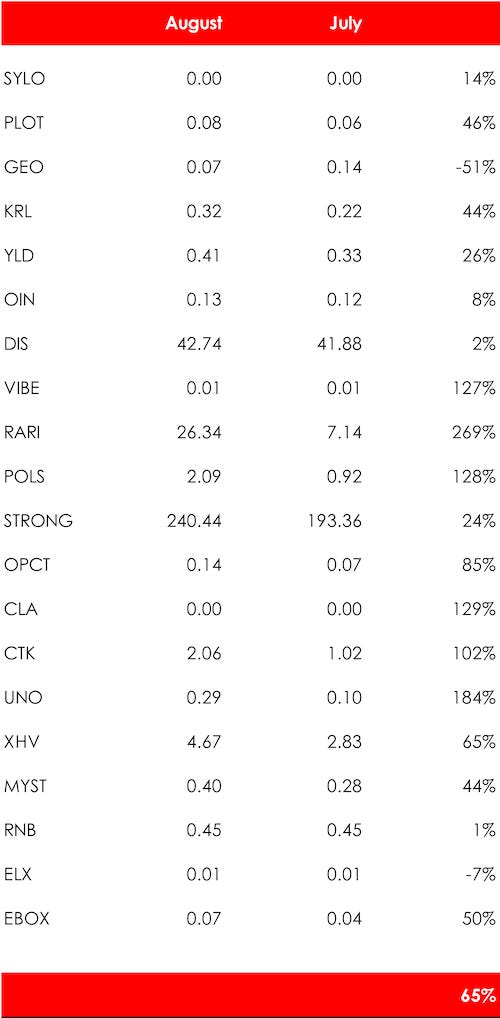

Moonshot Portfolio – August 2021

August’s Crypto Moonshot Portfolio

We analyze and rate twenty undervalued cryptocurrencies with moonshot potential

The last three months have been a little painful despite our regular requests to ignore the panic and use it as an opportunity to buy quality undervalued projects, advice we hope you followed.

However things are turning.The bear market which started in May appears to be at an end as commentators and investors restart talks about the return of the altcoin season and bullish forecasts of Bitcoin and Ethereum reaching over $100,000 and $10,000 by the end of the year.

The market has seen a rebound of over 20% in the last 14 days and 68% since it bottomed out. It is still some 25% off it’s all time high. We have certainly turned a corner and it has proved to the many naysayers that crypto is here to stay.

But don’t get complacent. Learn the lessons from the slump. TAKE PROFITS WHEN YOU CAN!

The last three months were brutal with our portfolio taking a big hit. But we continued to fine tune our selections and hold our favorite projects which we believe is a strategy that will pay off in the long term.

This month saw an increase in our portfolio of 65% which is up 160% since we launched in February.

State of play

Let’s now focus on our current portfolio of twenty cryptocurrencies. This is the first month where we have decided not to add or delete any projects. We have a few under review for a possible culling next month but that is next month.

This month saw only two fallers and some spectacular risers. It was good to see some of our bets paying off.

This month’s top 3 performers were:

The months worst performers were:

Overall performance

Now let’s look at the overall performance of our portfolio:

This month’s developments

SYLO

Sylo is a decentralized communication app that works like Whatsapp/Messenger without saving your data or violating your privacy. Over the last month the project has announced its platform’s support of NFTs and its new staking program.

PLOT

PLOT the prediction market for traders has reported phenomenal growth with the numbers of predictions made per day increasing by 347% in two months to nearly 60,000.

Listen to our podcast Inside Track here where the co-founder of PLOTX talks about the prediction market, the cryptocurrency market in general, including his favorite projects.

GeoDB

GeoDB the blockchain data sharing project launched on the mainnet after almost two years of testing and improving. The downside to this project is its aggressive tokenomics, with a maximum token supply of nearly 13 the number of its current token circulation. This overhang is definitely a factor weighing on its token price although its mainnet launch is a definite tick in the box. The project was subject to a hack where the hacker stole some 4 million tokens. This project is under review.

Kryll

Kryll.io is a platform for cryptocurrency traders looking to use the most advanced trading tools and strategies. It announced a ‘significant’ investment from a fund backed by BitMEX.

Yield App

YLD, the regulated wealth management platform, increased its managed assets by 100% to $270 million compared to $163.6 million as of 30 June 2021.

Listen to our podcast Inside Track here where the founder of Yield App talks about his project, the cryptocurrency market in general and some of his favorite projects.

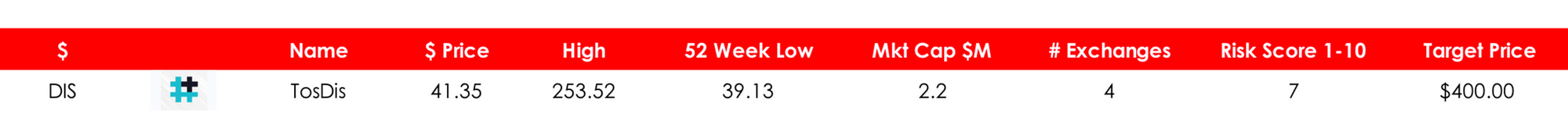

TosDis

Offering staking as a service to ERC-20 and BSC projects this is a potentially lucrative niche allowing projects to set up their own staking without the risk and infrastructure. It recently signed up Portion to its ecosystem, a NFT marketplace, and completed an IDO raising $125,000. TosDis is gaining momentum slowly and appears to be a solid project.

