Moonshot Portfolio

December’s Crypto Moonshot Portfolio

A diversified portfolio of twenty potential crypto moonshots

It’s been a tough month for a number of reasons. First of all our portfolio took a major hit with only one cryptocurrency surviving the red ink. Secondly, we were hit by a rug pull from one of our original high risk picks. The portfolio was down by 55% in December and whilst we feel we took a solid kick to the balls we have reasons to be optimistic. We learnt a lesson from the rug pull at Candela Coin and we are now holding some very exciting projects which should see some strong progress in 2022.

Outlook

We don’t believe this correction is over. There is still too much froth in the market with many of the metaverse and memecoins grossly overvalued in our opinion. The correction has not discriminated either, hitting many of the projects with fundamentals as hard as the projects backed by fresh air. There are bargains to be had but we must remember that the market will probably fall some more before recovering. It is important that we invest in quality projects with fundamentals as these are likely to recover faster than the projects with little more than a website and a bunch of Telegram followers.

What are we excited about?

Last month we told you that we were excited about Candela Coin, Rentible, Digital Fitness and Yield App. Apart from our misjudgement on Candela Coin we remain excited by these projects, as well as our recent new additions Catchy and SPIN.

With a valuation of only $650,000 and a growing user base of its multi chain tracker Catchy represents phenomenal value in our opinion.

State of play

Let’s focus on our current portfolio of twenty cryptocurrencies. This month we added two new cryptocurrencies which replaced Candela Coin and Don’t KYC.

The portfolio this month was down 55% for the month and up 283% since its inception in February 2021.

This month saw only one project in positive territory:

- Certik +3%

The months worst performers were:

- Candela -95%

- Haven -69%

- Mysterium -65%

- Bistroo -56%

Overall performance

Now let’s look at the overall performance of our portfolio:

This month’s developments

Kryll

Kryll.io is a platform for cryptocurrency traders looking to use the most advanced trading tools and strategies. Last month it announced its listing on Coinbase, this month that news was followed by a listing on Gate.IO. This is definitely an exciting project with an innovative team continuing to develop their offerings.

Yield App

YLD, the regulated wealth management platform, took a hit with assets under management falling for the first time this year by 8%. This can be attributed to the market correction and in our opinion YLD remains one of the better DeFi platforms out there.

Listen to our podcast Inside Track here where the founder of Yield App talks about his project, the cryptocurrency market in general and some of his favorite projects.

StrongBlock

Although there is competition emerging, STRONG is by far the leading player in the nodes as a service space. It continues to experience strong growth in its node network with December seeing an increase of 37% to 200,000. Although the project has exceeded our price target we believe its leading position in this growth space makes it a token worth holding. Earning passive income by operating a node is a market that is not going away and Strong is leading the way.

Candela Coin

Candela, the solar power energy transfer project, is dead to us after the recent shenanigan of its founder. After abusing us for calling him out and insisting the project was still alive and well despite what he claimed was a hack he then disappeared again. We banked some profits on this one last month but we took a hit this month.

Haven

Haven the privacy coin launched its 2.0 platform.

Listen to our podcast Inside Track here where one of the project managers of Haven talks about privacy coins, regulation and why Haven is different to its privacy coin competitors.

Mysterium

Mysterium Network the privacy network launched its mainnet. This is a quality project with substantial upside in our opinion.

Lunch Money

The business review platform announced the January launch of V2 of its platform.

Listen to our podcast Inside Track here where the co-founder of Lunch Money talks about his project, the gig economy and why Lunch Money is the way forward in the future of review sites.

Don’t KYC

The anonymous credit card and payment platform had a strong run last month but that was reversed this month. We believe in their business model but we have decided to cash in this one as we believe there are better lower risk opportunities available.

Rentible

Rentible is expected to launch a beta version of its platform this month. It also announced its intention of launching a metaverse based platform facilitating the renting of virtual property. A deal with a leading Chilean real estate agency was another bright spot in the Rentible story.

CertiK

Certik was buoyed by another round of fund raising from leading VCs.

New Additions

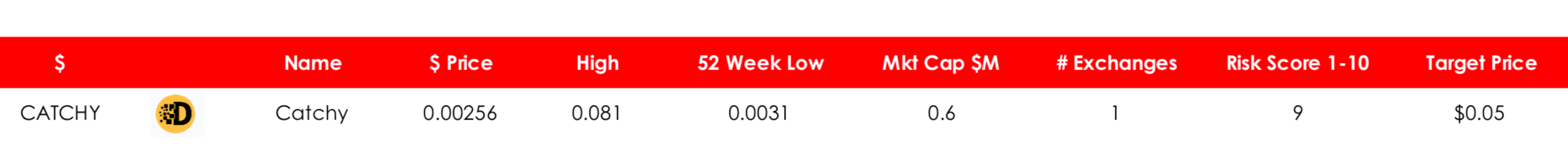

Catchy (CATCHY)

Overview

Multi chain wallet tracker.

Description

Catchy is focused on making crypto tracking simple and accessible. The project has already developed the first multichain Telegram wallet tracker. Holders of the token will eventually have access to premium features in all of their crypto tracking tools.

The team’s vision extends beyond what is currently offered. They intend to expand Catchy Wallet Bot’s utility to include more appealing visual designs, intuitive analytics, and other chains.

Click here to view Catchy White Paper

Team

Catchy recently revealed its founder to the crypto community. An experienced tech entrepreneur who has lofty ambitions for this project.

Our Opinion

Risk Score: 9

Target Price: $0.047

Maximum Supply: 104 million

What we like about Catchy’s tracker is that it is simple to download and provides real time values covering both Ethereum and Binance Smart Chain wallets. Once you start using it you can’t stop, hence the name.

Their next product in development is something called a sniper bot. This allows you to add the contract address of the token you are interested in and then receive instant notifications as soon as that token starts trading on platforms like Pancakeswap.

