Report: Crypto Moonshots on Binance Smart Chain

Binance Smart Chain (BSC) was launched in September 2020 and has grown at an eye-watering pace ever since. It is now the third-largest blockchain measured by transaction volume with over 60 million active users. To achieve this feat in under a year has to be some kind of record.

It was launched to challenge Ethereum’s dominance in the decentralized finance space, and its ambitions were helped by the exorbitant transaction fees and slow processing times on the Ethereum blockchain. That led to many project developers establishing copycat versions of successful Ethereum platforms on BSC. That included Pancakeswap, which imitated Uniswap, and Venus, which was a copy of Compound.

BSC is, in fact, a copy of Ethereum with two significant differences, both of which are the main reasons for its success. It is 4 times faster, and its gas fees are a fraction of Ethereum’s. Of course, Ethereum is hard at work to solve these problems, and by next year, all being well, these two key differentiators will be a thing of the past. But it is too late to reverse the migration to alternative blockchains. Ethereum left the barn door wide open for the maniacal CZ, the founder of Binance, to pounce and establish a credible competitor to Ethereum.

However, this isn’t a zero-sum game. When normality returns to Ethereum gas fees, BSC will have already established itself as a significant player. There will undoubtedly be other blockchains, including the likes of Polygon, Polkadot and Solana, etc., which also have their own unique selling points and loyal base of developers and fans, which will ensure that this market is going to be a hive of activity for some time to come.

There are a few downsides to BSC, from the point of view of both the investor and the developer. It is important that we bring these to your attention before we dive into the real reason why you are here. First, BSC isn’t fully decentralized, especially when compared to many of its competitors. Its direction is governed by Binance. CZ, in fact, calls decentralized finance on BSC ‘CeDeFi’ as in centralized DeFi. Further, because Binance and BSC are intrinsically linked to any regulatory or legal issues Binance may be subject to in the future will negatively impact BSC and the projects/cryptocurrencies on it.

The reality is if Binance at some point comes a cropper for some of its laissez-faire actions of the past, it is unlikely to lead to the shutting down of Binance and the discontinuance of BSC. Perhaps a massive fine, but that is probably the worst-case scenario. Whilst there has to be a discount built into similar projects built on BSC because of these factors it is arguably only a small discount. However, it is definitely something an investor must-have in the forefront of his or her mind before proceeding to the most exciting part of this article.

View our Monthly Moonshot Portfolio here. Twenty researched and rated cryptocurrencies that are both undervalued and undiscovered.

BSC an overview

There are over 180 Binance Smart Chain based cryptocurrencies. From this list, 7 have a market cap of over $1 billion and 36 over $100m. By far, the largest cryptocurrency is BNB, Binance’s native coin, with a market cap of $99 billion. The second-largest (excluding the Binance stable coin) is Pancakeswap, the decentralized exchange with a market cap in excess of $6 billion.