VIBE

If you continue to hold NFT based cryptocurrencies despite the market fallout you will be smiling proudly. This is a sector that continues to grow relentlessly. VIBE, the augmented and virtual reality marketplace, continues to perform, announcing that its ecosystem has surpassed 2 million transactions, which is a 100% increase from only two months ago.

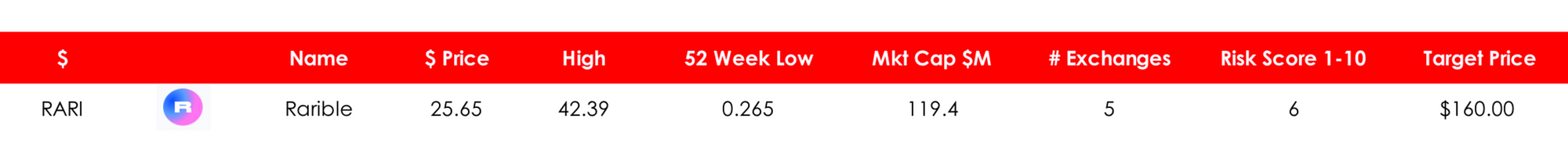

Rarible

RARI, another leading NFT platform, announced the launch of Rarible Protocol: a set of tools to simplify the go-to-market process for NFT projects and ideas.

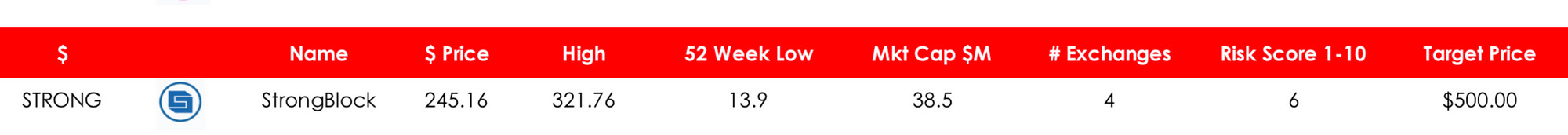

StrongBlock

Although there is competition emerging, STRONG is a leading player in the nodes as a service space. In only one month STRONG has increased the number of nodes from 50,000 to 65,000. Although we are not fans of its tokenomics the project is proving its model and is on a definite growth splurge. Many leading projects are signing up with STRONG adding further credibility to its platform.

OIN Finance

The DeFi platform suffers from the problem of overly aggressive tokenomics which is an overhang on its token price. However OIN is about to undergo a rebrand and is positioned in a hot space of stable coins and lending making this one to keep an eye on although it is a high risk bet.

Candela Coin

Candela, the solar power energy transfer project, is one of our long shot projects. Candela has obtained additional listings for it’s token and has started trialling its technology in a small residential neighbourhood in Australia. Candela is talking of a planned listing on the Canadian Stock Exchange to fund its future roll out which could add huge credibility to this project.

Listen to our podcast Inside Track here where the founder of Candela Coin talks about his project, blockchain and solar power and some of his favorite projects.

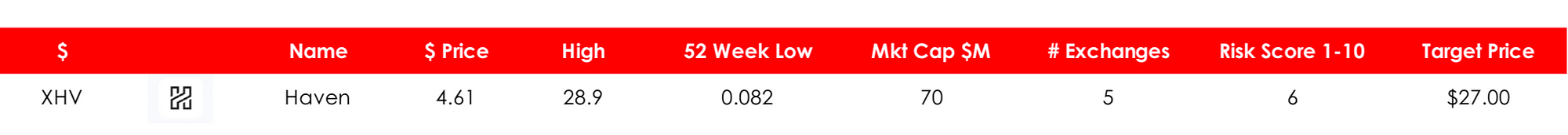

Haven

Haven the privacy coin saw its protocol hacked with $11 million of coins stolen last month. The community decided to roll back to the block before the hack and arrange a fork to fix the problem. The recovery from the hack was handled exceptionally well and the project appears to be back on track.

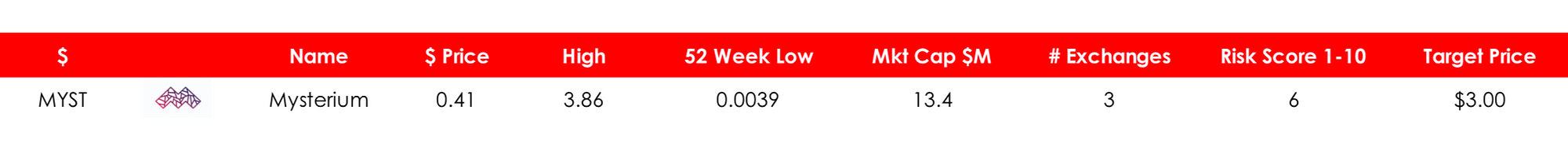

Mysterium

Mysterium Network the privacy network announced its imminent mainnet launch plus increasing user numbers.