Catchy launched it’s tracker wallet in mid October and has already amassed over one thousand users. It is in the process of negotiating partnerships which will allow them to further expand their user base.

This is a rare opportunity to get in early in a project that promises to be widely used by the crypto community.

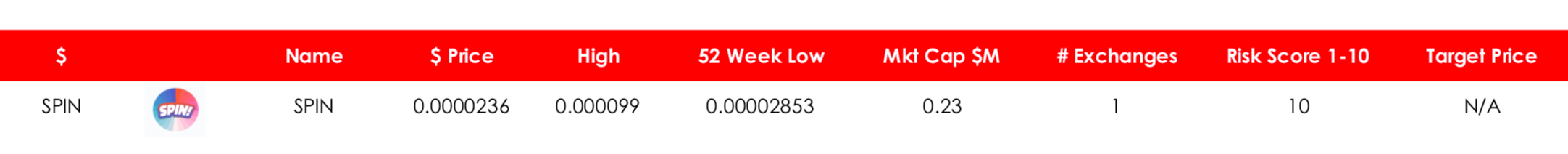

SPIN (SPIN)

Overview

Blockchain based ‘no loss’ lottery.

Description

SPIN is a rewards token with innovative Buy-to-Win tokenomics. Buying SPIN automatically enters you into the current daily and weekly SPIN Jackpots and rewards holders with BNB. The more SPIN you buy, the more chances you have to win.

Unlike traditional lotteries where you lose your wager with SPIN you are buying tokens which allows you to benefit from any upside in the project. By owning tokens you also receive free reflection tokens based on 3% of daily volumes. That means you have three ways of earning from owning SPIN. And all you have to do to participate is buy the token. There is no separate registration or other requirements.

Click here to view SPIN White Paper

Team

Our Opinion

Risk Score: 10

Target Price: N/A

Maximum Supply: 10,000,000,000

SPIN isn’t the only lottery type project on the blockchain. There is the project PoolTogether for example which is a no loss lottery where prizes are accumulated from interest earned from funds deposited by users. This is a $75 million project and shows the potential of SPIN.

SPIN is a new project which has only just been listed. It has a market cap of only $270,000 making this a great opportunity to buy in at a very low level.

Portfolio Selection — December 2021

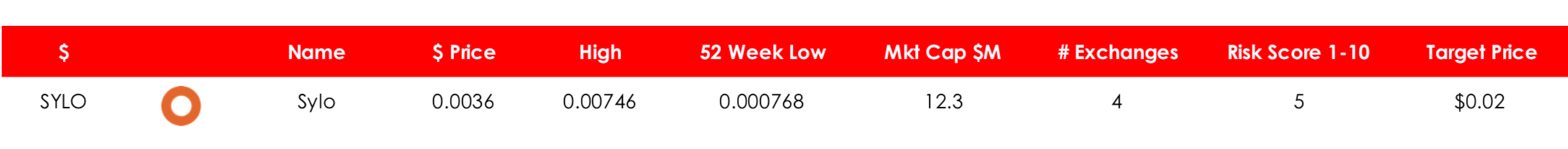

Sylo (SYLO)

Overview

Decentralized data exchange. Operator of the SYLO smart wallet, which has over 250,000 users.

Description

The Sylo Protocol provides confidential communication as a utility to the Sylo Confidential Communication App. The protocol acts as the confidential networking layer for the Sylo App, creating P2P connections and providing a way for users to interact and exchange data confidentially.

The Sylo Protocol is being developed to provide fully decentralised confidential communication as a utility to all connected-apps within the Sylo ecosystem. Powered by blockchain and combined with other decentralised technologies, this Protocol will act as the networking layer for the Sylo DApp and 3rd-party connected-apps, while providing charging options for specific communications and services over the network.

The fully decentralised Sylo DApp will be the 1st application built on the blockchain-based Sylo Protocol, using technology already commercialised in the Sylo App that’s currently used by thousands globally, available on Apple Store and Google Play Store.

Sylo is a decentralised communication and data exchange network powered by a layer 2 micropayments infrastructure and the SYLO token. User-run Service Peers provide infrastructure to the network which allows developers and businesses to run privacy-first, unstoppable apps without deploying any infrastructure of their own. A staking architecture and unique probabilistic ticketing solution ensure minimal transaction fees and limitless scalability. This scalability is already on show within the project’s flagship app, the Sylo Smart Wallet; a decentralized, private messenger and crypto wallet with over a quarter-million users.

Click here to view Sylo White Paper

Team

The team appears to combine a broad range of talents, skills, and experience which should provide any investor with confidence in this project. This is Sylo’s description of their core team: ‘…combines a deep background in computer science, development, and user experience with the real-world business experience of entrepreneurs, designers, and world-leading technologists. Both in experience and attitude, the strength of Sylo is in its people.’

Our Opinion

Risk Score: 5

Target Price: $0.02

Maximum Supply: 10B

The team has already demonstrated it is a force to be reckoned having developed and launched its smart wallet which has over a quarter-million users. It also has a decent-sized community following it. We have ranked the coin a 5 in terms of risk as the team has already achieved a level of success however the potential has not been fully recognized in the price.

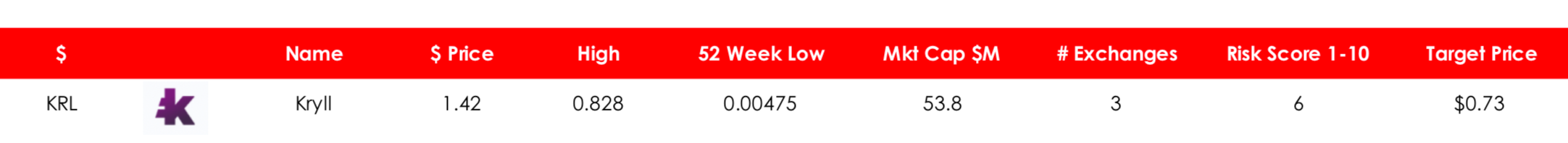

Kryll (KRL)

Overview

Kryll is your first intuitive platform to define powerful crypto trading strategies.

