralized and immutable ERC-20 Token with a fixed token supply. VIBE is used for purchasing digital goods and services in the ecosystem. VIBE Ecosystem is powered by the VIBE token and the Layer-2 side chain solution VIBENet.

White Paper is not available — click here for news

Team

Founded by Alessio Mack and Matthew Myers. The development team consists of 12 core members who are seasoned developers and marketing experts. It also has a quality assurance member, Renee Isaac.

Our Opinion

Risk Score: 9

Target Price: $0.250

Maximum Supply: 267m

VIBE is certainly in the right space — NFTs. However, although it is obvious from its constant flow of news and developments that this project is carving itself into a lucrative niche, it doesn’t come without risk. We have scored VIBE a 9 in terms of risk as it is in a highly competitive market, saying that with its low market cap and the strong community, this project, in our opinion, is a risk worth taking.

RARIBLE

Overview

Rarible is a creator-centric NFT marketplace and issuance platform. RARI is a governance token with a Marketplace Liquidity Mining program.

Description

Rarible brands itself as the world’s first “community-owned NFT marketplace.” Furthermore, Rarible leverages its RARI token — which, similarly, is the world’s first governance token in the NFT field — to power this community-run platform model. In giving users a token with governance powers, Rarible is borrowing a page from the DeFi playbook.

At its core, Rarible is an NFT (non-fungible token) platform for securing digital collectibles secured with blockchain technology. However, Rarible has a considerably more ambitious vision than merely becoming a platform for securing art and digital collectibles using blockchain.

Rarible represents a digital NTF platform with a particular focus on art assets. Specifically, Rarible includes a marketplace that allows users to trade various digital collectibles or NFTs, similar to OpenSea.

Users can also use Rarible to create — commonly known as “minting” NFTs, or non-fungible tokens. This is significant for various content creators. For example, an artist could sell their creations, such as books, music albums, or movies, as NFTs.

Rarible is placing significant emphasis on creating an entirely autonomous platform, run through a community governance model. Moreover, Rarible is now shifting heavily towards becoming an actual Decentralized Autonomous Organization (DAO).

The White Paper is not available — see this informative blog here.

Team

Rarible is a company founded by Alex Salnikov and Alexei Falin and is based in Moscow. Salnikov has worked in cryptocurrency since 2013, while Falin previously co-founded a marketplace for digital stickers that can be used on chat platforms.

Our Opinion

Risk Score: 6

Target Price: $160.00

Maximum Supply: 25M

Rarible is an easy-to-use platform that has received a great deal of praise for its relatively simple and intuitive user interface. Its connection to Yearn Finance’s yInsure initiative is another promising development as Yearn Finance is one of the hottest names in DeFi. Rarible is a standout project in the NFT space.

StrongBlock

Overview

StrongBlock is the first and only blockchain-agnostic protocol to reward nodes for supporting the infrastructure of their blockchain.

Description

STRONG believes it is important to incentivize nodes because with limited resources and no financial incentive many nodes run out-of-date software, maintain incomplete blockchain histories and are intermittently off-line. To solve this, StrongBlock has made it possible for anyone to create a node in seconds and receive STRONG token rewards every day.

They call this “Nodes as a Service”. This allows anyone to create a Full Ethereum node in a few seconds with no technical expertise.

Since the launch of the StrongBlock DeFi node protocol, over 350 nodes have been registered. The total number of nodes number nearly 15,000. STRONG recently announced a tie up with leading DeFi platform Maker DAO, a major endorsement of STRONG’s business model.

According to STRONG each Node earns $20 per day, some people have multiple nodes. That makes this an attractive way of making passive income for anyone with a PC and some IT knowledge which is a definite formula for massive growth.

White Paper

There is no formal white paper. Read more info here.

Team

The project is led by an accomplished and experienced team. You can view the team here.

Our Opinion

Target Price: $500

Risk Score: 6

Max circulation: 528,886

Although there is competition emerging, STRONG is a leading player in the nodes as a service space. In only one month STRONG has increased the number of nodes from 25,000 to 37,000. Although we are not fans of its tokenomics the project is proving its model and is on a definite growth splurge. With the market weaknesses STRONG is a project worth buying into.

Polkastarter (POLS)

Overview

Polkastarter is a blockchain platform designed to provide an easy to use launchpad for cross-chain token pools and auctions. It is most commonly used by early-stage blockchain projects that want to raise capital and easily distribute their tokens at the same time.