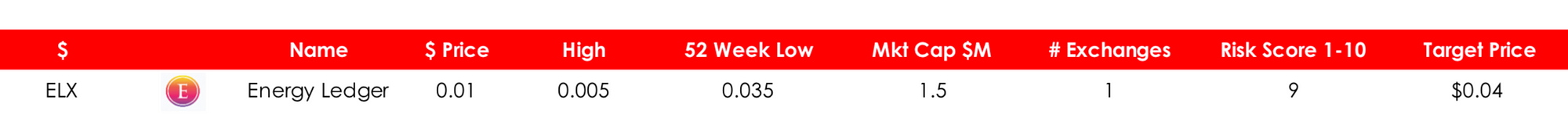

Energy Ledger

Listen to our podcast Inside Track where the COO of Energy Ledger talks about his project and how it could prevent another Colonial pipeline hack.

Portfolio Selection — August 2021

Sylo

Overview

Decentralized data exchange. Operator of the SYLO smart wallet, which has over 250,000 users.

Description

The Sylo Protocol provides confidential communication as a utility to the Sylo Confidential Communication App. The protocol acts as the confidential networking layer for the Sylo App, creating P2P connections and providing a way for users to interact and exchange data confidentially.

The Sylo Protocol is being developed to provide fully decentralised confidential communication as a utility to all connected-apps within the Sylo ecosystem. Powered by blockchain and combined with other decentralised technologies, this Protocol will act as the networking layer for the Sylo DApp and 3rd-party connected-apps, while providing charging options for specific communications and services over the network.

The fully decentralised Sylo DApp will be the 1st application built on the blockchain-based Sylo Protocol, using technology already commercialised in the Sylo App that’s currently used by thousands globally, available on Apple Store and Google Play Store.

Sylo is a decentralised communication and data exchange network powered by a layer 2 micropayments infrastructure and the SYLO token. User-run Service Peers provide infrastructure to the network which allows developers and businesses to run privacy-first, unstoppable apps without deploying any infrastructure of their own. A staking architecture and unique probabilistic ticketing solution ensure minimal transaction fees and limitless scalability. This scalability is already on show within the project’s flagship app, the Sylo Smart Wallet; a decentralized, private messenger and crypto wallet with over a quarter-million users.

Click here to view Sylo White Paper

Team

The team appears to combine a broad range of talents, skills, and experience which should provide any investor with confidence in this project. This is Sylo’s description of their core team: ‘…combines a deep background in computer science, development, and user experience with the real-world business experience of entrepreneurs, designers, and world-leading technologists. Both in experience and attitude, the strength of Sylo is in its people.’

Our Opinion

Risk Score: 5

Target Price: $0.02

Maximum Supply: 10B

The team has already demonstrated it is a force to be reckoned having developed and launched its smart wallet which has over a quarter-million users. It also has a decent-sized community following it. We have ranked the coin a 5 in terms of risk as the team has already achieved a level of success however the potential has not been fully recognized in the price.

PlotX

Overview

Prediction market platform.

Description

PlotX is a non-custodial prediction protocol that enables users to earn rewards on high-yield prediction markets.

Dubbed as the Uniswap of Prediction Markets, PlotX uses an Automated Market Making algorithm to create, settle markets and distribute rewards on the Ethereum Blockchain without any counterparty risk. Markets are focused on crypto-pairs like BTC, ETH, YFI, etc, and are automatically created in intervals of 4 hours, 1 day, and 1 week. PlotX also uses on-chain governance powered by GovBlocks.

Click here to view PlotX White Paper

Team

Check out the team here in this video on PLOT’s website

A well rounded team who have launched an impressive platform. They appear to have a close eye on regulation having restricted access to high risk countries such as the US. That is a comforting sign for the future.

Our Opinion

Risk Score: 7

Target Price: $1.00

Maximum Supply: 200M

PLOT’s closest competitor is Augur which is one of the biggest players in this market, although PLOT’s focus is more on financial bets. It benefits from an experienced management team and a platform that is already proving popular with users. The main risk is potential regulation and adoption. However with a market cap significantly less than Augur, PLOTX represents a decent investment opportunity.

GeoDB

Overview

GeoDB is a decentralized peer-to-peer big data sharing ecosystem.

Description

GeoDB is a decentralized peer-to-peer big data sharing ecosystem, which returns value to its creators, the users. GeoDB’s mission is to democratize the 260bn Big Data industry, building an open ecosystem in which to establish better and trusted relationships between market participants while giving back control and value to data generators, the users. GeoDB is using blockchain technology to eliminate intermediation in a huge industry and allow faster growth and adoption.

Click here to view GeoDB White Paper

Team

GEO boasts an experienced team of technology professionals that have demonstrated that they are credible by raising money through a crowdfunding round. See the full team here.

Our Opinion

Risk Score: 4

Target Price: $4.00

Maximum Supply: 300M

The team behind GEO recently completed a capital raising through Seedrs, raising GBP2.5M, surpassing their target of GBP2M. The downside is there is a large maximum supply compared to the current circulation, but we believe that is outweighed by the potential of the project and the team behind it.

Kryll

Overview

Kryll is your first intuitive platform to define powerful crypto trading strategies.

Description

Kryll is your first intuitive platform to define powerful crypto trading strategies through a simple drag n drop editor. Create automated winning strategies, benchmark them, share with the community, and enjoy user-generated content.

Kryll is the ultimate platform for cryptocurrency traders looking to use the most advanced trading tools and strategies, as well as benefit from the community’s hive-mind to get the best returns within cryptocurrency markets.