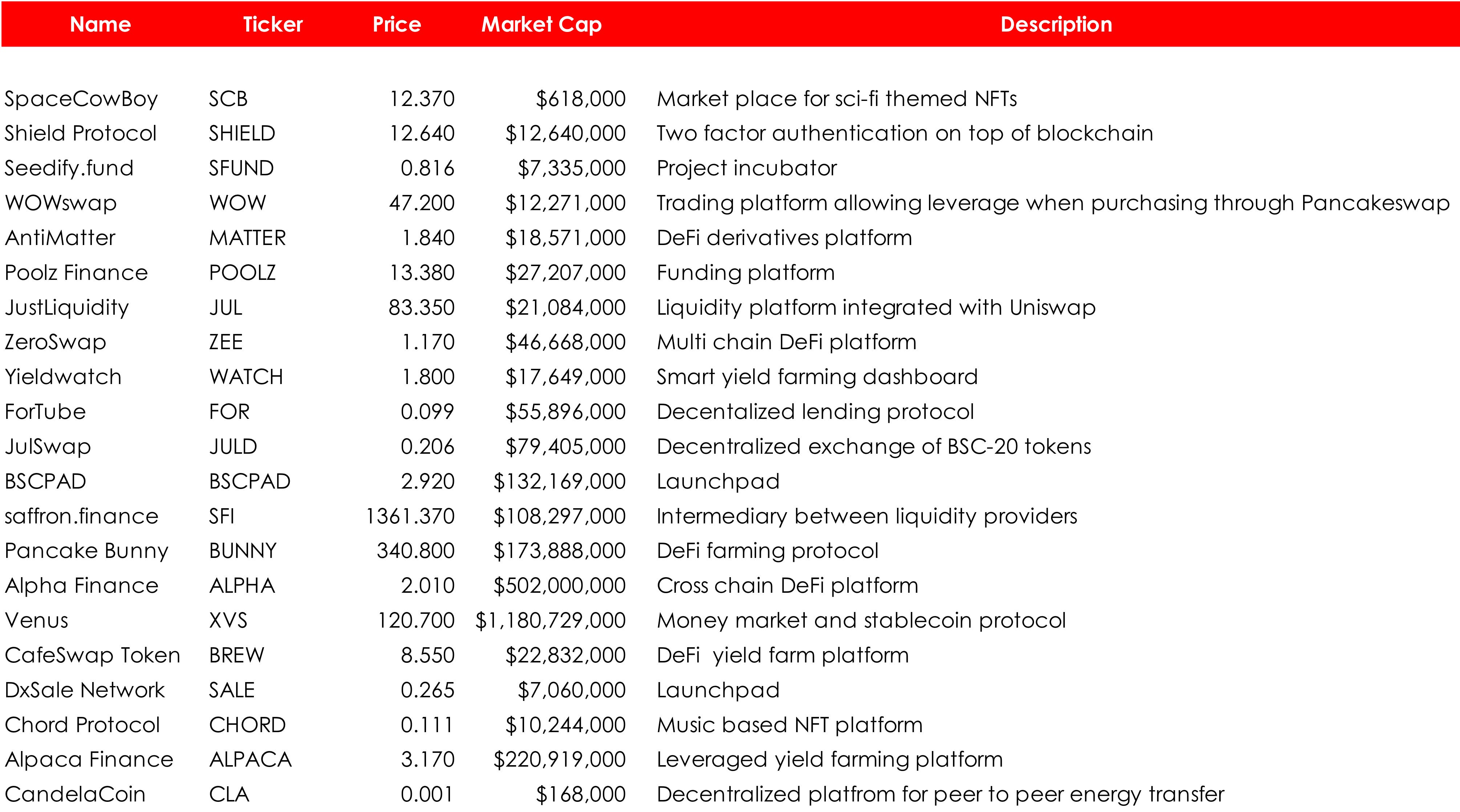

Cryptocurrencies on BSC

This isn’t an exhaustive list of every cryptocurrency on BSC. Life and attention spans are too short for that mission. Firstly, we are going to summarize the projects which we feel are worth further investigation and then we are going to select a handful of what we describe as cryptocurrencies with moonshot potential.

Cryptocurrencies worth further investigation

BSC Moonshots

From the above list, we have selected six cryptocurrencies that we believe are undervalued and represent potential moonshots subject to additional due diligence, of course.

Venus (XVS)

Overview

Venus Protocol is a money market and stablecoin protocol that operates on Binance Smart Chain. The protocol is forked from Compound and MarkerDAO.

Binance originally incubated Venus. After Binance acquired Swipe, Swipe took over the work of developing Venus. Venus is a completely decentralized protocol. As of January 2021, the Venus team announced on Twitter that it had handed over the protocol to the community to make decisions and execute each step of the plan. Today Venus has over 18,000 users and over $11 billion dollars of total value locked. The major benefit of Venus is that it’s arguably the most decentralized finance product in the entire blockchain space.

Our Opinion

Price: $120.13

Market Cap: $1.1 billion

Fully Diluted Market Cap: $3.6 billion

Price Target: $188

Risk score: 5

Venus is one of the most valuable projects on BSC. As a fork from Compound, it would seem wise to compare the numbers of each. Compound has a TVL of approx $10 billion, which compares to Venus’ $11 billion. However, the market values are substantially different. If you compare the fully diluted valuations, Venus’ market cap is at a 55% discount to Compound’s. That is too high, in our opinion. If you attach a discount of 25% to Venus, based on Compound’s current value, we would expect to see a price of around $188, which is a 56% increase from its current level.

Listen to our weekly podcast Moonshot Monday where we discuss three new cryptocurrencies that we believe offer significant upside potential.

Pancake Bunny (BUNNY)

Overview

PancakeBunny is a decentralized finance yield aggregator and optimizer which is used for PancakeSwap. The PancakeBunny protocol gives farmers the opportunity to multiply their tokens.

Farmers at PancakeBunny get permission from private individuals for automatic summation and reinvestment of yield on their behalf through mono-contracts. Users can farm on their own, but doing so involves a complex process of determining the optimal frequency and time at which to increase and reinvest profitability. With PancakeBunny, users can delegate this process. The actual farming takes place on PancakeSwap.