Description

Through Polkastarter, blockchain projects can easily create their own cross-chain swap pools, which allow them to securely raise funds, while users can invest without risks, since swaps are automatically executed by smart contracts.

POLS is the native utility token of the Polkastarter platform and plays a number of roles in its ecosystem, being used for liquidity mining, governance, paying transaction fees, and gaining eligibility to participate in POLS-holder only pools.

Polkastarter’s main offering is its fixed swap smart contract, which allows projects to easily launch liquidity pools that execute orders at a fixed price — rather than using the AMM model made popular by Uniswap.

The platform is designed to handle a range of auction types, including sealed-bid and dutch auctions, as well as both fixed and dynamic ratio swaps. This makes it suitable for cryptocurrency projects looking to raise funds, as well as a variety of other use-cases, including private trades, OTC deals, and discounted sales.

Beyond this, other key features of the platform include permissionless listings, anti-scam capabilities, full KYC integration and liquidity mining.

The platform first went live in December 2020, and has quickly grown to become one of the most commonly used platforms for initial DEX offerings (IDOs).

Team

Polkastarter features an executive team with over three decades of combined experience in tech firms. It was co-founded by Daniel Stockhaus and Tiago Martins, who currently hold the roles of CEO and CTO at Polkastarter respectively.

Daniel Stockhaus is a serial entrepreneur credited with co-founding a highly successful e-commerce firm known as LiGo, as well as the digital growth agency Oliphant Ltd. Prior to this, he worked as a digital media designer for Fitch, and graduated with a bachelor’s degree in communication and media studies.

Tiago Martins, on the other hand, is a former professor of computer science and an experienced developer with expertise in online education and product development. He is also the co-founder of Codeplace, an online platform that teaches the fundamentals of web development.

Click here to view Polkastarter’s White Paper.

Our Opinion

Target Price: $12

Risk Score: 6

Max circulation: 100,000,000

Having already established a strong user base, Polkastarter is one of the leading lights in the decentralized launchpad space. It is looking to use its credibility and large investor base to diversify into other areas — the first one being DeFi insurance. Polkastarter is probably a billion dollar plus platform when you compare it to its rivals in the space such as PancakeSwap and Uniswap. We have set a risk score of 6 and a price target of $12.

Alpaca Finance (ALPACA)

Overview

Alpaca Finance is the first leveraged yield farming protocol on Binance Smart Chain

Description

ALPACA was a fair launch project with no pre-sale, no investors, and no pre-mine. Their protocol allows users to open a leveraged yield farming position by borrowing from their deposit vaults.

Pioneered by Compound during the DeFi Summer, yield farming has become a popular way for projects to bootstrap their liquidity and acquire new users. Alpaca Finance has expanded on the success of these early entrants by providing value to the BSC community through leveraged yield farming.

Click here to view more information

Team

Check out the team here.

Our Opinion

Risk Score: 4

Target Price: $10

Maximum Supply: 102,393,251

Alpaca has been hit hard by the market decline seeing a drop in both its market cap and it’s TVL. However with a TVL of over $1 billion the project is a potential recovery play.

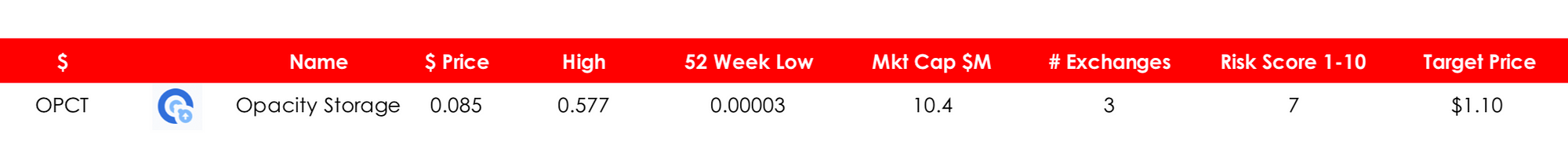

Opacity Storage (OPCT)

Overview

Opacity is a cloud storage provider with one major difference, privacy.

Description

With the rise of digital property, many people have increasingly become concerned with the security and privacy of materials stored with cloud storage companies such as Dropbox, Google, and others. Small businesses, individuals, and enterprises want to keep their data private.