The platform provides intuitive ways to create your own trading strategies that can be set to execute automatically. Through a What You See Is What You Trade™ interface, you can design trading strategies making use of the industry’s most powerful tools and safely test them with backtesting and sandboxing.

Once your tools prove their worth, you can set them to live-trade on your behalf, taking the right positions at the right time, as if you were following the markets 24/7.

On Kryll you can also rent out your very own winning strategies to help fellow traders be more successful. You will be rewarded with passive income for sharing your strategies.

Click here to view Kryll White Paper

Team

An accomplished team with a proven track record of success in both tech and entrepreneurial flair. Check out the full team here.

Our Opinion

Risk Score: 6

Target Price: $0.73

Maximum Supply: 49M

We believe that Kryll has a unique business model which is gaining traction. We especially like the novel touch, where traders can rent out their own strategies to help fellow traders be more successful. This allows traders to be rewarded with passive income for sharing their strategies on something that could scale quickly. Despite the large max supply compared to tokens in circulation, the price does not take into account the quality of the team and its current growth. The most significant risk in the near terms is its sensitivity to market volatility..

Yield App

Overview

YLD, a licensed and regulated FinTech company, offers a mobile app and web platform designed to provide the easiest way to invest in DeFi using crypto or traditional currencies.

Description

YLD’s intuitive app and web platform enable users around the world to earn high returns from DeFi products without having to go through a lengthy, complex, and often costly learning process. Operating under a banking license, YLD offers an insured investment fund managed by a team with years of experience in FinTech and cybersecurity. At the core of its strategy is the YLD token, which rewards community members and allows them to boost their APY.

Click here to view Yield App White Paper

Team

Both an experienced and accomplished project team benefiting from a team of quality advisors. See the full team here

Our Opinion

Risk Score: 3

Target Price: $1.50

Maximum Supply: 300M

When you compare YLD to other similar platforms in the DeFi space it appears grossly undervalued. YLD’s platform is regulated and is aimed at the unsophisticated user, which could make this an attractive bet on the eventual mass adoption of DeFi. YLD is a good choice for any portfolio.

OIN Finance

Overview

DeFi platform providing liquidity mining and loans.

Description

OIN is described as being the first DeFi platform to provide liquidity mining and loans on Ontology, and ultimately on other top platforms through cross-chain functionality. The platform will build the bridge technology to seamlessly integrate Ethereum into its ecosystem, opening up to all of the current DeFi space. Cross-chain technology is crucial in DeFi and its growth as a legitimate financial infrastructure, after all, traditional finance also integrates the whole world, its currencies, and its different financial systems.

Click here to view OIN White Paper

Team

OIN has what appears to be a large dedicated team, check the full team out here

Our Opinion

Risk Score: 9

Target Price: $1.10

Maximum Supply: 100M

This cryptocurrency suffers from the same problem as many others: a massive maximum token supply, with a total supply of 100M compared to only 6.75M in circulation. That all probably goes some way to explaining OIN’s low market cap which we believe doesn’t reflect its full potential, however, this is a high-risk high reward investment which should definitely be balanced with some lower-risk opportunities.

TosDis

Overview

The one-stop DeFi interoperable solution powered with Liquid Staking.

Description

TosDis is a new DeFi project which combines the power of staking as a service and liquid staking for POS coins. In this way, they are combining the best of both worlds — allowing crypto investors to stake their PoS digital assets via TosDis EasyStake. At the same time, they take care of the technical aspect of the staking process and the benefits of liquid staking. TosDis is bringing together Staking-as-a-Service and liquid staking to unlock more generous access to digital assets. It is a new word in the Proof-of-Stake algorithm’s improvement, allowing its users to use a platform-independent betting mechanism and increasing the liquidity of tokens.

Click here to view TosDis White Paper

Team

See here for more information

Our Opinion

Risk Score: 7

Target Price: $400.00

Maximum Supply: 99,986

DIS continues to develop new innovative solutions in the fast-expanding DeFi space. That, coupled with the low market cap and low maximum circulation, makes this a good buying opportunity. Take a read of the article here to see the various developments since launch:

VIBE

Overview

VIBE operates marketplaces and hubs inside Augmented and Virtual Reality created on the Ethereum blockchain driven by the cryptocurrency VIBE.

Description

Creating next generation NFTs and developing new standards for gaming on the blockchain. Built for users and developers on the layer 2 solution VIBENet and powered by the VIBE token.

VIBE is a fully decentralized and immutable ERC-20 Token with a fixed token supply. VIBE is used for purchasing digital goods and services in the ecosystem. VIBE Ecosystem is powered by the VIBE token and the Layer-2 side chain solution VIBENet.

White Paper is not available — click here for news

Team

Founded by Alessio Mack and Matthew Myers. The development team consists of 12 core members who are seasoned developers and marketing experts. It also has a quality assurance member, Renee Isaac.

Our Opinion

Risk Score: 9

Target Price: $0.250

Maximum Supply: 267m

VIBE is certainly in the right space — NFTs. However, although it is obvious from its constant flow of news and developments that this project is carving itself into a lucrative niche, it doesn’t come without risk. We have scored VIBE a 9 in terms of risk as it is in a highly competitive market, saying that with its low market cap and the strong community, this project, in our opinion, is a risk worth taking.