The primary goal of the platform is to support the DeFi ecosystem by providing users with an easy way to automatically increase their profitability on Binance Smart Chain.

PancakeBunny is being built by a group of anonymous developers who claim that their “code [speaks] for itself.”

PancakeBunny is developed in cooperation with PancakeSwap.

Owners of BUNNY tokens control the ecosystem of PancakeBunny and receive most of the profits from farming rewards. BUNNY holders place their tokens in the management pool to claim the profit, which is sent to the pool in the form of Binance Coin (BNB) rewards. The share of profit received by a participant is proportionate to the size of their BUNNY stake: the more tokens you stake, the higher your impact on the ecosystem.

MOUND, the company behind PancakeBunny, recently raised $1.6 million in seed funding led by Binance Labs. Other participants included IDEO CoLab, SparkLabs Korea, and Handshake co-founder, Andrew Lee.

Pancake Bunny now has more than 30,000 daily average users and has accumulated more than $7 billion in total value locked (TVL) since its launch in December 2020.

Our Opinion

Price: $339.73

Market Cap: $173 million

Fully Diluted Market Cap: $460 million

Price Target: $2833

Risk score: 7

Like most of our selection of moonshots in this article, PancakeBunny has experienced astounding growth in a short period of time. Having amassed $7 billion in TVL is some achievement. When comparing its fully diluted market cap of $460 million with its TVL, there is a significant disparity. Even based on a reasonably conservative ratio of market value/TVL of 0.5 that produces a target price of $2833. The major risk is its reliance on Pancakeswap however it is looking to diversify into other areas which should reduce this dependence. However you spin it, PancakeBunny is significantly undervalued based on its current position.

Seedify.fund (SFUND)

Overview

Seedify is a disruptive blockchain incubator program and decentralized seed-stage fund, empowered through DAO-based community involvement mechanisms.

They provide an incubator/seed fund to make seed investments into projects selected by community voting while supporting projects with a decentralized incubation program to achieve their fullest potential through systematic community involvement mechanisms.

Supported through reward mechanisms for experts who want to be involved as well as a new way of staking for token holders who want to receive tokens from the projects that have been selected and supported by the decentralized incubation program.

Our Opinion

Price: $0.8124

Market Cap: $7 million

Fully Diluted Market Cap: $81 million

Price Target: N/A

Risk score: 9

This is a new project in a competitive space. However, it does have a novel approach and has already built a large community with over 100,000 followers on Telegram. With a fully diluted market cap of $81 million, this isn’t a steal at the current price, but there is one major caveat. If you look at its closest competitor BSCPAD, which has a fully diluted market cap of $510 million and a smaller community, this starts to look moderately priced. We have scored Seedify a 9 for risk as it is yet to launch its mainnet, and it is entering a very competitive market. However, we believe this could be worth a small investment based on the success of similar platforms such as BSCPAD and Polkastarter.

The Inside Track podcast on iTunes Apple Podcasts, Spotify and Google Play

Listen to our growing library of podcasts here presented by leaders in the crypto community discussing everything from their favorite projects to what they believe is going to be the next big thing in crypto. Listen to our latest podcast here from the team at Candela Coin one of our BSC moonshots.

CafeSwap (BREW)

Overview

CafeSwap started as a community-driven project with an all-hands-on-deck philosophy. BREW was sold out within 2 minutes of the pre-sale process in Feb 2021.

CafeSwap moved from its old platform to a newly launched DEX. The migration of CafeSwap to its new DEX site coincided with the listing of its native token, BREW, on centralized exchanges.

Since its inception, CafeSwap has partnered with Beefy Finance, Apeswap, Hyperjump, ITAM Games, Ditto Money, DeFiPie, Supra, and Astronaut, resulting in a deluge of staking/farming pools for brewers and community members of these projects.

CafeSwap smart contracts was audited by the most credible auditing firms receiving a positive outcome.

CafeSwap started burning 10,000 BREW weekly. This has seen more than 120,000 BREW being burned. The aftermath is a decrease in supply that has reflected positively on the price of BREW.

More farming and staking pools have been added and the platform has over $30 million in TVL.