Description

Kryll is your first intuitive platform to define powerful crypto trading strategies through a simple drag n drop editor. Create automated winning strategies, benchmark them, share with the community, and enjoy user-generated content.

Kryll is the ultimate platform for cryptocurrency traders looking to use the most advanced trading tools and strategies, as well as benefit from the community’s hive-mind to get the best returns within cryptocurrency markets.

The platform provides intuitive ways to create your own trading strategies that can be set to execute automatically. Through a What You See Is What You Trade™ interface, you can design trading strategies making use of the industry’s most powerful tools and safely test them with backtesting and sandboxing.

Once your tools prove their worth, you can set them to live-trade on your behalf, taking the right positions at the right time, as if you were following the markets 24/7.

On Kryll you can also rent out your very own winning strategies to help fellow traders be more successful. You will be rewarded with passive income for sharing your strategies.

Click here to view Kryll White Paper

Team

An accomplished team with a proven track record of success in both tech and entrepreneurial flair. Check out the full team here.

Our Opinion

Risk Score: 6

Target Price: $0.73

Maximum Supply: 49M

We believe that Kryll has a unique business model which is gaining traction. We especially like the novel touch, where traders can rent out their own strategies to help fellow traders be more successful. This allows traders to be rewarded with passive income for sharing their strategies on something that could scale quickly. Despite the large maximum supply the token price does not take into account the quality of the team and its current growth. The most significant risk in the near terms is its sensitivity to market volatility particularly in a downturn in market sentiment.

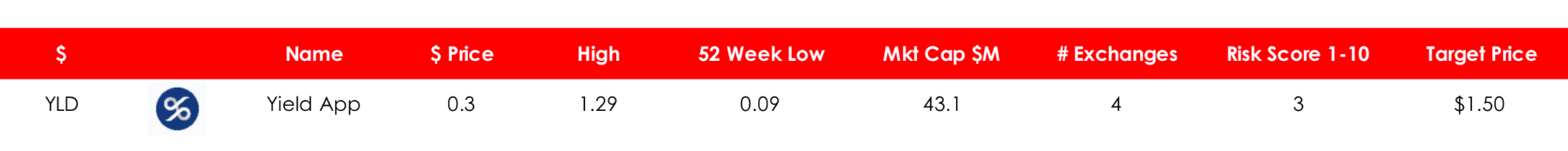

Yield App (YLD)

Overview

YLD, a licensed and regulated FinTech company, offers a mobile app and web platform designed to provide the easiest way to invest in DeFi using crypto or traditional currencies.

Description

YLD’s intuitive app and web platform enable users around the world to earn high returns from DeFi products without having to go through a lengthy, complex, and often costly learning process. Operating under a banking license, YLD offers an insured investment fund managed by a team with years of experience in FinTech and cybersecurity. At the core of its strategy is the YLD token, which rewards community members and allows them to boost their APY.

Click here to view Yield App White Paper

Team

Both an experienced and accomplished project team benefiting from a team of quality advisors. See the full team here

Our Opinion

Risk Score: 3

Target Price: $1.50

Maximum Supply: 300M

When you compare YLD to other similar platforms in the DeFi space it appears grossly undervalued. YLD’s platform is regulated and is aimed at the unsophisticated user, which could make this an attractive bet on the eventual mass adoption of DeFi. YLD is a good choice for any portfolio.

Rarible (RARI)

Overview

Rarible is a creator-centric NFT marketplace and issuance platform. RARI is a governance token with a Marketplace Liquidity Mining program.

Description

Rarible brands itself as the world’s first “community-owned NFT marketplace.” Furthermore, Rarible leverages its RARI token — which, similarly, is the world’s first governance token in the NFT field — to power this community-run platform model. In giving users a token with governance powers, Rarible is borrowing a page from the DeFi playbook.

At its core, Rarible is an NFT (non-fungible token) platform for securing digital collectibles secured with blockchain technology. However, Rarible has a considerably more ambitious vision than merely becoming a platform for securing art and digital collectibles using blockchain.

Rarible represents a digital NTF platform with a particular focus on art assets. Specifically, Rarible includes a marketplace that allows users to trade various digital collectibles or NFTs, similar to OpenSea.

Users can also use Rarible to create — commonly known as “minting” NFTs, or non-fungible tokens. This is significant for various content creators. For example, an artist could sell their creations, such as books, music albums, or movies, as NFTs.

Rarible is placing significant emphasis on creating an entirely autonomous platform, run through a community governance model. Moreover, Rarible is now shifting heavily towards becoming an actual Decentralized Autonomous Organization (DAO).

The White Paper is not available — see this informative blog here.

Team

Rarible is a company founded by Alex Salnikov and Alexei Falin and is based in Moscow. Salnikov has worked in cryptocurrency since 2013, while Falin previously co-founded a marketplace for digital stickers that can be used on chat platforms.

Our Opinion

Risk Score: 6

Target Price: $160.00

Maximum Supply: 25M

Rarible is an easy-to-use platform that has received a great deal of praise for its relatively simple and intuitive user interface. Its connection to Yearn Finance’s yInsure initiative is another promising development as Yearn Finance is one of the hottest names in DeFi. Rarible is a standout project in the NFT space.

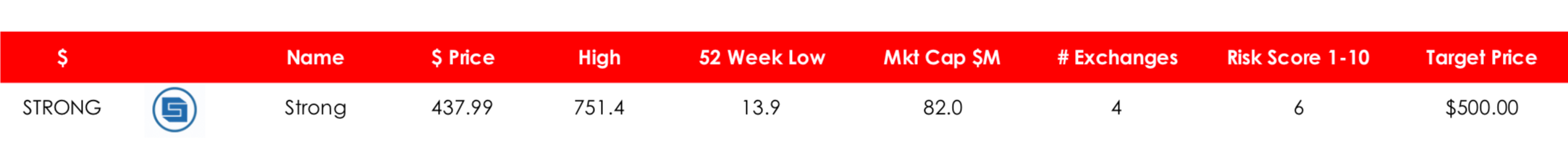

StrongBlock (STRONG)

Overview

StrongBlock is the first and only blockchain-agnostic protocol to reward nodes for supporting the infrastructure of their blockchain.