RARIBLE

Overview

Rarible is a creator-centric NFT marketplace and issuance platform. RARI is a governance token with a Marketplace Liquidity Mining program.

Description

Rarible brands itself as the world’s first “community-owned NFT marketplace.” Furthermore, Rarible leverages its RARI token — which, similarly, is the world’s first governance token in the NFT field — to power this community-run platform model. In giving users a token with governance powers, Rarible is borrowing a page from the DeFi playbook.

At its core, Rarible is an NFT (non-fungible token) platform for securing digital collectibles secured with blockchain technology. However, Rarible has a considerably more ambitious vision than merely becoming a platform for securing art and digital collectibles using blockchain.

Rarible represents a digital NTF platform with a particular focus on art assets. Specifically, Rarible includes a marketplace that allows users to trade various digital collectibles or NFTs, similar to OpenSea.

Users can also use Rarible to create — commonly known as “minting” NFTs, or non-fungible tokens. This is significant for various content creators. For example, an artist could sell their creations, such as books, music albums, or movies, as NFTs.

Rarible is placing significant emphasis on creating an entirely autonomous platform, run through a community governance model. Moreover, Rarible is now shifting heavily towards becoming an actual Decentralized Autonomous Organization (DAO).

The White Paper is not available — see this informative blog here.

Team

Rarible is a company founded by Alex Salnikov and Alexei Falin and is based in Moscow. Salnikov has worked in cryptocurrency since 2013, while Falin previously co-founded a marketplace for digital stickers that can be used on chat platforms.

Our Opinion

Risk Score: 6

Target Price: $160.00

Maximum Supply: 25M

Rarible is an easy-to-use platform that has received a great deal of praise for its relatively simple and intuitive user interface. Its connection to Yearn Finance’s yInsure initiative is another promising development as Yearn Finance is one of the hottest names in DeFi. Rarible is a standout project in the NFT space.

StrongBlock

Overview

StrongBlock is the first and only blockchain-agnostic protocol to reward nodes for supporting the infrastructure of their blockchain.

Description

STRONG believes it is important to incentivize nodes because with limited resources and no financial incentive many nodes run out-of-date software, maintain incomplete blockchain histories and are intermittently off-line. To solve this, StrongBlock has made it possible for anyone to create a node in seconds and receive STRONG token rewards every day.

They call this “Nodes as a Service”. This allows anyone to create a Full Ethereum node in a few seconds with no technical expertise.

Since the launch of the StrongBlock DeFi node protocol, over 350 nodes have been registered. The total number of nodes number nearly 15,000. STRONG recently announced a tie up with leading DeFi platform Maker DAO, a major endorsement of STRONG’s business model.

According to STRONG each Node earns $20 per day, some people have multiple nodes. That makes this an attractive way of making passive income for anyone with a PC and some IT knowledge which is a definite formula for massive growth.

White Paper

There is no formal white paper. See info here.

Team

The project is led by an accomplished and experienced team. You can view the team here.

Our Opinion

Target Price: $500

Risk Score: 6

Max circulation: 528,886

Although there is competition emerging, STRONG is a leading player in the nodes as a service space. In only one month STRONG has increased the number of nodes from 50,000 to 65,000 in the last month. Although we are not fans of its tokenomics the project is proving its model and is on a definite growth splurge. With the market weaknesses STRONG is a project worth buying into.

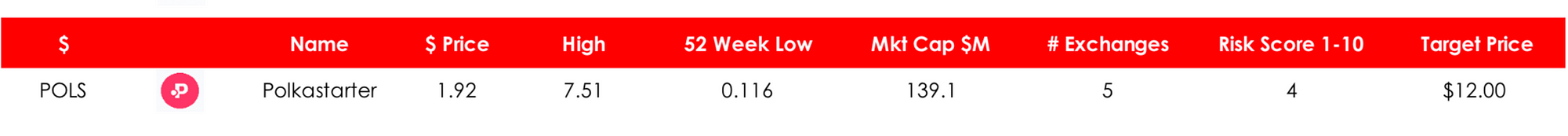

Polkastarter (POLS)

Overview

Polkastarter is a blockchain platform designed to provide an easy to use launchpad for cross-chain token pools and auctions. It is most commonly used by early-stage blockchain projects that want to raise capital and easily distribute their tokens at the same time.

Description

Through Polkastarter, blockchain projects can easily create their own cross-chain swap pools, which allow them to securely raise funds, while users can invest without risks, since swaps are automatically executed by smart contracts.

POLS is the native utility token of the Polkastarter platform and plays a number of roles in its ecosystem, being used for liquidity mining, governance, paying transaction fees, and gaining eligibility to participate in POLS-holder only pools.

Polkastarter’s main offering is its fixed swap smart contract, which allows projects to easily launch liquidity pools that execute orders at a fixed price — rather than using the AMM model made popular by Uniswap.

The platform is designed to handle a range of auction types, including sealed-bid and dutch auctions, as well as both fixed and dynamic ratio swaps. This makes it suitable for cryptocurrency projects looking to raise funds, as well as a variety of other use-cases, including private trades, OTC deals, and discounted sales.

Beyond this, other key features of the platform include permissionless listings, anti-scam capabilities, full KYC integration and liquidity mining.