Our Opinion

Price: $8.53

Market Cap: $23 million

Fully Diluted Market Cap: $24 million

Price Target: $19

Risk score: 5

CafeSwap has a loyal following of ‘brewers.’ It has also established a number of fruitful partnerships, all of which have led to growth in TVL to $30 million and an expansion in the range of products it offers. BREW has a low total supply, and with the weekly burn, this is likely to lead to upward pressure on the token price. We believe a target price of $19 is reasonable, especially when you compare it to its ATH of $25.

Alpaca Finance (ALPACA)

Overview

Alpaca Finance is the first leveraged yield farming protocol on Binance Smart Chain. The project was a fair launch project with no pre-sale, no investors, and no pre-mine. Their protocol allows users to open a leveraged yield farming position by borrowing from their deposit vaults.

Pioneered by Compound during the DeFi Summer, yield farming has become a popular way for projects to bootstrap their liquidity and acquire new users. Alpaca Finance has expanded on the success of these early entrants by providing value to the BSC community through leveraged yield farming.

Our Opinion

Price: $3.19

Market Cap: $222 million

Fully Diluted Market Cap: $317 million

Price Target: $10

Risk score: 4

Alpaca, despite being a new project, is one of the true gems amongst our selection of moonshots. With a TVL of over $2 billion and a fully diluted market cap of $317 million this is a project that deserves a re-rating. Based on a ratio of market value/TVL of 0.5, that would suggest a price of $10, not a million miles away from its ATH of $8.78.

Candela Coin (CLA)

Overview

Candela Coin’s vision is to create decentralized solar energy all across the world by cutting out the middleman — the power companies. They have created IoT hardware and software for seamless peer-to-peer energy transfer. By using blockchain technology this enables owners of solar panels to sell their generated energy to other users, bringing in the best returns possible for their solar energy and the cheapest green energy on the market. People across the globe will be able to transfer solar energy to others in their communities using Candela Coin as a medium of exchange.

Their decentralized system does not rely on the existing power grid infrastructure. In the event of inclement weather, power outages, or down power lines, decentralized solar power will still be able to be generated and provide electricity to the community. Candela is the impetus for the democratization of energy.

Our Opinion

Price: $0.00134

Market Cap: $167,500

Fully Diluted Market Cap: $167,500

Price Target: N/A

Risk score: 10

Candela Coin is our long shot selection. There is one area of the crypto market that is yet to experience a boom — energy. Some crypto projects have tried and failed. Power Ledger being one such example. Power Ledger hasn’t been able to get the traction needed to make an impact. There are many theories as to why, but many blame it on their willingness to work with the power company monopolies and not the people in the communities.

Unlike Power Ledger’s b2b approach, Candela has taken an alternative path. They are targeting individual households, initially through a partnership with a panel manufacturer. Their business model allows householders to sell their excess energy to other householders in exchange for their native currency CLA. The beauty of their plan is that it allows households who do not have a solar installation to still buy green energy. That is a major selling point for Candela’s solution.

Now let’s look at the numbers. There are, in fact, two coins, a BEP-20, and an ERC-20. They both have the same tokenomics. It is worth checking out the prices of each to see where you can obtain the best deal. At the time of writing, the best price can be obtained by buying the ERC-20 token.

Based on CLA’s ERC-20 token, the fully diluted market cap is only $167,000 with limited volume. Compare that to Power Ledger, which has a fully diluted market value of $389 million. Admittedly Candola is new to the party and is yet to prove their model. The reality is this is going to be a hot space — the big question is whether Candela has the ability to execute. If they get it right, you will probably not have enough zeros on your calculator to calculate your profits! Listen to our latest podcast here from the team at Candela Coin.

Summary

There is no doubt that Binance Smart Chain is a breeding ground for exciting projects and not just in the DeFi space. This is likely to continue whatever happens at Ethereum. As we have seen, some of the projects built on BSC have experienced phenomenal growth. We didn’t even get round to mentioning the exponential numbers at launchpad BSCPAD in the space of only a few months.

There are obvious downsides for an investor, including BSC’s close association with Binance, however, as long as you are fully aware of these and factor them into your investment decisions, this market is ripe for the savvy investor. As you can see from our brief analysis, there are multiple opportunities to take advantage of the significant price differentials between BSC and Ethereum based cryptocurrencies. That strategy alone should reap healthy profits. Tread carefully, and good luck with your own due diligence.

No Financial Advice

This article does not constitute financial advice or a recommendation to buy in any way. Always do your own research and never invest more than you can afford to lose. Investing in cryptocurrencies is high risk, and you could lose 100% of your investment. The article should be treated as supplementary information to add to your existing knowledge.

Recent Comments