Description

STRONG believes it is important to incentivize nodes because with limited resources and no financial incentive many nodes run out-of-date software, maintain incomplete blockchain histories and are intermittently off-line. To solve this, StrongBlock has made it possible for anyone to create a node in seconds and receive STRONG token rewards every day.

They call this “Nodes as a Service”. This allows anyone to create a Full Ethereum node in a few seconds with no technical expertise.

Since the launch of the StrongBlock DeFi node protocol, over 350 nodes have been registered. The total number of nodes number nearly 15,000. STRONG recently announced a tie up with leading DeFi platform Maker DAO, a major endorsement of STRONG’s business model.

According to STRONG each Node earns $20 per day, some people have multiple nodes. That makes this an attractive way of making passive income for anyone with a PC and some IT knowledge which is a definite formula for massive growth.

White Paper

There is no formal white paper, however this link provides a valuable insight.

Team

The project is led by an accomplished and experienced team. You can view the team here.

Our Opinion

Target Price: $500

Risk Score: 6

Max circulation: 528,886

Although there is competition emerging, STRONG is a leading player in the nodes as a service space. In only one month STRONG has increased the number of nodes from 65,000 to 88,000 in the last month. Although we are not fans of its tokenomics the project is proving its model and is on a definite growth splurge. With the market weaknesses STRONG is a project worth buying into.

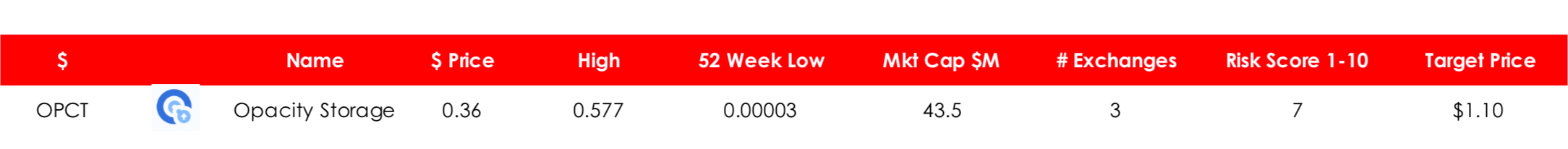

Opacity Storage (OPCT)

Overview

Opacity is a cloud storage provider with one major difference, privacy.

Description

With the rise of digital property, many people have increasingly become concerned with the security and privacy of materials stored with cloud storage companies such as Dropbox, Google, and others. Small businesses, individuals, and enterprises want to keep their data private.

Opacity protects people’s basic rights and provides private cloud storage to anyone through its Opacity token, OPCT. The token can be purchased on a crypto exchange and then used to purchase data storage plans that are completely private, and can only be accessed by the purchaser with the private key.

Unlike other service providers, Opacity does not require personal identification information. Opacity stores no information on its users, and allows people to store private information, such as company secrets, intellectual property, personal photographs, legal documents, and family moments, with assurance that personal data stays personal.

Click here to view more information

Team

Check out the teamhere

Our Opinion

Risk Score: 7

Target Price: $1.10

Maximum Supply:130,000,000

Opacity has an experienced team led by Jason Coppola who has previously worked at Microsoft, Paypal and Salesforce. We believe Opacity is a well thought out project that has the potential to carve a significant share of this market. Based on the valuations of both MaidSafeCoin and 0chain we believe Opacity is significantly undervalued.

Listen to our podcast Inside Track here where Opacity talks about their project, the decentralized storage space and the cryptocurrency market in general including some of their favorite projects.

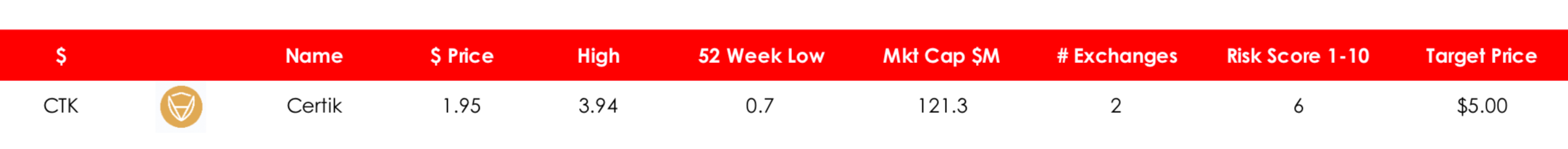

Certik (CTK)

Overview

A cross-chain Protocol with security scoring and decentralized reimbursements for building secure dApps.

Description

CertiK is a pioneering blockchain security firm that uses a cross-chain protocol with security scoring and decentralized reimbursements for building secure dApps.

Blockchain projects can receive security insights from its Security Oracle, which provides real-time guards of on-chain transactions and identifying and flagging a wide range of malicious vulnerabilities before they occur.

Depending on the level of the security score, audited blockchain projects of any protocol may be eligible for a CertiKShield membership, which is a flexible, decentralized reimbursement system for any crypto asset that is irretrievably lost or stolen due to security issues. CertiKShield memberships are open to all community members of these eligible blockchain projects, providing a safety net to holders of crypto assets in case anything unexpected happens.

Click here to view CertiK White Paper

Team

CertiK has the advantage of an exceptionally experienced team. You can view the team here

Our Opinion

Risk Score: 6

Target Price: $5.00

Maximum Supply: 100,183,153

CertiK has been at the forefront of crypto investor interest recently after auditing the memecoin SafeMoon. CertiK and Quantstamp are the two leaders in this field, although Quantstamp focuses more on non DeFi projects. With the exponential growth of DeFi on BSC and DeFi in general there is going to be a continued demand for projects to be audited and as importantly, insurance cover.