The platform first went live in December 2020, and has quickly grown to become one of the most commonly used platforms for initial DEX offerings (IDOs).

Team

Polkastarter features an executive team with over three decades of combined experience in tech firms. It was co-founded by Daniel Stockhaus and Tiago Martins, who currently hold the roles of CEO and CTO at Polkastarter respectively.

Daniel Stockhaus is a serial entrepreneur credited with co-founding a highly successful e-commerce firm known as LiGo, as well as the digital growth agency Oliphant Ltd. Prior to this, he worked as a digital media designer for Fitch, and graduated with a bachelor’s degree in communication and media studies.

Tiago Martins, on the other hand, is a former professor of computer science and an experienced developer with expertise in online education and product development. He is also the co-founder of Codeplace, an online platform that teaches the fundamentals of web development.

Click here to view Polkastarter’s White Paper.

Our Opinion

Target Price: $12

Risk Score: 6

Max circulation: 100,000,000

Having already established a strong user base, Polkastarter is one of the leading lights in the decentralized launchpad space. It is looking to use its credibility and large investor base to diversify into other areas — the first one being DeFi insurance. Polkastarter is probably a billion dollar plus platform when you compare it to its rivals in the space such as PancakeSwap and Uniswap. We have set a risk score of 6 and a price target of $12.

Opacity Storage (OPCT)

Overview

Opacity is a cloud storage provider with one major difference, privacy.

Description

With the rise of digital property, many people have increasingly become concerned with the security and privacy of materials stored with cloud storage companies such as Dropbox, Google, and others. Small businesses, individuals, and enterprises want to keep their data private.

Opacity protects people’s basic rights and provides private cloud storage to anyone through its Opacity token, OPCT. The token can be purchased on a crypto exchange and then used to purchase data storage plans that are completely private, and can only be accessed by the purchaser with the private key.

Unlike other service providers, Opacity does not require personal identification information. Opacity stores no information on its users, and allows people to store private information, such as company secrets, intellectual property, personal photographs, legal documents, and family moments, with assurance that personal data stays personal.

Click here to view more information

Team

Check out the team here.

Our Opinion

Risk Score: 7

Target Price: $1.10

Maximum Supply: 130,000,000

Opacity has an experienced team led by Jason Coppola who has previously worked at Microsoft, Paypal and Salesforce. We believe Opacity is a well thought out project that has the potential to carve a significant share of this market. Based on the valuations of both MaidSafeCoin and 0chain which are yet to launch we believe Opacity is significantly undervalued.

Listen to our podcast Inside Track where Opacity talks about their project, the decentralized storage space and the cryptocurrency market in general including some of their favorite projects.

Candela Coin (CLA)

Overview

Provision of solar energy through decentralized p2p energy transfer.

Description

Candela Coin’s vision is to create decentralized solar energy all across the world by cutting out the middleman — the power companies. They have created IoT hardware and software for seamless peer-to-peer energy transfer. By using blockchain technology this enables owners of solar panels to sell their generated energy to other users, bringing in the best returns possible for their solar energy and the cheapest green energy on the market. People across the globe will be able to transfer solar energy to others in their communities using Candela Coin as a medium of exchange.

Their decentralized system does not rely on the existing power grid infrastructure. In the event of inclement weather, power outages, or down power lines, decentralized solar power will still be able to be generated and provide electricity to the community. Candela is the impetus for the democratization of energy.

Click here to view the Whitepaper

Team

Candela’s core team brings a diversity of skill sets, ranging from hardware development to utility design, technical standards setting, marketing strategy and policy advocacy. Check out the team here.

Our Opinion

Risk Score: 10

Target Price: N/A

Maximum Supply: 125,000,000

Candela Coin is our long shot selection. There is one area of the crypto market that is yet to experience a boom — energy. Some crypto projects have tried and failed. Power Ledger being one such example. Power Ledger hasn’t been able to get the traction needed to make an impact. There are many theories as to why but many blame it on their willingness to work with the power company monopolies and not the people in the communities. Unlike Power Ledger’s b2b approach, Candela has taken an alternative path. They are targeting individual households, initially through a partnership with a panel manufacturer. Their business model allows householders to sell their excess energy to other householders in exchange for their native currency CLA. The beauty of their plan is that it allows households who do not have a solar installation to still buy green energy. That is a major selling point for Candela’s solution.

Now let’s look at the numbers. There are in fact two coins, a BEP-20 and an ERC-20. They both have the same tokenomics. It is worth checking out the two prices to see where you can obtain the best deal. At the time of writing the best price can be obtained by buying the ERC-20 token.

The reality is energy transfer on the blockchain is going to be a hot space — the big question is whether Candela has the ability to execute.

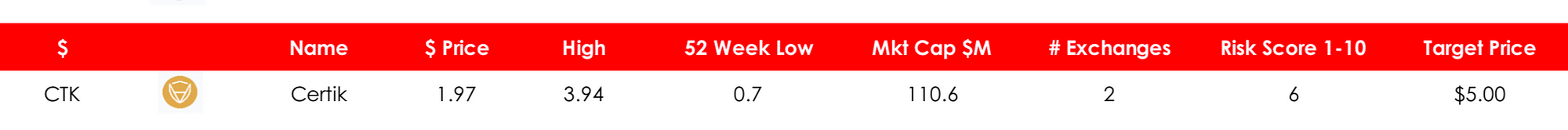

Certik (CTK)

Overview

A cross-chain Protocol with security scoring and decentralized reimbursements for building secure dApps.