Opacity protects people’s basic rights and provides private cloud storage to anyone through its Opacity token, OPCT. The token can be purchased on a crypto exchange and then used to purchase data storage plans that are completely private, and can only be accessed by the purchaser with the private key.

Unlike other service providers, Opacity does not require personal identification information. Opacity stores no information on its users, and allows people to store private information, such as company secrets, intellectual property, personal photographs, legal documents, and family moments, with assurance that personal data stays personal.

Click here to view more information

Team

Check out the team here.

Our Opinion

Risk Score: 7

Target Price: $1.10

Maximum Supply: 130,000,000

Opacity has an experienced team led by Jason Coppola who has previously worked at Microsoft, Paypal and Salesforce. We believe Opacity is a well thought out project that has the potential to carve a significant share of this market. Based on the valuations of both MaidSafeCoin and 0chain which are yet to launch we believe Opacity is significantly undervalued.

Listen to our podcast Inside Track here where Opacity talks about their project, the decentralized storage space and the cryptocurrency market in general including some of their favorite projects.

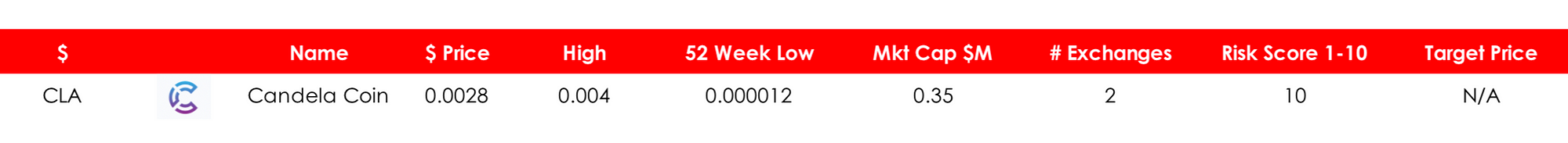

Candela Coin (CLA)

Overview

Provision of solar energy through decentralized p2p energy transfer.

Description

Candela Coin’s vision is to create decentralized solar energy all across the world by cutting out the middleman — the power companies. They have created IoT hardware and software for seamless peer-to-peer energy transfer. By using blockchain technology this enables owners of solar panels to sell their generated energy to other users, bringing in the best returns possible for their solar energy and the cheapest green energy on the market. People across the globe will be able to transfer solar energy to others in their communities using Candela Coin as a medium of exchange.

Their decentralized system does not rely on the existing power grid infrastructure. In the event of inclement weather, power outages, or down power lines, decentralized solar power will still be able to be generated and provide electricity to the community. Candela is the impetus for the democratization of energy.

Click here to view the Whitepaper.

Team

Candela’s core team brings a diversity of skill sets, ranging from hardware development to utility design, technical standards setting, marketing strategy and policy advocacy. Check out the team here.

Our Opinion

Risk Score: 10

Target Price: N/A

Maximum Supply: 125,000,000

Candela Coin is our long shot selection. There is one area of the crypto market that is yet to experience a boom — energy. Some crypto projects have tried and failed. Power Ledger being one such example. Power Ledger hasn’t been able to get the traction needed to make an impact. There are many theories as to why but many blame it on their willingness to work with the power company monopolies and not the people in the communities. Unlike Power Ledger’s b2b approach, Candela has taken an alternative path. They are targeting individual households, initially through a partnership with a panel manufacturer. Their business model allows householders to sell their excess energy to other householders in exchange for their native currency CLA. The beauty of their plan is that it allows households who do not have a solar installation to still buy green energy. That is a major selling point for Candela’s solution.

Now let’s look at the numbers. There are in fact two coins, a BEP-20 and an ERC-20. They both have the same tokenomics. It is worth checking out the two prices to see where you can obtain the best deal. At the time of writing the best price can be obtained by buying the ERC-20 token.

The reality is energy transfer on the blockchain is going to be a hot space — the big question is whether Candela has the ability to execute.

View Previous Portfolio’s:

Moonshot Portfolio – April 2021

Moonshot Portfolio – March 2021

Moonshot Portfolio – February 2021

Not Financial Advice

This article does not constitute financial advice or a recommendation to buy in any way. Always do your own research and never invest more than you can afford to lose. Investing in cryptocurrencies is high risk, and you could lose 100% of your investment. The article should be treated as supplementary information to add to your existing knowledge.

Recent Comments