We analyzed the crypto insurance space in a previous report highlighting its massive potential and the key players. CertiK wasn’t part of that analysis but it should have been. CertiK is in a prime position to build a significant share of this market competing directly with the likes of Nexus Mutual, its largest player.

The main risk is the unregulated nature of DeFi and the possibility governments will start coming down hard on projects which claim to be decentralized but still have an element of central control. On that basis we have scored Certik a 6 for risk. The beauty of CertiK is how its native currency is critical to its platform. That is a major tick in the box for the investor.

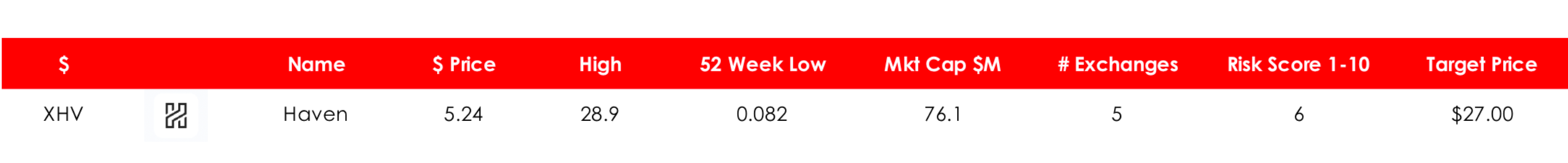

Haven (XHV)

Overview

Haven is an untraceable cryptocurrency with a mix of standard market pricing and stable fiat value storage.

Description

Haven has a built in on-chain smart contract that controls the minting and burning of coins to facilitate value for users that choose to send their coins to offshore storage contracts.

Sending Haven to offshore storage or burning records a reference on the blockchain to the current fiat value which can be restored later back into Haven by minting new coins to the tune of the current fiat value.

Haven uses ring signatures, ring confidential transactions and stealth addresses meaning payments cannot be tracked or linked back to any user. Wallet addresses and transaction amounts are completely obfuscated on the Haven blockchain making all activity invisible.

Click here to view Haven White Paper

Team

The team is anonymous.

Our Opinion

Risk Score: 6

Target Price: $27

Maximum Supply: 18,400.000

We believe Haven offers a novel solution to the user looking for privacy combined with stability.

Haven definitely has a unique solution to the privacy problem and is a hybrid of the typical privacy coin with its storage function. Haven’s market cap is at a significant discount to many of the larger privacy coins especially after the recent hack. We believe Haven is well worth closer attention.

Uno Re (UNO)

Overview

The first Decentralized Reinsurance platform.

Description

Reinsurance is also known as insurance for insurance companies. Reinsurance is the practice whereby insurers transfer portions of their risk portfolios to other parties to reduce the likelihood of having to pay a large obligation resulting from an insurance claim.

The option to trade in this highly profitable market is currently controlled by a few large corporations — Uno Re is a first-of-its-kind platform, allowing the average user to reap the rewards of trading and investing in this risk.

Click here to view Uno Re White Paper

Team

An experienced and technically capable team. You can view the team here

Our Opinion

Risk Score: 5

Target Price: $1.00

Maximum Supply: 384,649,206

UNO is the first decentralized reinsurance platform. We have been followers of the crypto insurance market for some time as most of you know. However, a few months ago we predicted it would be the next big thing in cryptocurrency. What we hadn’t anticipated was how many new insurance based projects would enter the market. The good thing about UNO is that many of these new entrants are using UNO to offset some of their risk putting them in a unique position in a competitive space. The DeFi insurance market is set to grow exponentially and projects like UNO are in a prime position to benefit.

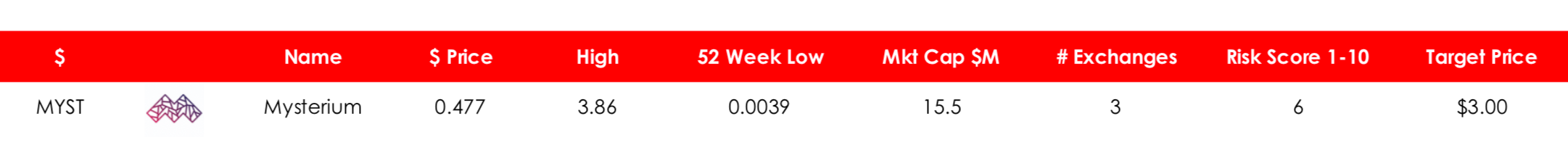

Mysterium (MYST)

Overview

Mysterium is building a decentralised P2P VPN and other tools that allow users to browse the internet freely, earn by sharing connections and build censorship-resistant applications.

Description

Mysterium Network is building the world’s largest P2P network to power Web 3 privacy applications. An open source, Swiss-based company founded in 2017, Mysterium is rewiring the internet so it’s secure, free and accessible for all. Mysterium held a token sale through which it raised $18 million USD.

The network is transparent and permission-less by default, made up of layered VPN protocols, blockchain and smart contracts. It lays the groundwork for all kinds of next-gen services to be built on top of it, including Mysterium’s flagship product, the decentralized VPN app.

This dVPN plugs into Mysterium’s global network of residential nodes, one of the fastest growing online communities decentralising the web. This open marketplace allows anyone to become a node and rent their unused bandwidth and IP address to those in need. Individual users can choose from providers located all around the world, allowing them to unblock content, and making them resistant to logging, surveillance and cybercrime. Users pay nodes for providing VPN services in MYST, the network’s native token and reserve currency.