Description

CertiK is a pioneering blockchain security firm that uses a cross-chain protocol with security scoring and decentralized reimbursements for building secure dApps.

Blockchain projects can receive security insights from its Security Oracle, which provides real-time guards of on-chain transactions and identifying and flagging a wide range of malicious vulnerabilities before they occur.

Depending on the level of the security score, audited blockchain projects of any protocol may be eligible for a CertiKShield membership, which is a flexible, decentralized reimbursement system for any crypto asset that is irretrievably lost or stolen due to security issues. CertiKShield memberships are open to all community members of these eligible blockchain projects, providing a safety net to holders of crypto assets in case anything unexpected happens.

Click here to view CertiK White Paper

Team

CertiK has the advantage of an exceptionally experienced team. You can view the team here.

Our Opinion

Risk Score: 6

Target Price: $5.00

Maximum Supply: 100,183,153

CertiK has been at the forefront of crypto investor interest recently after auditing the memecoin SafeMoon. CertiK and Quantstamp are the two leaders in this field, although Quantstamp focuses more on non DeFi projects. With the exponential growth of DeFi on BSC and DeFi in general there is going to be a continued demand for projects to be audited and as importantly, insurance cover.

We analyzed the crypto insurance space in a previous report highlighting its massive potential and the key players. CertiK wasn’t part of that analysis but it should have been. CertiK is in a prime position to build a significant share of this market competing directly with the likes of Nexus Mutual, its largest player.

The main risk is the unregulated nature of DeFi and the possibility governments will start coming down hard on projects which claim to be decentralized but still have an element of central control. On that basis we have scored Certik a 6 for risk. The beauty of CertiK is how its native currency is critical to its platform. That is a major tick in the box for the investor.

Haven (XHV)

Overview

Haven is an untraceable cryptocurrency with a mix of standard market pricing and stable fiat value storage.

Description

Haven has a built in on-chain smart contract that controls the minting and burning of coins to facilitate value for users that choose to send their coins to offshore storage contracts.

Sending Haven to offshore storage or burning records a reference on the blockchain to the current fiat value which can be restored later back into Haven by minting new coins to the tune of the current fiat value.

Haven uses ring signatures, ring confidential transactions and stealth addresses meaning payments cannot be tracked or linked back to any user. Wallet addresses and transaction amounts are completely obfuscated on the Haven blockchain making all activity invisible.

Click here to view Haven White Paper

Team

The team is anonymous.

Our Opinion

Risk Score: 6

Target Price: $27

Maximum Supply: 18,400.000

We believe Haven offers a novel solution to the user looking for privacy combined with stability.

Haven definitely has a unique solution to the privacy problem and is a hybrid of the typical privacy coin with its storage function. Haven’s market cap is at a significant discount to many of the larger privacy coins especially after the recent hack. We believe Haven is well worth closer attention.

Uno Re (UNO)

Overview

The first Decentralized Reinsurance platform.

Description

Reinsurance is also known as insurance for insurance companies. Reinsurance is the practice whereby insurers transfer portions of their risk portfolios to other parties to reduce the likelihood of having to pay a large obligation resulting from an insurance claim.

The option to trade in this highly profitable market is currently controlled by a few large corporations — Uno Re is a first-of-its-kind platform, allowing the average user to reap the rewards of trading and investing in this risk.

Click here to view Uno Re White Paper

Team

An experienced and technically capable team. You can view the team here.

Our Opinion

Risk Score: 5

Target Price: $1.00

Maximum Supply: 384,649,206

UNO is the first decentralized reinsurance platform. We have been followers of the crypto insurance market for some time as most of you know. However, a few months ago we predicted it would be the next big thing in cryptocurrency. What we hadn’t anticipated was how many new insurance based projects would enter the market. The good thing about UNO is that many of these new entrants are using UNO to offset some of their risk putting them in a unique position in a competitive space. The DeFi insurance market is set to grow exponentially and projects like UNO are in a prime position to benefit.

Mysterium (MYST)

Overview

Mysterium is building a decentralised P2P VPN and other tools that allow users to browse the internet freely, earn by sharing connections and build censorship-resistant applications.

Description

Mysterium Network is building the world’s largest P2P network to power Web 3 privacy applications. An open source, Swiss-based company founded in 2017, Mysterium is rewiring the internet so it’s secure, free and accessible for all. Mysterium held a token sale through which it raised $18 million USD.

The network is transparent and permission-less by default, made up of layered VPN protocols, blockchain and smart contracts. It lays the groundwork for all kinds of next-gen services to be built on top of it, including Mysterium’s flagship product, the decentralized VPN app.

This dVPN plugs into Mysterium’s global network of residential nodes, one of the fastest growing online communities decentralising the web. This open marketplace allows anyone to become a node and rent their unused bandwidth and IP address to those in need. Individual users can choose from providers located all around the world, allowing them to unblock content, and making them resistant to logging, surveillance and cybercrime. Users pay nodes for providing VPN services in MYST, the network’s native token and reserve currency.