Click here to view Mysterium White Paper

Team

Although there is limited information available on the team it does appear they are more than capable of achieving their goals having already raised significant funds and grown to 1,100 nodes in 409 countries in relatively short order. You can view the full line up here

Our Opinion

Risk Score: 6

Target Price: $3.00

Maximum Supply: 32,433,365

Mysterium provides an alternative and arguably superior product to the popular VPN. It allows users to pay as they go, whilst node operators are paid to participate. This is a perfect use case for blockchain technology, providing an alternative to VPNs which are centrally controlled, owned and operated.

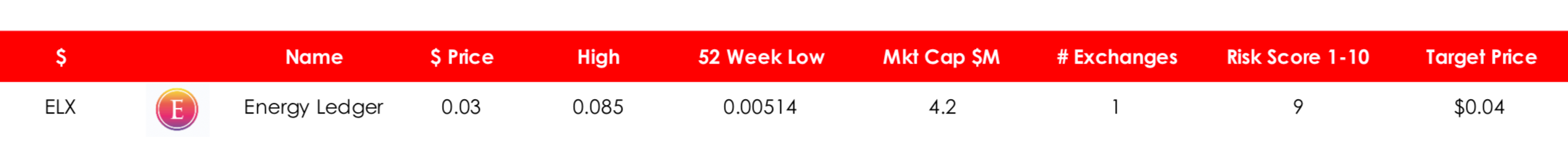

Energy Ledger (ELX)

Overview

Energy Ledger is a company and a token seeking to provide an energy value trade platform on the blockchain for the management of oil from ground to barrel to distribution.

Description

Energy Ledger seeks to make ELX the standard software development platform for energy value trade on the blockchain. The goal and intent of creating this generalized crypto-commodity is to (i) create a cryptocurrency that can be utilized by the energy industry to manage oil containers, and (ii) to incentivize the long term storage of crude oil through investment in the ecosystem. The idea for ELX was originally conceptualized in 2018 by founder and CEO of Energy Ledger Inc., William G. Pete, who identified the potential for Crude Oil markets to fall into contango or backwardation due to the lack of a computer system such as blockchain being developed to manage and understand the scarcity of storage for crude oil.

Energy Ledger was formed to prove the concept and eventual execution of a deployed blockchain solution for crude oil storage units. Smart contract process characteristics portend potential business process continuous improvement for supply chain processes.

The robust ecosystem available for smart contract development within the Ethereum Solidity Ecosystem, and IBM Hyperledger platforms became the catalyst for the development of Energy Ledger’s proposed solutions: i.) A public blockchain on Ethereum for developers to launch open source energy software utilizing the ELX token, ii.) A business, Energy Ledger Inc., who will act as a consultancy firm for private enterprise blockchains, iii.) Development of tamper proof IoT flow meters & liquid level sensors for containers.

Click here to view Energy Ledger’s White Paper

Team

The CEO Willam G Pete is a software engineer and developer who has an in-depth knowledge of the blockchain. You can view the full team here

Our Opinion

Risk Score: 9

Target Price: $0.04

Maximum Supply: 714M

Energy Ledger has a great idea to solve a problem no one else in the blockchain space has got round to tackling. It is however too early to make an estimation of its chances of success as the project is yet to launch. The valuation however does reflect this. Energy Ledger seems to offer excellent value but with the added risk that you would expect from any moonshot. It has a fully documented and experienced team which provides some confidence in their ability to pull this off. The one downside is its lack of volume but that can work both ways and is to be expected by undiscovered projects such as this one. ELX is one to add to your watch list.

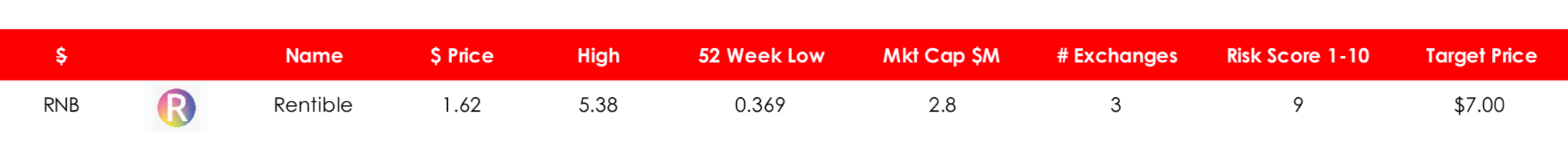

Rentible (RNB)

Overview

Rentible is a solution bringing decentralized Proptech to the masses. Rentible enables tenants and landlords to conveniently send and receive rental payments in cryptocurrencies.

Description

Rentible seeks to position itself as a first-mover in this niche and to advance the move towards a decentralized proptech-economy. Its platform is in development and is expected to be deployed in quarter four of this year. It has recently introduced a staking pool on Bancor where token holders can stake their currency.

Click here to view Rentible’s White Paper

Team

Founded by a team of seasoned Proptech entrepreneurs and blockchain experts. View the team here.

Our Opinion

Risk Score: 9

Target Price: $7.00

Maximum Supply: 3.5M

Similar to Energy Ledger you have to take the rough with the smooth. The smooth is the high reward available if this project gains traction, the risks include among others poor liquidity and poor execution. The surprising thing about this project is its listing on the top tier exchange Bittrex. This should provide the investor with some level of comfort.

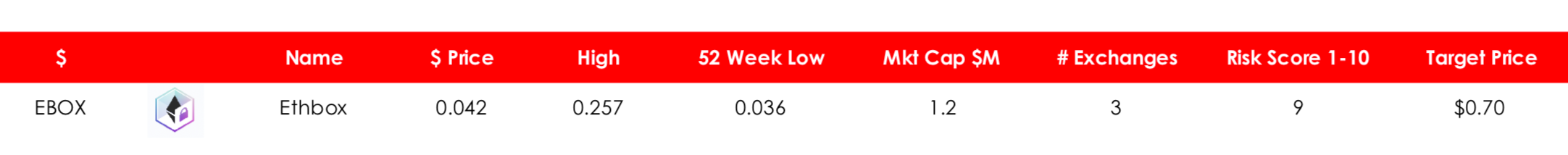

Ethbox (EBOX)

Overview

Ethbox facilitates privacy both by design, and with an extra opt-in privacy feature. Sending and receiving funds through Ethbox interrupts the chain of transactions that can be clearly traced back. Additionally, an extra privacy feature will be implemented, which obfuscates the sender’s and recipient’s addresses.

Description

Ethbox provides a unique solution to a problem in cryptocurrency trading that is as devastating as it is widespread. Accidentally sending funds to a mistyped or mistaken recipient address has already been the cause for hundreds of millions, if not billions, of financial damage. Harnessing the cryptographically unbreakable safety of the underlying Ethereum blockchain, ethbox provides a smart contract based digital escrow service to completely alleviate any risk of loss while sending cryptocurrency.

Click here to view Ethbox’s White Paper

Team

An experienced and accomplished management team supported by an impressive team of advisors. View the complete team here

Our Opinion

Risk Score: 9

Target Price: $0.70

Maximum Supply: 65M

The platform only launched a few weeks ago however the market value does not reflect that. This is one of those undervalued and undiscovered projects we love to find. It is a total moonshot as you are betting on the fact that people will start using their new platform in their droves. That is possible but like most things it is a long shot. However they do have a valuable product which is quite likely to gain traction but it may take some time.

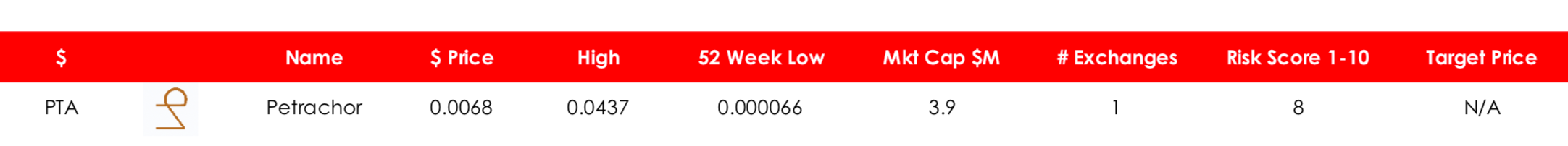

Petrachor (PTA)

Overview

Petrachor is a secure and scalable digital asset platform, empowering a decentralized Internet experience.

Description

Its light-weight architecture can run from a phone, tablet, or desktop. Petrachor uses 100% original code for the Ariel Protocol; a resource efficient and censorship resistant Proof of Stake consensus. Millions of nodes can actively participate in mining, which eliminates the need for mining pools, and provides optimal security.

Petra is the native unit of the Petrachor network and can be used for payments,smart contract interactions and mining for block rewards.

Click here to view Petrachor’s White Paper

Team

Petrachor is a community run project.

Our Opinion

Risk Score: 8

Target Price: N/A

Maximum Supply: 1B

The first question many of you may be asking is why are we adding a blockchain investment to our portfolio when there are hundreds of these already, all vying for investor dollars. And we would have to say, that is a fair question. But Petrachor breaks the mold To demonstrate the potential of Petrachor let’s turn our attention briefly to a platform called Pi. It is an app that allows you to mine their native currency. It has captured the imagination of the mainstream attracting over 18 million users. The funny thing is it isn’t even a blockchain and Pi isn’t a cryptocurrency. Their idea of mining is logging onto the app daily. Like Pi Petrachor allows any user with limited technical ability to mine it’s native currency. That is made possible because of the limited processing power required allowing practically any device to participate in the mining process and earn. By opening up mining to the masses this makes the system far more secure whilst also providing an opportunity for the mainstream to earn from mining, something Pi promises but fails miserably to deliver.

Petrachor is an operational blockchain although a new more powerful version is due to be launched within the next six months. Their focus so far has been on technology, their next focus is on user growth.

Petrachor is one of the few blockchain solutions that could easily be adapted by the masses and that alone makes this an interesting investment opportunity although like with any moonshot, high risk.

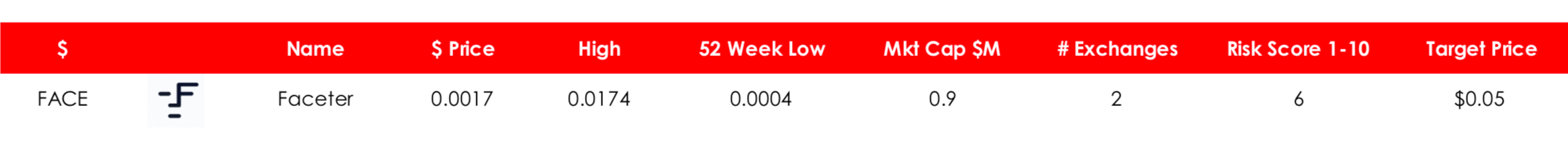

Faceter (FACE)

Overview

Faceter is designed to perform big data video analysis in real time — extracting faces, objects and events resulting in the transformation of these meaningless recordings into meaningful assets.

Description

In the next 3 years over 1 billion cameras will be installed across the globe, producing petabytes of video recordings daily. Faceter is designed to perform big data video analysis in real time — extracting faces, objects and events resulting in the transformation of these meaningless recordings into meaningful assets.

FACE token is the core of the decentralized network as a flexible, transparent, cross-border settlement mechanism for all participants. Starting with the payments they receive from customers who want to use Faceter for video analysis. Work of miners in their decentralized network is also paid by FACE.

Click here to view Faceter White Paper

Team

An experienced accomplished team. View the full team here

Our Opinion

Risk Score: 6

Target Price: $0.05

Maximum Supply: 1B

Faceter has found a potentially lucrative niche which has so far remained unexplored particularly in the blockchain space. With over 500,000 users of its app this is a project that deserves significantly more attention.