Click here to view Mysterium White Paper

Team

Although there is limited information available on the team it does appear they are more than capable of achieving their goals having already raised significant funds and grown to 1,100 nodes in 409 countries in relatively short order. You can view the full line up here.

Our Opinion

Risk Score: 6

Target Price: $3.00

Maximum Supply: 32,433,365

Mystereum provides an alternative and arguably superior product to the popular VPN. It allows users to pay as they go, whilst node operators are paid to participate. It already boasts some 1800 nodes in 80 countries, a 60% increase from last month and it continues to grow its user base and node network. This is a perfect use case for blockchain technology, providing an alternative to VPNs which are centrally controlled, owned and operated.

Energy Ledger

Overview

Energy Ledger is a company and a token seeking to provide an energy value trade platform on the blockchain for the management of oil from ground to barrel to distribution.

Description

Energy Ledger seeks to make ELX the standard software development platform for energy value trade on the blockchain. The goal and intent of creating this generalized crypto-commodity is to (i) create a cryptocurrency that can be utilized by the energy industry to manage oil containers, and (ii) to incentivize the long term storage of crude oil through investment in the ecosystem. The idea for ELX was originally conceptualized in 2018 by founder and CEO of Energy Ledger Inc., William G. Pete, who identified the potential for Crude Oil markets to fall into contango or backwardation due to the lack of a computer system such as blockchain being developed to manage and understand the scarcity of storage for crude oil.

Energy Ledger was formed to prove the concept and eventual execution of a deployed blockchain solution for crude oil storage units. Smart contract process characteristics portend potential business process continuous improvement for supply chain processes.

The robust ecosystem available for smart contract development within the Ethereum Solidity Ecosystem, and IBM Hyperledger platforms became the catalyst for the development of Energy Ledger’s proposed solutions: i.) A public blockchain on Ethereum for developers to launch open source energy software utilizing the ELX token, ii.) A business, Energy Ledger Inc., who will act as a consultancy firm for private enterprise blockchains, iii.) Development of tamper proof IoT flow meters & liquid level sensors for containers.

Click here to view Energy Ledger’s White Paper

Team

The CEO Willam G Pete is a software engineer and developer who has an in depth knowledge of the blockchain. You can view the full team here.

Our Opinion

Risk Score: 9

Target Price: $0.04

Maximum Supply: 714M

Energy Ledger has a great idea to solve a problem no one else in the blockchain space has got round to tackling. It is however too early to make an estimation of its chances of success as the project is yet to launch. The valuation however does reflect this. Energy Ledger seems to offer excellent value but with the added risk that you would expect from any moonshot. It has a fully documented and experienced team which provides some confidence in their ability to pull this off. The one downside is its lack of volume but that can work both ways and is to be expected by undiscovered projects such as this one. ELX is one to add to your watch list.

Rentible

Overview

Rentible is a solution bringing decentralized Proptech to the masses. Rentible enables tenants and landlords to conveniently send and receive rental payments in cryptocurrencies.

Description

Rentible seeks to position itself as a first-mover in this niche and to advance the move towards a decentralized proptech-economy. Its platform is in development and is expected to be deployed in quarter four of this year. It has recently introduced a staking pool on Bancor where token holders can stake their currency.

Click here to view Rentible’s White Paper

Team

Founded by a team of seasoned Proptech entrepreneurs and blockchain experts. View the team here.

Our Opinion

Risk Score: 9

Target Price: $7.00

Maximum Supply: 3.5M

Similar to Energy Ledger you have to take the rough with the smooth. The smooth is the high reward available if this project gains traction, the risks include among others poor liquidity. The surprising thing about this project is its listing on the top tier exchange Bittrex. This should provide the investor with some level of comfort. A small investment which is then staked on Bancor is probably not a bad bet as long as you don’t bet the house or the childrens lunch money!

Ethbox

Overview

Ethbox facilitates privacy both by design, and with an extra opt-in privacy feature. Sending and receiving funds through Ethbox interrupts the chain of transactions that can be clearly traced back. Additionally, an extra privacy feature will be implemented, which obfuscates the sender’s and recipient’s addresses.

Description

Ethbox provides a unique solution to a problem in cryptocurrency trading that is as devastating as it is widespread. Accidentally sending funds to a mistyped or mistaken recipient address has already been the cause for hundreds of millions, if not billions, of financial damage. Harnessing the cryptographically unbreakable safety of the underlying Ethereum blockchain, ethbox provides a smart contract based digital escrow service to completely alleviate any risk of loss while sending cryptocurrency.

Click here to view Ethbox’s White Paper

Team

An experienced and accomplished management team supported by an impressive team of advisors. View the complete team here.

Our Opinion

Risk Score: 9

Target Price: $0.70

Maximum Supply: 65M

The platform only launched a few weeks ago however the market value does not reflect that. This is one of those undervalued and undiscovered projects we love to find. It is a total moonshot as you are betting on the fact that people will start using their new platform in their droves. That is possible but like most things it is a long shot. However they do have a valuable product which is quite likely to gain traction but it may take some time.

Click below to view previous Moonshot Portfolio’s:

Not Financial Advice

This article does not constitute financial advice or a recommendation to buy in any way. Always do your own research and never invest more than you can afford to lose. Investing in cryptocurrencies is high risk, and you could lose 100% of your investment. The article should be treated as supplementary information to add to your existing knowledge.

Recent Comments