Lunch Money (LMY)

Overview

Lunch Money describes itself as a universal loyalty rewards program aimed at improving customer service through anonymous customer oversights and incentives. Restaurant customers and restaurant delivery service customers can simply earn Lunch Money by providing real feedback on their service experience.

Description

Lunch Money aims to implement the use of blockchain and cryptocurrency into everyday life through strategic partnerships with existing technologies including video games, POS terminals, ATMs, digital and paper wallets, Credit Cards, online payment services, and eCommerce platform providers. It is already incorporated within 150 vending machines which have been programmed to accept cryptocurrencies.

Lunch Money is an Ethereum based ERC20 token sharing all of the benefits of compatibility with Ethereum based apps such as Uniswap, Bancor and 1inch exchange. Lunch Money has been integrated into over 25 different wallets including MEW, Incognito, Trust Wallet, Trezor, Ellipal, Zelcore, Infinito, and Enjin Wallet.

To date, Lunch Money has formed strategic partnerships with IvendPay, PolisPay, Origin Protocol, Blockfolio Signals, Block Card, and Fowler Electronics, the developer of the TheCryptoBill.Com paper wallets.

Click here to view Lunch Money White Paper

Team

A committed and dedicated team with a background in tech and blockchain. You can view the team here.

Our Opinion

Risk Score: 8

Target Price: N/A

Maximum Supply: 189,000

Lunch Money has been around now but the project is far from dead. The team has been quietly beavering away. Amazingly it is one of the few crypto projects who registered their token with the US’s Securities Exchange Commission exempting it as a security.

The big question we have to ask is what have these guys been doing for the last few years because the platform has not gained any major traction.

The major reason for this is their focus on building and upgrading their platform and getting the fundamentals rights. You only have to look at the partnerships they have formed and the SEC registration to see that these guys take that deadly seriously. That focus on the technology and the basics has meant that their marketing spend has been sacrificed. Of course when it came time to market Covid hit.

To be fair, Lunch Money has the same problem as many blockchain projects. They focus on the technology and leave marketing as an afterthought. However saying all that this is the kind of project that could easily go viral. Why wouldn’t you provide a restaurant review if you are being paid to do it? This project is all about getting traction. It is in exactly the right spot, the gig economy.

Bistroo (BIST)

Overview

World’s first food token and competitor of deliveroo or takeaway.

Description

Takeaway platforms have made it easy to enjoy our favourite meals, but they’ve made life tough for the restaurants we love.

Current platforms demand that restaurants pay disproportionate fees, while dictating control over data, pay-out, client relations, loyalty and contact. It results in higher costs for consumers and restaurants.

Bistroo puts an end to this, by providing a platform where businesses are back in control.

Offering better user experience, lower transaction costs and a fairer infrastructure Bistroo. provides the tools, insights and support to facilitate direct-2-consumer relationships for merchants.

Merchants are in full control of their payments, product selection, orders, advertising, and analytics. They can speak directly with their customers and are paid out instantly when orders are received.

Click here to view Bistroo White Paper

Team

A committed and experienced team who are rolling the product out prudently. You can view the team here.

Our Opinion

Risk Score: 8

Target Price: N/A

Maximum Supply: 100,000,000

Bistro operational product launched in March 2020 within the Netherlands and has quickly built over 20k active and recurring users, generating 250k USD platform turnover monthly. Expansion internationally is on the horizon, with entry into the Belgium market planned by the end of 2021.

Since the pandemic when food delivery really took off it became more apparent that restaurants are dissatisfied with the current arrangement where companies like Deliveroo and Uber eats take a significant percentage from the total order value. — 20% in the case of Uber eats. Some US cities are introducing caps to this fee. Decentralizing delivery, putting the restaurant in control whilst owning its own customers is the way forward. Bistroo is the most advanced blockchain solution so far. There are two big risks. Poor execution and another blockchain operator with bigger resources taking a more gun hoe approach, building faster and bigger than Bistroo’s more prudent approach. We believe Bistroo shows great potential.

Digital Fitness (DEFIT)

Overview

Next generation of digital fitness through crypto rewards to stay fit and healthy and complete challenges.

Description

DEFIT was first created by its parent company 360Wellness to become its native token.

It completed a fundraising in April via IDO which sold out in 2 minutes receiving 4,000 applicants with its token hitting an all time high price of $1.39.

DEFIT’s objective is to disrupt the Fitness Industry and build the next generation of digital wellness.

The project is building momentum nicely and is in talks with various fitness related entities looking to implement DEFIT into their products and services. In addition they have over 700 personal trainers who have shown an interest in utilizing DEFIT’s technology.

Click here to view Digital Fitness White Paper

Team

An experienced documented team which you can view here

Our Opinion

Risk Score: 7

Target Price: N/A

Maximum Supply: 50M

DEFIT is the kind of project we love. It is focusing on a niche that others have not ventured into yet. It is also an area which lends itself perfectly to crypto and is unlikely to be caught up in the cross hairs of any regulatory crackdown when that time comes.We believe DEFIT has massive growth potential and is a project worth closer attention.

Click below to view previous months of the Moonshot Portfolio:

- Moonshot Portfolio — November 2021

- Moonshot Portfolio — October 2021

- Moonshot Portfolio — September 2021

- Moonshot Portfolio — August 2021

- Moonshot Portfolio — July 2021

- Moonshot Portfolio — June 2021

- Moonshot Portfolio — May 2021

- Moonshot Portfolio — April 2021

- Moonshot Portfolio — March 2021

- Moonshot Portfolio — February 2021

Follow us on Twitter @cryptoimpartial and Instagram @cryptoimpartial and register for our newsletter here www.cryptoquestion.tech

Join our Telegram channel here.

Not Financial Advice

This article does not constitute financial advice or a recommendation to buy in any way. Always do your own research and never invest more than you can afford to lose. Investing in cryptocurrencies is high risk, and you could lose 100% of your investment. The article should be treated as supplementary information to add to your existing knowledge.

Recent Comments